Stock Market Prediction: Investment in the Best Industries (GICS Level 2)

This article "Stock market prediction: "Investment in the Best Industries" was written by the I Know First Research Team.

This article "Stock market prediction: "Investment in the Best Industries" was written by the I Know First Research Team.

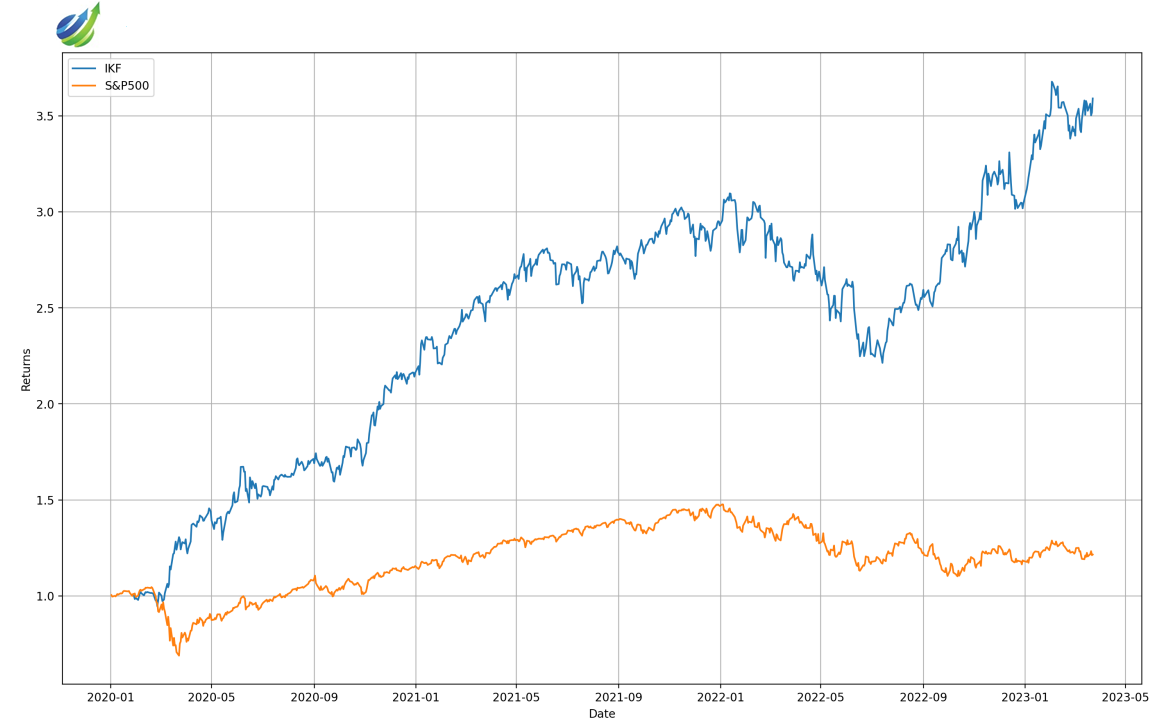

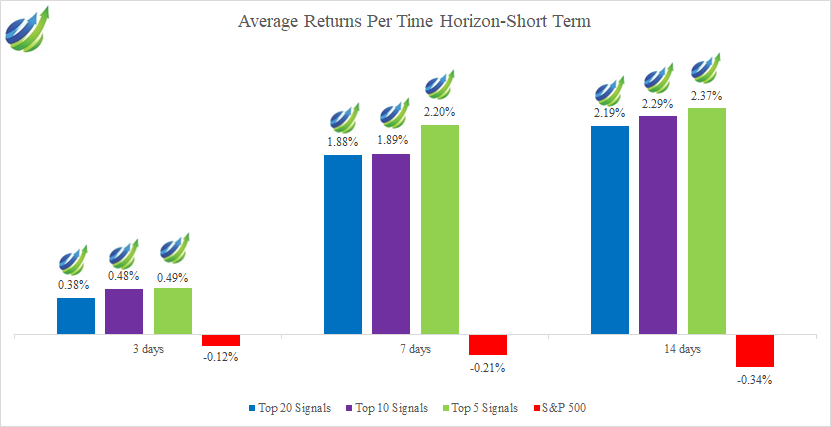

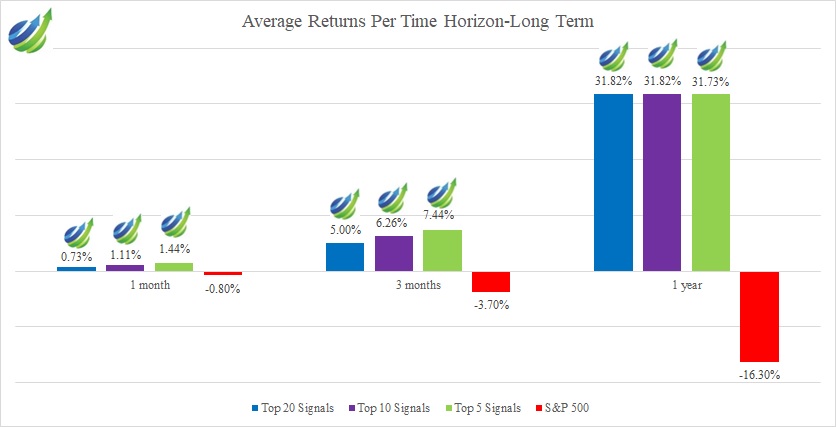

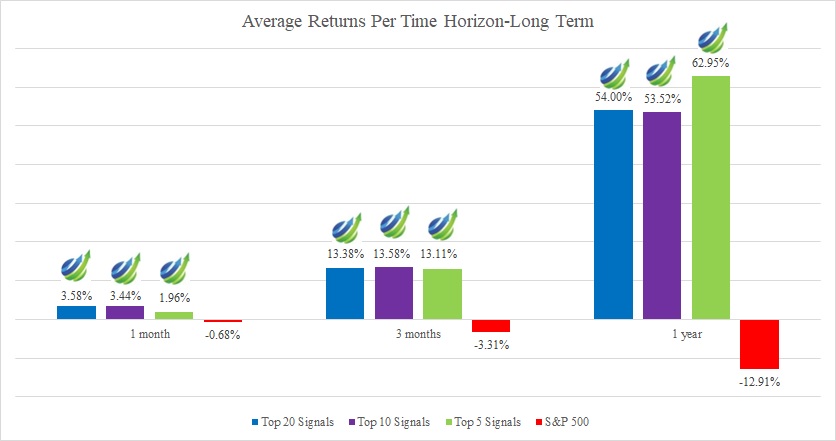

I Know First provides investment solutions for institutional investors with a competitive advantage utilizing our advanced self-learning algorithm. I Know First provides an individual approach for institutional clients to improve their investment process based on their needs and preferences. We have reviewed the performance of the investment in the best industries strategy contents Industries in GICS Level 2 during the period from January 1 to June 26. Visit our website for more details about I Know First solutions for institutional investors.

Read The Full Premium Article

Read The Full Premium Article