Uncertainty Aversion: Why Cliffs Natural Resources Is A Good Buy

Iron ore prices have fallen more than 25% so far this year and seem bound to fall further according to major financial institutions. Larger mining conglomerates, which own more diverse portfolios of mineral resources as well as have better quality and more efficient iron mines, will be better able to weather the decline in iron prices than smaller producers, such as Cliffs Natural Resources that rely overwhelmingly on iron ore. Additionally, since most iron ore producers have stopped negotiating long-term contracts with their largest consumer, the steel industry, they are much more susceptible to iron ore price fluctuations.

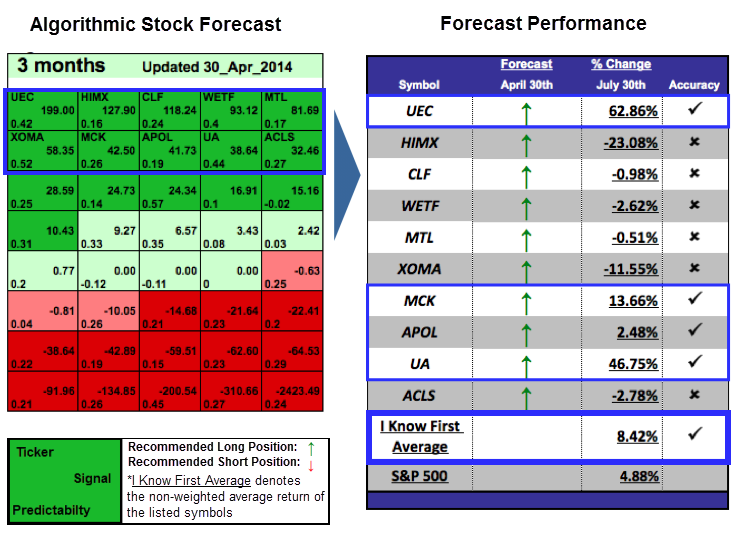

Cliffs Natural Resources has the additional misfortune of being saddled with years of poor management, an inefficient coal division, increased costs of producing iron ore, increased operating expenses, mounting debt, activist investors, lawsuits, and a particularly harsh U.S. winter. I Know First's algorithm indicates that Cliffs has much room to rebound, and it ranks Cliffs as one of its top investments for both the medium and long-term time horizons.

Cliffs Natural Resources has the additional misfortune of being saddled with years of poor management, an inefficient coal division, increased costs of producing iron ore, increased operating expenses, mounting debt, activist investors, lawsuits, and a particularly harsh U.S. winter. I Know First's algorithm indicates that Cliffs has much room to rebound, and it ranks Cliffs as one of its top investments for both the medium and long-term time horizons.

Read The Full Article On Seeking Alpha Here

Cliffs Natural Resources has the additional misfortune of being saddled with years of poor management, an inefficient coal division, increased costs of producing iron ore, increased operating expenses, mounting debt, activist investors, lawsuits, and a particularly harsh U.S. winter. I Know First's algorithm indicates that Cliffs has much room to rebound, and it ranks Cliffs as one of its top investments for both the medium and long-term time horizons.

Cliffs Natural Resources has the additional misfortune of being saddled with years of poor management, an inefficient coal division, increased costs of producing iron ore, increased operating expenses, mounting debt, activist investors, lawsuits, and a particularly harsh U.S. winter. I Know First's algorithm indicates that Cliffs has much room to rebound, and it ranks Cliffs as one of its top investments for both the medium and long-term time horizons.Read The Full Article On Seeking Alpha Here