S&P 500 Index Tend to Rally in Late December

December is a strong month for stocks and the S&P500 index, as they tend to rally in the second half of the last month of the year.

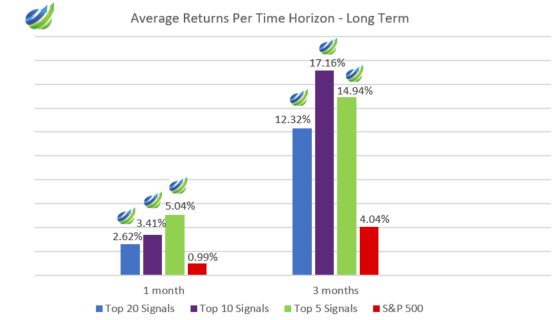

Now is a good opportunity to use the I Know First algorithm to invest in the best opportunities for the bullish second half of December.

About I Know First

I Know First, Ltd. is a financial technology company that provides daily investment forecasts based on an advanced, self-learning algorithm. Thus, the company’s algorithm predicts over 10,500 securities (and growing). Thus, it has capabilities to discover patterns in large sets of the historical stock market data.

The underlying

This MRO stock forecast article was written by Emily Adelson – Analyst at

This MRO stock forecast article was written by Emily Adelson – Analyst at  Read The Full Premium Article

Read The Full Premium Article

The article was written by

The article was written by  Read The Full Premium Article

Read The Full Premium Article