Stock Market Outlook: An Average Return Of 26.51% In A Year

Stock Market Outlook: Aggressive Stocks

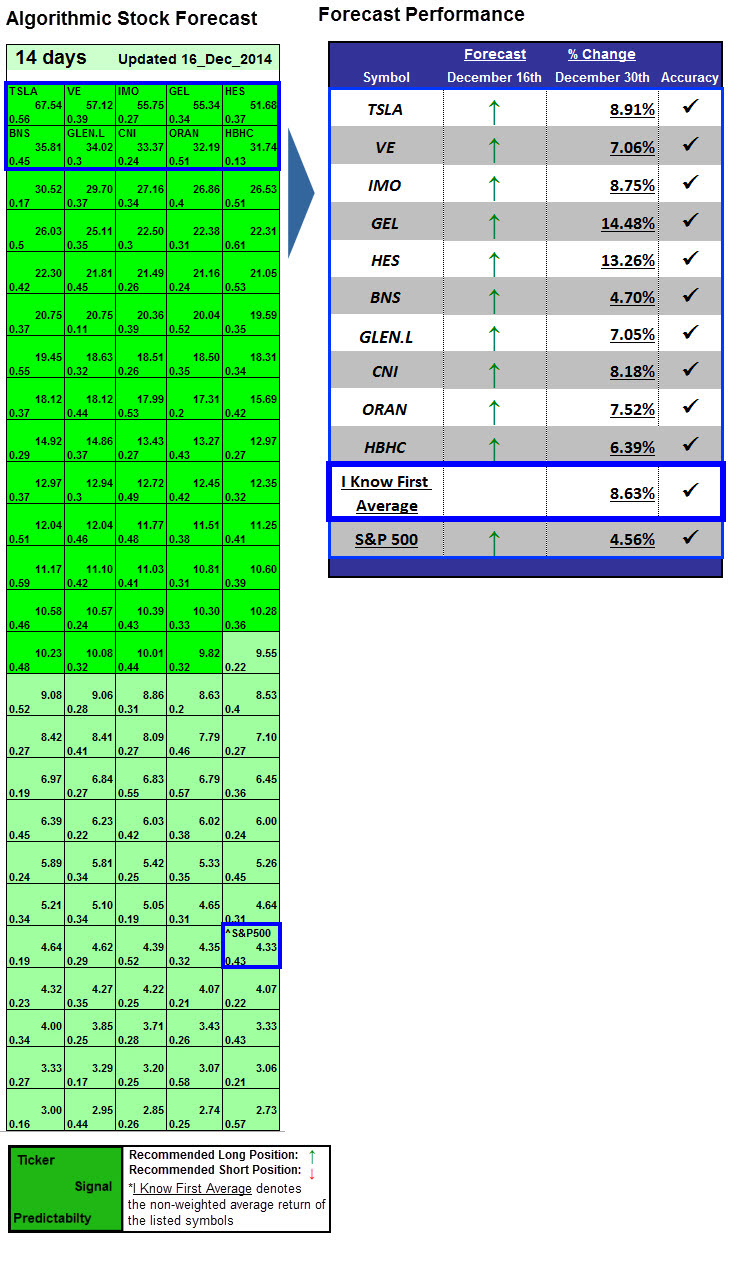

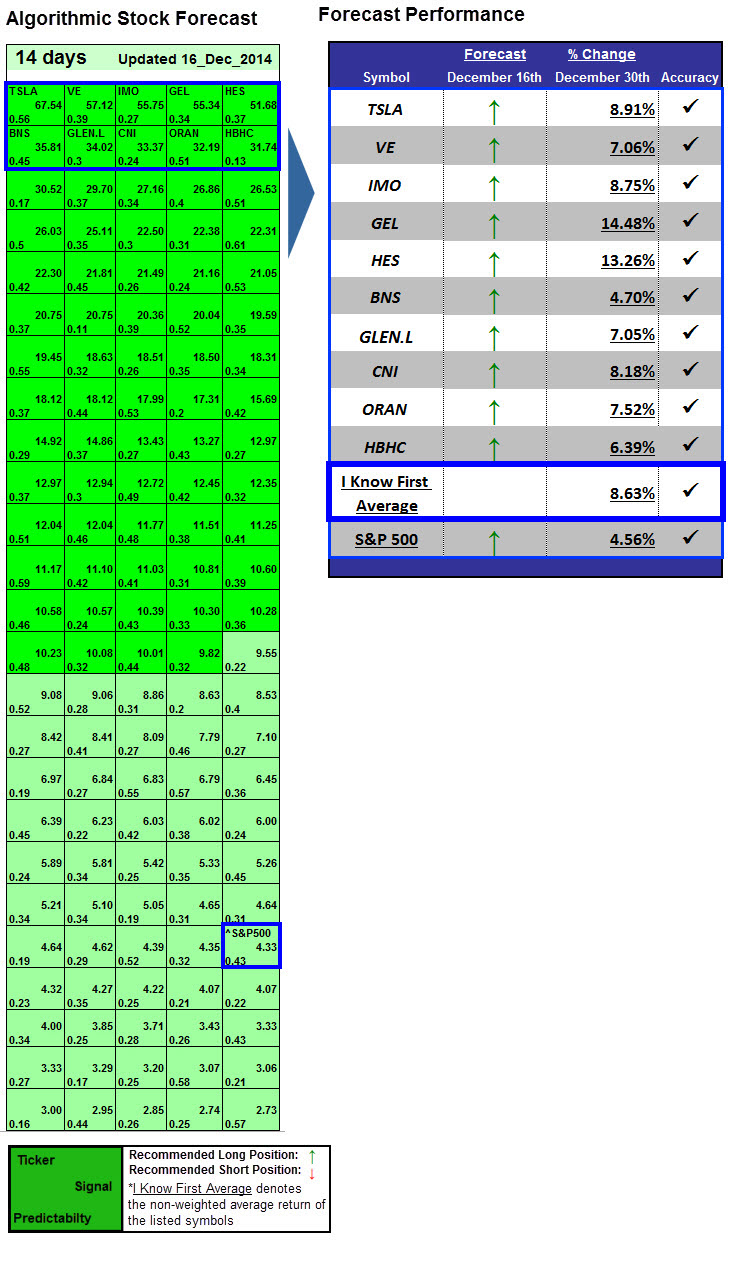

Stock Market Forecast: This forecast is part of the "Risk-Conscious" package, as one of I Know First's quantitative investment solutions. We determine our aggressive stock picks by screening our database daily for higher volatility stocks that present more opportunities, but are also more risky. The full Risk-Conscious Package includes a daily forecast for a total of 40 stocks with four main categories:

- top ten aggressive stocks picks that best fit for long position

- top ten aggressive stocks picks that best fit for short position

- top ten conservative stocks picks that best fit for long position

- top ten conservative stocks picks that best fit for short position

Recommended Positions: Long

Forecast Length: 1 Year (12/22/2013 - 12/22/2014) I Know First Average: 26.51% Get the "Risk-Conscious" Package.

Forecast Length: 1 Year (12/22/2013 - 12/22/2014) I Know First Average: 26.51% Get the "Risk-Conscious" Package.