Stock Market Prediction: ETF Level 2 Count Weighted Portfolio by Controlling the Short Majority Direction

This article "Stock market prediction: ETF Level 2 Count Weighted Portfolio by Controlling the Short Majority Direction" was written by the I Know First Research Team.

This article "Stock market prediction: ETF Level 2 Count Weighted Portfolio by Controlling the Short Majority Direction" was written by the I Know First Research Team.

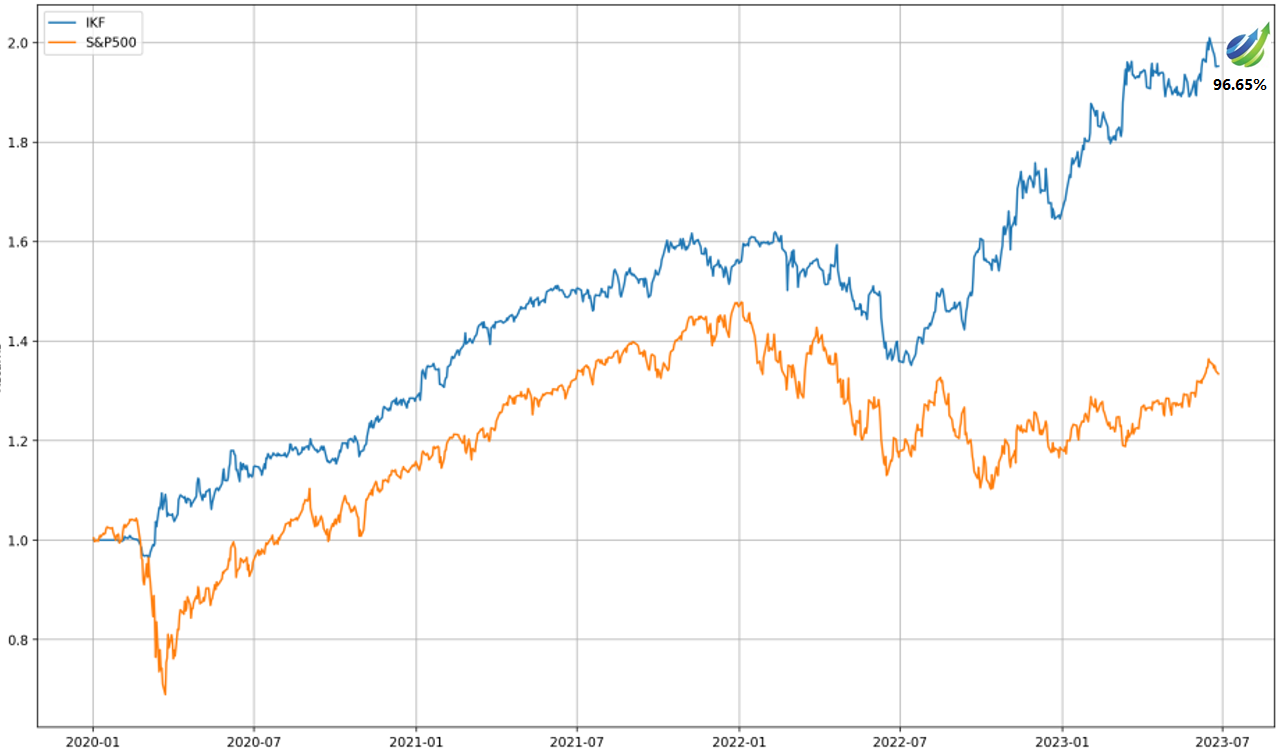

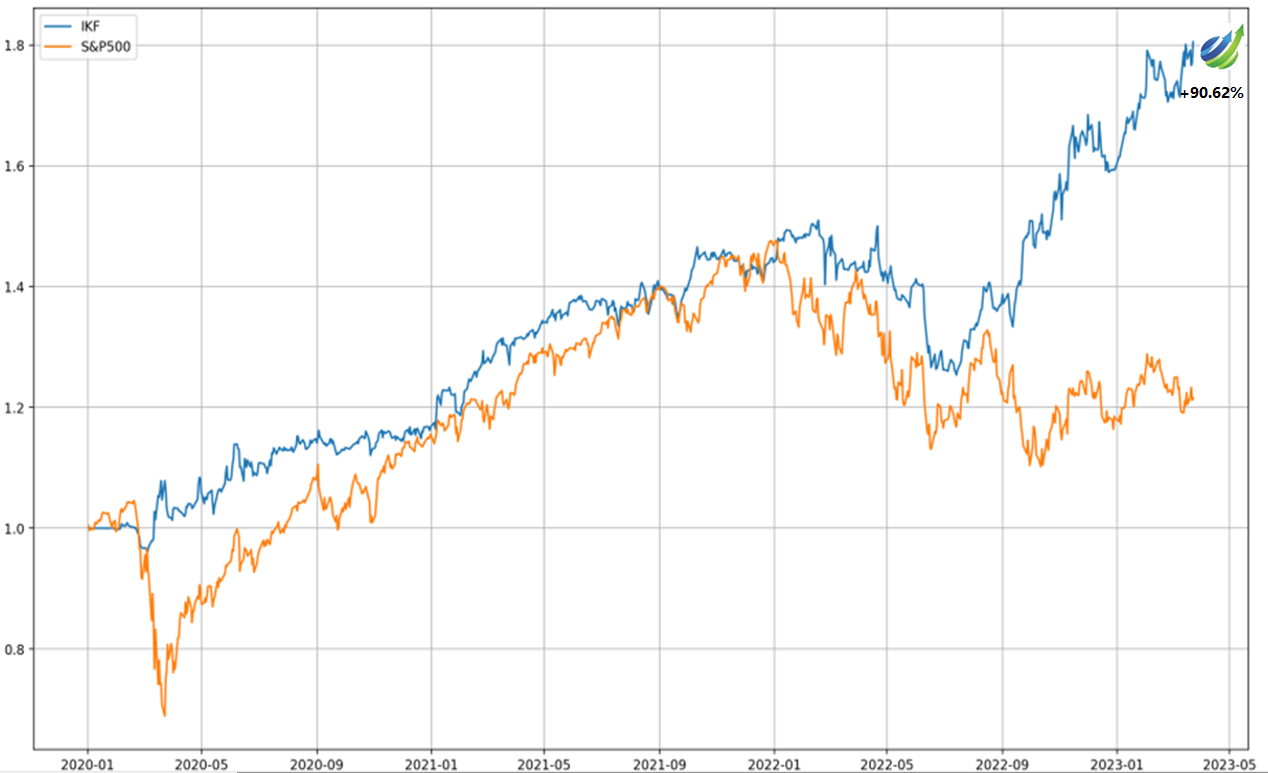

I Know First provides investment solutions for institutional investors with a competitive advantage utilizing our advanced self-learning algorithm. I Know First provides an individual approach for institutional clients to improve their investment process based on their needs and preferences. We have evaluated the performance of the ETF Level 2 Count Weighted Portfolio by Controlling the Short Majority Direction during the period from January 21 to June 26. Visit our website for more details about I Know First solutions for institutional investors.

Read The Full Premium Article

Read The Full Premium Article

Read The Full Premium Article

Read The Full Premium Article