Top Japanese Stocks: Daily Forecast Evaluation Report

Executive Summary

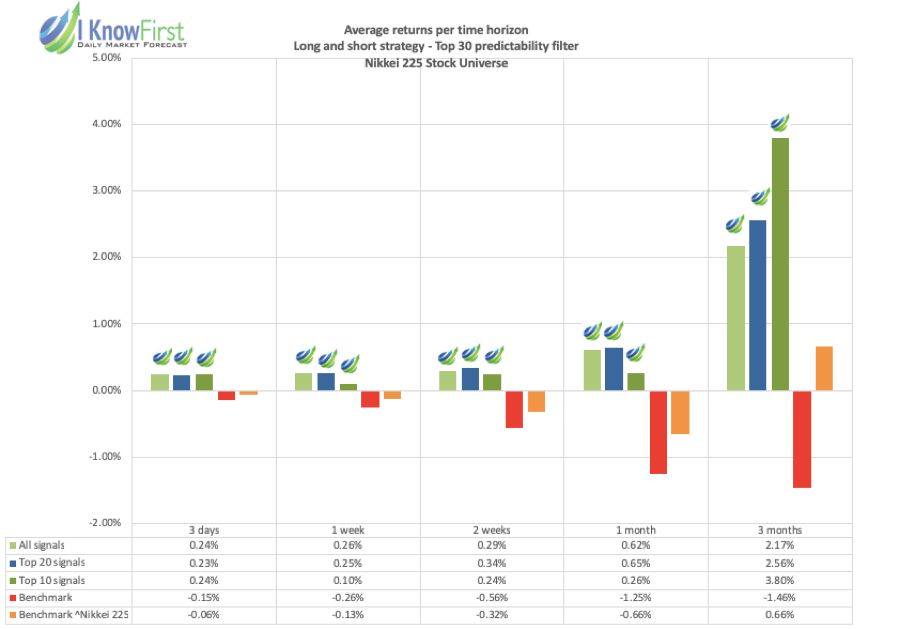

In this stock market forecast evaluation report, we will examine the performance of the forecasts generated by the I Know First AI Algorithm for the Japanese stocks for long and short positions (20 stocks) which were sent daily to our customers. Our analysis covers the period from January 1st, 2019, to June 22nd, 2020 and further analyzes the performance of the Japanese market since the beginning of the Coronavirus pandemic, February 22nd, 2020.

Top Japanese Stocks Highlights

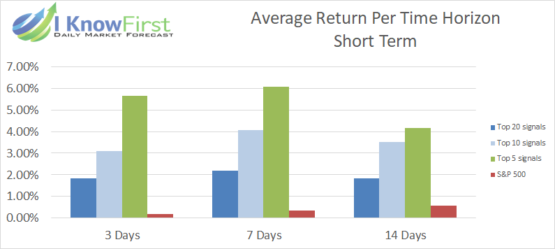

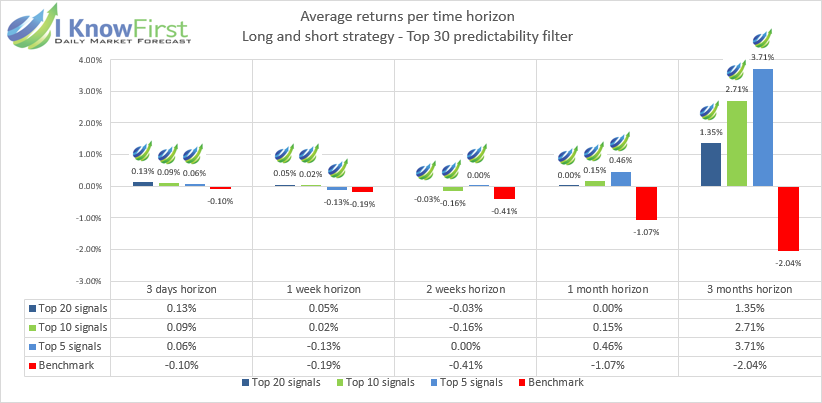

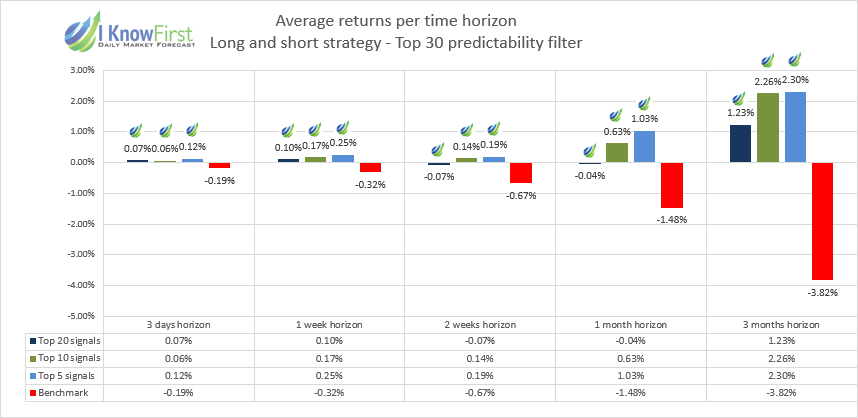

- The Top 20, Top 10, and Top 5 signal groups generated by I Know First consistently outperformed Nikkei 250 Index for all three time horizons.

- The Top 5 signal group outperformed the Nikkei 250 by 5.39% using the two-week time horizon.

- Since the start of the Coronavirus, the Top 20, Top 10, and Top 5 signal groups generated by I Know First remained extremely profitable, while the Nikkei 250 declined.

- Using the two-week time horizon, the top 5 signal group outperformed the Nikkei 250 by 10.89% since the start of the Coronavirus.

- Every signal group generated by I Know First succeeded in outperforming Nikkei 250 both before and after the start of the Coronavirus pandemic.

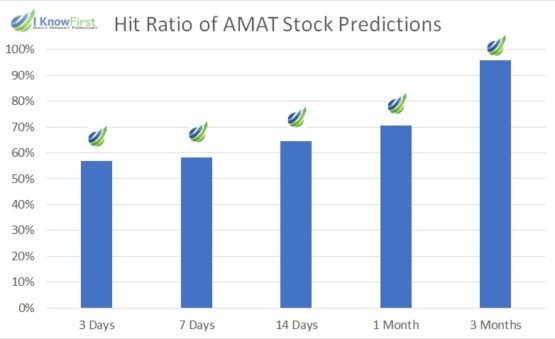

- Hit ratios for all time horizons are above 50% since the start of COVID-19.