Interest Rate Cuts: Silver Lining Growing Brighter.

![]() This Interest Rate Forecast article was written by Milana Papadopoulou – Financial Analyst at I Know First.

This Interest Rate Forecast article was written by Milana Papadopoulou – Financial Analyst at I Know First.

Highlights

- The US, UK and the EU decided to hold interest rate levels steady at least until Q2.

- Inflation has been declining steadily in the countries, with new figures approaching targets.

- If the trend continues, interest rate cuts will be expected by June 2024.

Interest Rate Cuts: To Cut or Not to Cut?

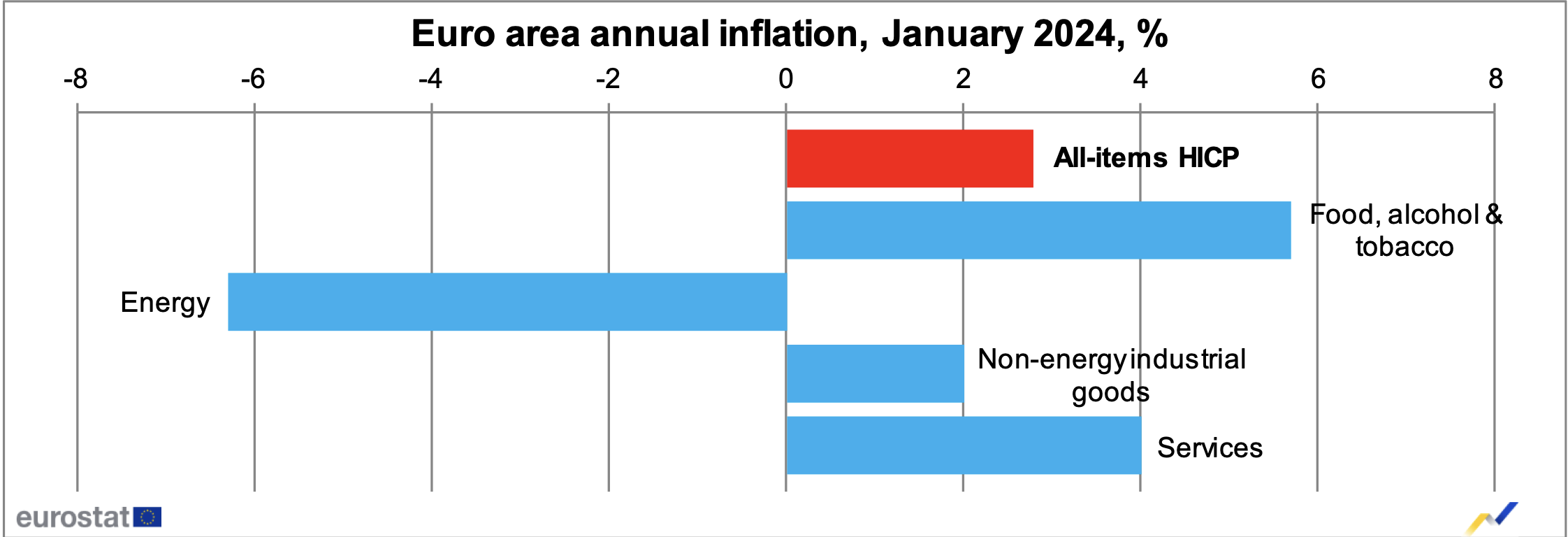

Last week saw three major economies: the US, the UK and the EU holding off on interest rate cuts. Despite the positive buzz in the markets at the end of 2023, policymakers highlighted that the time for cuts has yet to come and remained cautious on forward-looking statements. EU’s Christine Lagarde concluded her 25th January statement by saying there has been a consensus among ECB rate-setters that it was “premature to discuss rate cuts”. The BoE followed, stating on the 1st of February that it needed further evidence that the inflation was under control before announcing cuts. Finally, the US Federal Reserve also announced a holdoff on cuts despite the US edging closer to the inflation target.

Interest Rate Cuts: Is “Too Good” a Possibility?

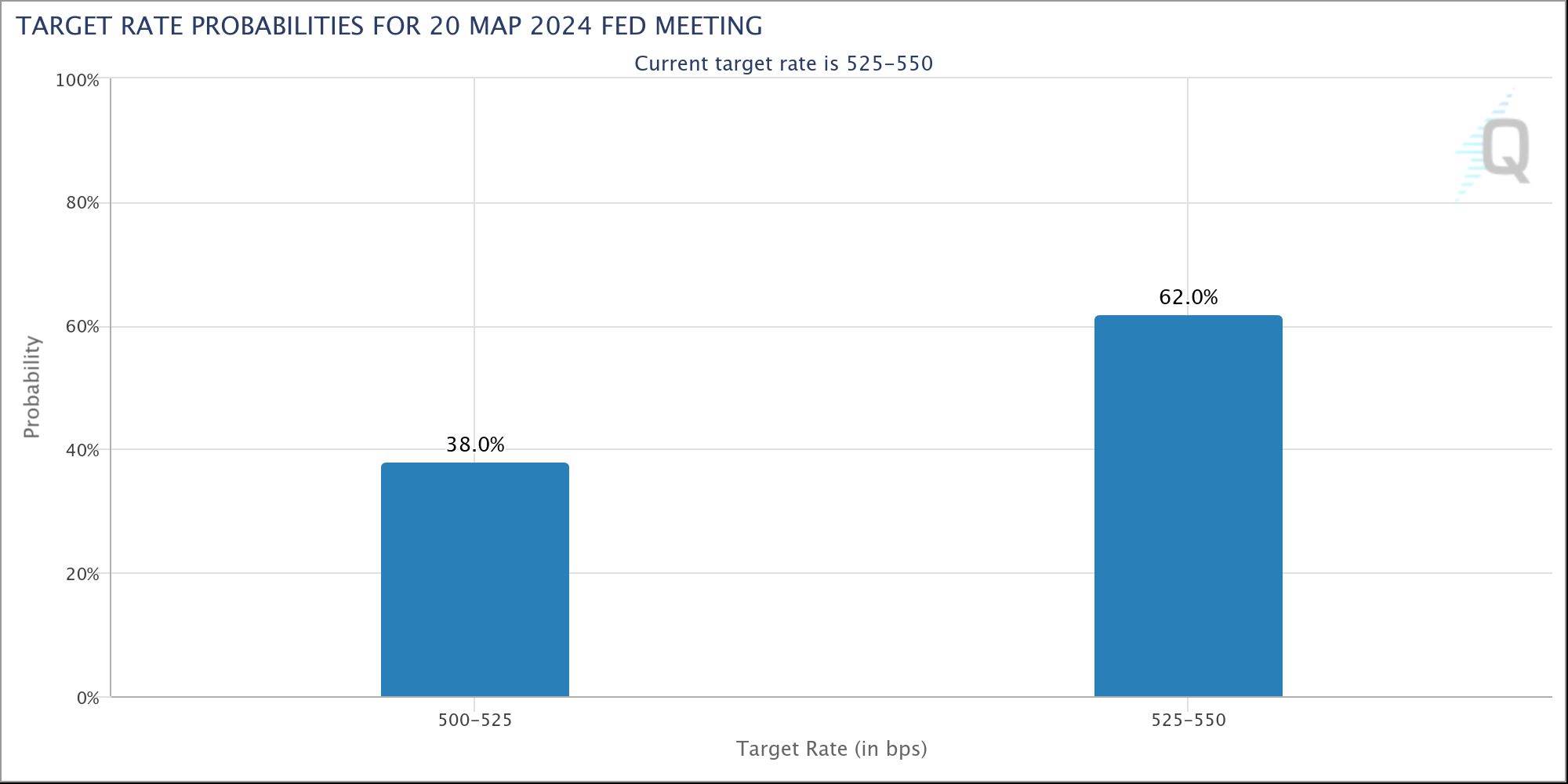

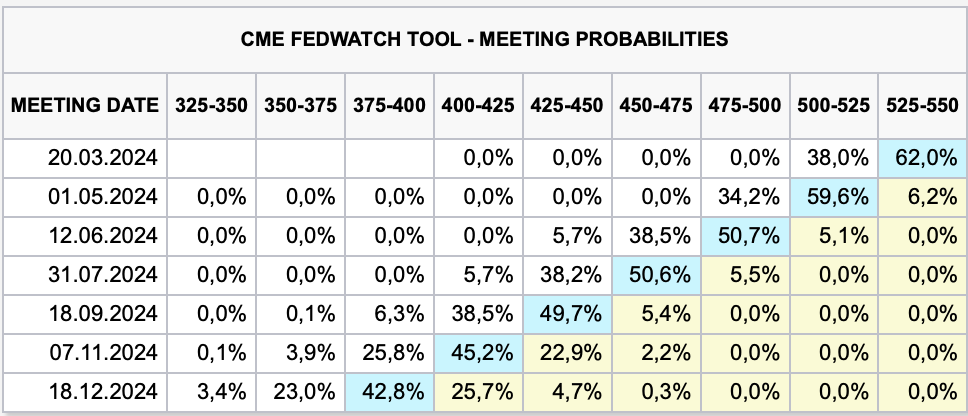

A Friday report by the US Labour Bureau revealed that the US Economy added 353,000 jobs in January. Notably, the expectations from LSEG were dramatically lower, with a figure of only 180,000. This development validated Jay Powell’s claims that it was too soon to cut back rates. The Federal Reserve has faced criticisms from industry participants and presidential candidate Donald Trump following the decision to keep interest rates at a 23-year high of 5.25%-5.5% for the fourth consecutive meeting on January 31st, 2024.

However, the US Labour market figures might indicate that rate cuts will not be likely even in March, with CME’s Fed Watch placing the probability of interest rates remaining unchanged at 62%. However, with productivity growth so far remaining positive, it is likely that interest rate cuts will be announced in the Fed’s May release with a 93.8% probability.

Are High Hopes Justified?

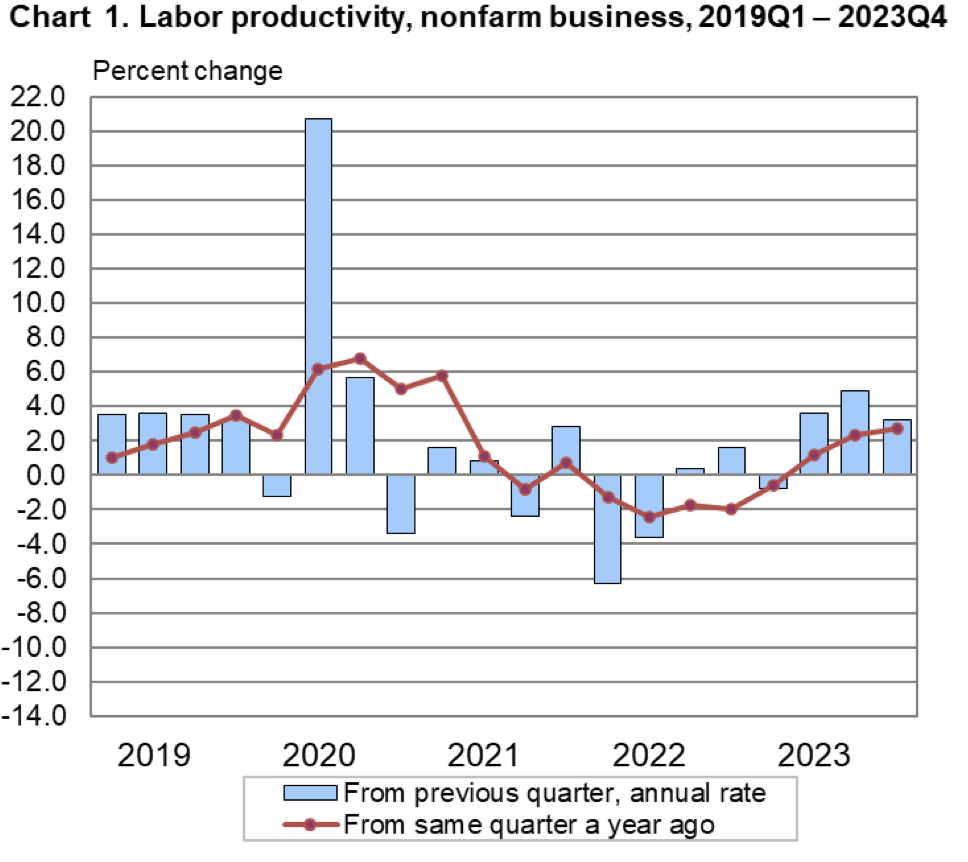

Inflationary pressure has eased significantly from highs reached in 2023. Increased interest rates have been a factor, as well as decreases in energy prices and easing pressure exerted on the supply chain. Growth in productivity due to AI and general technological development has also been a significant factor.

(US Productivity Statistics)

Although close, it has yet to reach the 2% target set by governments. This news sent positive waves around the markets and increased hopes of interest rate cuts soon. This pushed valuations to reflect the supportive environment broadly, with S&P 500 forward P/E tipping just over 20x. However, the Fed’s announcement and the job supply news deemed that cuts were priced prematurely.

Red Sea Supply Chain Risks.

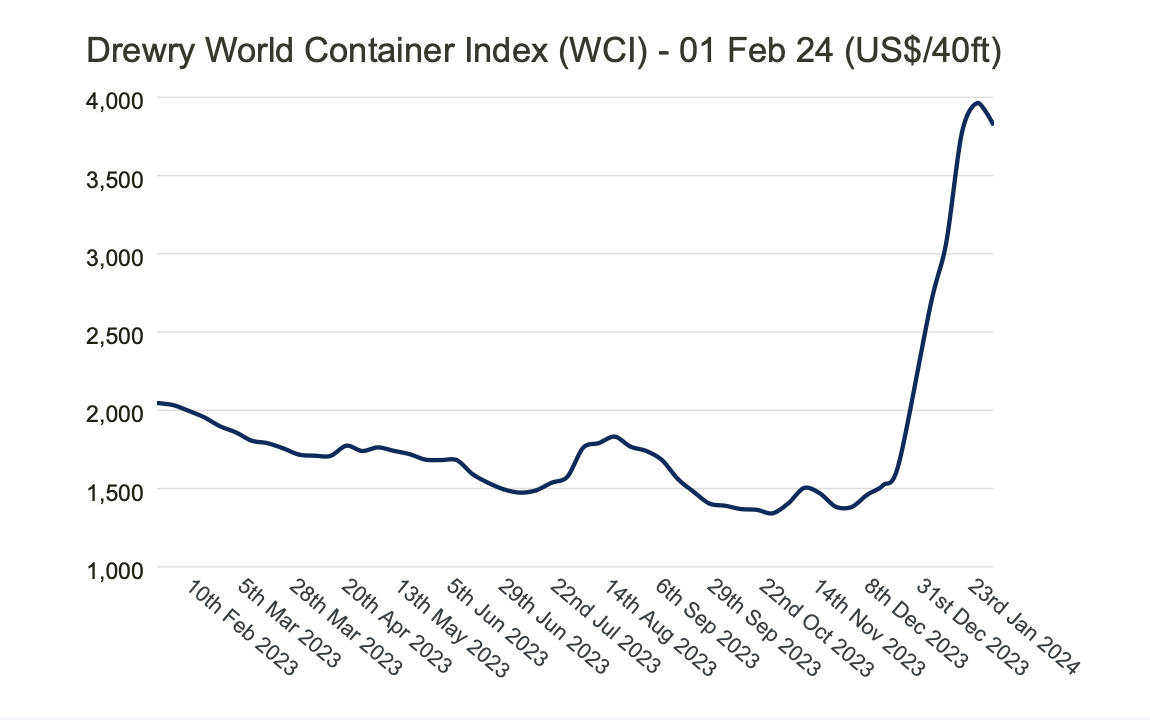

Recent news has been, once again, dominated by updates on the unrest in the Middle East. There has been a sharp drop in commercial shipping through the Red Sea due to Houthi Rebels targeting container and commodity ships they link to supporters of Israel. Apart from the geopolitical aspects, the unrest has been discussed in the context of supply chain and potential inflationary pressure.

(Container Freight Rate Index)

According to Drewry, the supply chain adviser, the price of shipping a standard-size container from Shanghai to Rotterdam has nearly tripled from $1,442 in December 2023 to $4,984 in late January. Despite that, this is less significant of an increase than it might seem. In 2021, the figure was, in fact, $14,000, and shipping costs were still not the main factor driving record inflation back then. Analysts at Goldman Sachs claim that Houthi Rebel attacks can raise inflation figures only by 0.1% by the end of the year.

Tiptoeing Around the Inevitable.

Despite the governments’ holding their stance on interest rates, it is possible that too much caution is being exerted. Primary inflation drivers: soaring natural gas prices, increasing food costs and supply chain disruptions appear to have reverted, and with winter being nearly over, energy prices will go down even further. Despite increases in jobs beating all expectations, they, too, show signs of reversal together with wage growth slowing down.

More fixed-rate lending has also slowed the transmission of higher rates to the economy. Many consumers still have not refinanced as real interest rates are rising, which will drive demand down shortly.

The above might call for more decisive action by governments, especially the EU, which has seen the biggest disinflation and is the closest to the target figure.

The US might also be inclined to move towards interest rate cuts sooner rather than later as the decision would have a political side to it as well. Facing elections, post-cut economic resurgence could be Democrats’ golden ticket to another term in the White House.

The UK is more delicate as it is the furthest of three from the target with 4%. Despite price growth having halved in the space of half a year, it might still be too early to declare victory. The last leap towards the target could prove to be the most difficult one to achieve unless wage growth decreases persist.

Interest Rate Cuts: Winds of Political Change.

The caution exerted by politicians, however, is not without reason. Policymakers must act appropriately with several countries awaiting elections, as mistakes will be costly. History has seen instances when interest rates were cut too soon, and ten had to be raised again in the 1970s in the US. The consequences were catastrophic, and it took the economy decades to recover. Political agenda, however, should not be a force driving policymaking. It is likely that data overwhelmingly suggest that rate cuts are imminent and will most likely happen sooner rather than later.

Beat the Market with the IKF AI

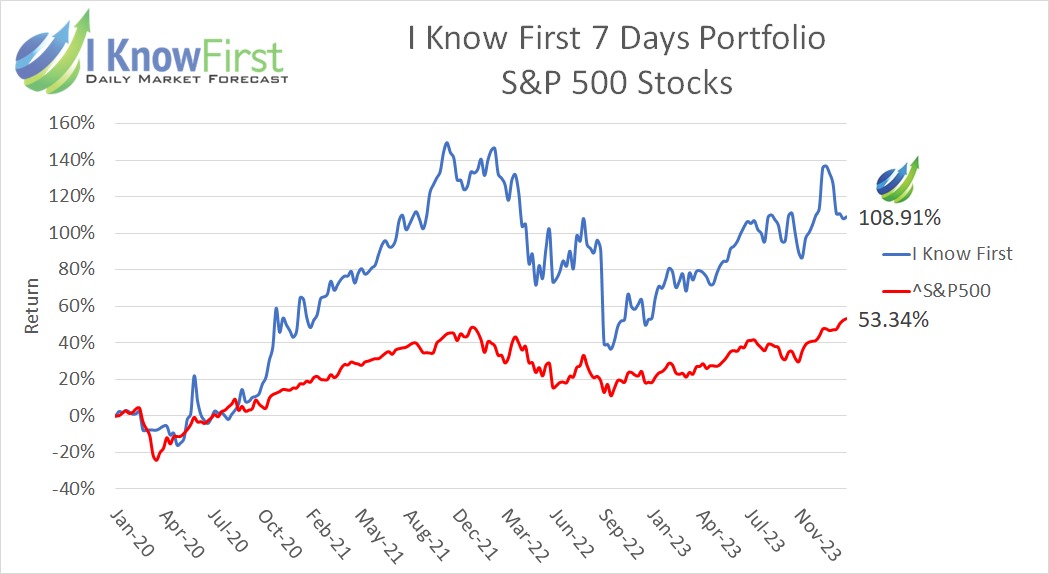

Modern progress in machine learning methods enables us to uncover patterns that remain beyond human understanding. Complex investment models allow for the partial unveiling of the asymmetry within the capital market, and not all experts possess a clear comprehension of them. AI can encompass and test numerous potential investment scenarios, utilizing its deep machine-learning capabilities to provide a comprehensive view of the investment landscape and reveal risks and rewards in manners that the human mind cannot achieve. The AI endeavors to identify factors and trends that may delve deeper than traditional stock-picking methods. Given that many portfolios already incorporate conventional factors, discovering alpha through these traditional means could prove more challenging. As more people adopt the same strategy, it often becomes embedded in the price, eroding price discovery.

I Know First provides stock market forecasts based on chaos theory approaches. Previously, we discussed the Conceptual Framework of Applying ML and AI Models to Analyze and Forecast Financial Assets. The I Know First predictive algorithm is a successful attempt to discover the rules of the market that enable us to make accurate stock market forecasts. Taking advantage of artificial intelligence and machine learning and using insights of chaos theory and self-similarity (the fractals), the algorithmic system is able to predict the behavior of over 13,500 markets. The key principle of the algorithm lays in the fact that a stock’s price is a function of many factors interacting non-linearly. Therefore, it is advantageous to use elements of artificial neural networks and genetic algorithms. How does it work? At first, an analysis of inputs is performed, ranking them according to their significance in predicting the target stock price. Then multiple models are created and tested utilizing 15 years of historical data. Only the best-performing models are kept while the rest are rejected. Models are refined every day, as new data becomes available. As the algorithm is purely empirical and self-learning, there is no human bias in the models and the market forecast system adapts to the new reality every day while still following general historical rules.

I Know First has used algorithmic outputs to provide an investment strategy for institutional investors. Below you can see the investment result of our S&P 500 Stocks package which was recommended to our clients for the period from January 1st, 2020 to September 6th, 2023 (you can access our forecast packages here).

The investment strategy that was recommended by I Know First accumulated a return of 108.91%, which exceeded the S&P 500 return by 55.57%.

Conclusion. Shift from “If” to “When”.

UK, US, and EU governments have been erring on the side of caution so far and made sure that the markets did not receive their statements overly positively. Despite that, overall sentiment suggests that the fundamental probability of interest rate cuts is ever-increasing. This sentiment has been reflected in bullish tendencies, strengthening in equity markets. If correct timing is found, governments have pulled off a seemingly impossible task of curbing inflation without sending the economy into a freefall recession.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.