Brazil Stock Market: Daily Forecast Evaluation Report

Executive Summary

In this stock market forecast evaluation report, we will examine the performance of the forecasts generated by the I Know First AI Algorithm for Brazilian stocks for long and short positions (20 stocks) which were sent daily to our customers. Our analysis covers the period from January 1st, 2018, to June 30th, 2020.

Brazilian Stocks Highlights

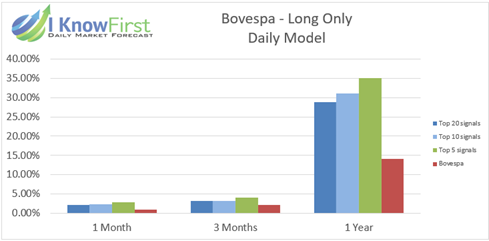

- The Top 20, Top 10, and Top 5 signal groups generated by I Know First consistently outperformed Bovespa Index for almost all time horizons.

- The Top 5 signal group outperformed the Bovespa by 16.23% using the 1 year time horizon.

- All hit ratios for 7 day time horizon or longer are above 50%.

- Using only long positions, every signal group for every time horizon outperformed Bovespa.

- For long positions only, the top 5 signals with a 1 year time horizon outperformed the Bovespa Index by 21.07%.

- Long position hit ratios for all time horizons longer than 3 days are above 50% and all 1 year forecast hit ratios are above 70%

The article was written by Chloe Peng, Analyst at

The article was written by Chloe Peng, Analyst at  Read The Full Premium Article

Read The Full Premium Article