Stock Forecast Based on AI: Combined Equity and Best Industries Strategy

This article "Stock market prediction: ETF Level 2 Count Weighted Portfolio by Controlling the Short Majority Direction" was written by the I Know First Research Team.

This article "Stock market prediction: ETF Level 2 Count Weighted Portfolio by Controlling the Short Majority Direction" was written by the I Know First Research Team.

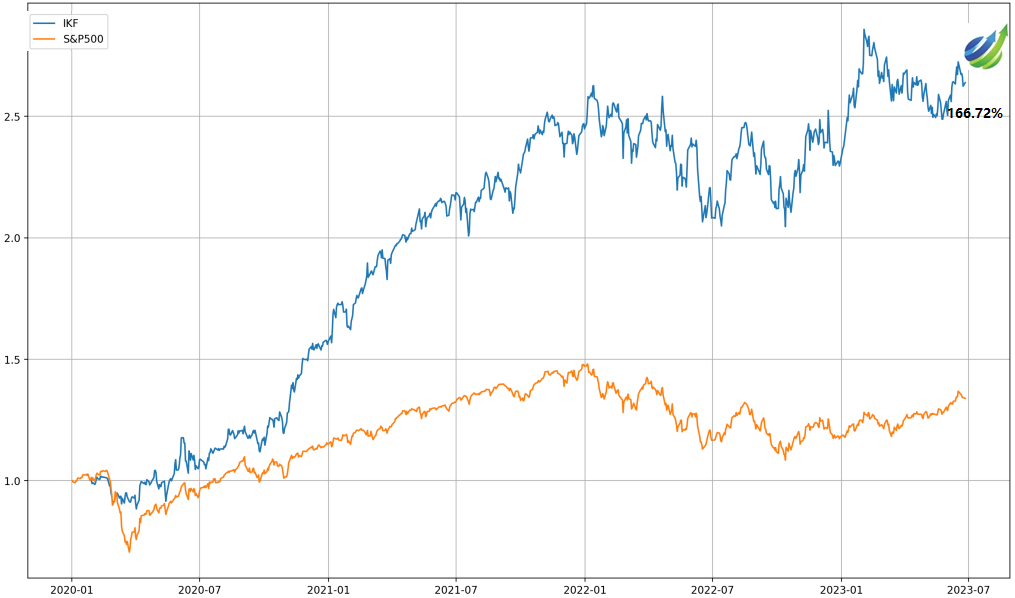

I Know First provides investment solutions for institutional investors with a competitive advantage utilizing our advanced self-learning algorithm. I Know First provides an individual approach for institutional clients to improve their investment process based on their needs and preferences. We have evaluated the performance of the ETF Level 2 Count Weighted Portfolio by Controlling the Short Majority Direction during the period from January 21 to June 26. Visit our website for more details about I Know First solutions for institutional investors.

Read The Full Premium Article

Read The Full Premium Article

Subscribe to receive exclusive PREMIUM content hereStock Market Prediction: The Best Industries in GICS Level 2

This article "Stock market prediction: The best industries in GICS level 2" was written by the I Know First Research Team.

This article "Stock market prediction: The best industries in GICS level 2" was written by the I Know First Research Team.

I Know First provides investment solutions for institutional investors with a competitive advantage utilizing our advanced self-learning algorithm. I Know First provides an individual approach for institutional clients to improve their investment process based on their needs and preferences. We have reviewed the performance of the portfolio strategy contents Industries in GICS Level 2 during the period from January 21 to June 26. Visit our website for more details about I Know First solutions for institutional investors.

Read The Full Premium Article

Read The Full Premium Article

Subscribe to receive exclusive PREMIUM content hereStock Market Prediction: Tiered Portfolio for Buy and Shorting SPY

This article "Stock market prediction: Tiered Portfolio for Buy and Shorting SPY" was written by the I Know First Research Team.

This article "Stock market prediction: Tiered Portfolio for Buy and Shorting SPY" was written by the I Know First Research Team.

I Know First provides investment solutions for institutional investors with a competitive advantage utilizing our advanced self-learning algorithm. I Know First provides an individual approach for institutional clients to improve their investment process based on their needs and preferences. We have evaluated the performance of the trading strategy involving a long position in the tiered portfolio and a short position in SPY from January 21 to June 26. Visit our website for more details about I Know First solutions for institutional investors.

Read The Full Premium Article

Read The Full Premium Article

Subscribe to receive exclusive PREMIUM content hereStock Market Prediction: Trading SPY

This article "Stock market prediction: Sector Rotation Strategy" was written by the I Know First Research Team.

This article "Stock market prediction: Sector Rotation Strategy" was written by the I Know First Research Team.

I Know First provides investment solutions for institutional investors with a competitive advantage utilizing our advanced self-learning algorithm. I Know First provides an individual approach for institutional clients to improve their investment process based on their needs and preferences. We have reviewed the performance of the trading SPY strategy during the period from January 21 to June 26. Visit our website for more details about I Know First solutions for institutional investors.

Read The Full Premium Article

Read The Full Premium Article

Subscribe to receive exclusive PREMIUM content hereIn the News: Yaron Golgher Talks on The Future of Investments and Trading at FinTech Junction 2019

I Know First Co-Founder and CEO, Yaron Golgher, discussed the future of money, trading and investing, in a panel discussion during the Fintech Junction 2019 conference held in Berlin last week.

During the panel, Yaron briefly presented I Know First’s algorithm and explained how the company utilizes AI and Deep Learning techniques to generate its price forecast for different assets. Alongside Yaron, the panel included Ziv Adato, COO of Levent, and Nicolas Borsotto from Archgriffin Consulting.

<path d="M556.869,30.41 C554.814,30.41 553.148,32.076 553.148,34.131 C553.148,36.186 554.814,37.852

Why Machine Learning Is Important In The Future

Summary

- How Neurons Build A Neural Network

- Difference Between Unsupervised And Supervised Learning

- For Google Machine Learning Is The Future

- I Know First Predictive Algorithm

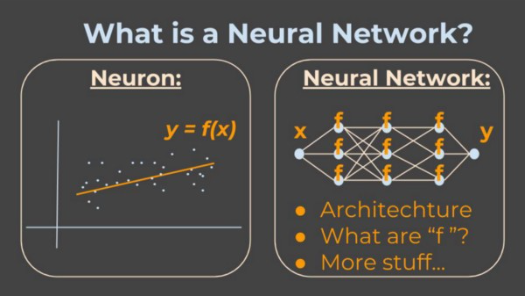

How Neurons Build A Neural Network

[Image Source: medium.freecodecamp.org]

A Neuron can simply be described as a function. A function is a fancy name for something that takes some input, applies some logic, and outputs the result. A Neuron can also be determined as one learning unit. The crucial part is to understand what a learning unit (function) is, then we will understand the basic building block of a Neural Network. A function is basically a relationship between two variables usually denoted by x and y. The goal is to find a common pattern for these two variables by drawing a straight line with very few errors(see graph above). The advantage here is, that next you are looking for x, the machine can apply the function and tell you y.

So, a neuron is a function, consequently a Neural Network is a network of functions. This means, that we have many functions (learning units). Now once I gave them many correct inputs and outputs (functions), I can give the Neural Network new input it has never seen before and it can give you the right output.

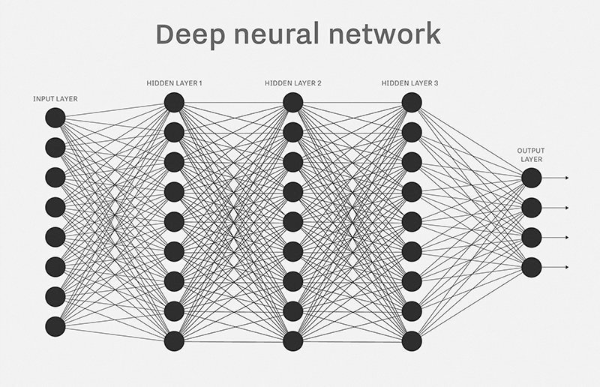

A neural network usually involves many functions and tiers. The first tier contains receives the input information. After that each successive tier gets the from the previous tier and then the final tier gives the output of the total system. The graph below illustrates the complexity of such a deep neural network.

[Image Source: searchenterpriseai.techtarget.com]

[Image Source: searchenterpriseai.techtarget.com]

As the amount of data, we are talking about here is immense, the amount of new content coming out every minute is impossible for any human to follow. As the designer of a network you must consider the following questions:

- How do I model the inputs and outputs? (for example, if the input is some text, can I model it in letters? numbers? vectors?….)

- What are the functions in each neuron? (are they linear? exponential?…)

- What is the architecture of the network? (that is, which function’s output is which function’s input?)

Machine Learning

[Image Source: towardsdatascience.com]

In general, Machine Learning is learning from examples. Machine learning is a part of artificial intelligence (AI) that provides systems with ability to learn automatically from experience. The process of learning begins with collection data, such as examples, direct experience, or instruction in order to look at patterns. The primary goal is that the machine learns automatically without any human intervention.

There are two main types of machine learning: supervised learning and unsupervised learning. Supervised machine learning is used by most of the practical machine learning. You have the input variables (X) and the output variable (Y) and the algorithm gives you the function from the input to the output. The goal is to calculate the right function that you can just insert the data (X) and predict the variables , in our case the stock predictions for Y. We call it supervised learning because we know the correct answers and the algorithm makes forecasts for the data and is corrected by the teacher .

The second type is unsupervised machine learning. There you have the input data (X) but no corresponding output variables. The goal is to draw a model of the underlying structure or distribution to learn about the data. As there is no correct answer and no teacher, it is called unsupervised learning. The system can not figure out the right output but can still draw inferences from datasets to describe patterns.

The reasons that I Know First uses a predictive algorithm instead of financial analysts is as follows: The amount of data that must be used to forecast so many different assets, can only be handled by a computer. Secondly the speed that a computer can proceed data, is much faster than any human ever could do. And last is that the algorithm is objective and relies 100% on empirical data, whereas financial analysts are often influenced by their opinion when analyzing a company.

For Google, Machine Learning Is the Future

[Image Source: insidebigdata.com]

Machine learning is about to revolute the world, as we do not have to teach computers how to solve complex tasks. The senior research Greg Corrado, who works for Google as scientist states: “It’s not magic. It’s just a tool. But it’s a really important tool.” He also said that “Before internet technologies, if you worked in computer science, networking was some weird thing that weirdos did. And now everyone, regardless of whether they’re an engineer or a software developer or a product designer or a CEO understands how internet connectivity shapes their product, shapes the market, what they could possibly build.” He says that in the future most people will know machine learning and that it is going to be a normal thing. Nevertheless, it remains a complex system. On June 16th, Google announced to open a machine learning team in its Zurich engineering office, the largest collection of Google developers outside of the US. The group will be divided into three groups: machine intelligence, natural language processing, and machine perception. Google is highly investing in machine learning, as they consider it to be the future. Google acquired the start-up company named DeepMind in January 2014 for $500 million. Already now machine learning is integrated into many Google product. Google already gave running in-house courses to teach the engineers the machine learning and therefore have a big advance compared to their competitors. Although machine learning has been long part of Google’s technology, the company in 2016 became obsessed with it as the Ceo Sundar Pichai said in a corporate mindset: “Machine learning is a core, transformative way by which we’re rethinking how we’re doing everything. We are thoughtfully applying it across all our products, be it search, ads, YouTube, or Play. And we’re in early days, but you will see us — in a systematic way — apply machine learning in all these areas.” This statement shows the strong commitment of Google to machine learning and its future perspective.

I Know First Predictive Algorithm Based on Artificial Intelligence and Machine Learning

The system is a predictive stock forecast algorithm based on Artificial Intelligence and Machine Learning with elements of Artificial Neural Networks and Genetic Algorithms incorporated in it.

This means the algorithm is able to create, modify, and delete relationships between different financial assets. Based on the relationships and the latest market data, the algorithm calculates its forecasts. Since the algorithm learns from its previous forecasts and is continuously adapting the relationships, it adapts quickly to changing market situations.

[Image Source: iknowfirst.com]

The I Know First Market Prediction System models and predicts the flow of money between the markets. It separates the predictable information from any “random noise”. It then creates a model that projects the future trajectory of the given market in the multidimensional space of other markets.

The system outputs the predicted trend as a number, positive or negative, along with the wave chart that predicts how the waves will overlap the trend. This helps the trader decide which direction to trade, at what point to enter the trade, and when to exit.

The model is 100% empirical, meaning it is based on historical data and not on any human derived assumptions. The human factor is only involved in building the mathematical framework and initially presenting to the system the “starting set” of inputs and outputs.

From that point onward, the computer algorithms take over, constantly proposing “theories”, testing them on years of market data, then validating them on the most recent data, which prevents over-fitting. If an input does not improve the model, it is “rejected” and another input can be substituted.

This bootstrapping system is self-learning, and thus live. The resulting formula is constantly evolving, as new daily data is added and a better machine-proposed “theory” is found.

Some stocks are members of several separate modules. Thus, multiple predictions can be obtained based on different data sets. Also, each module consists of a number of sub-modules, each giving an independent prediction. If sub-modules give contradictory predictions, this should be a warning sign. Six different filters are also employed to refine the predictions.

For further information, please review related articles:

AI Hedge Fund: Artificial Intelligence Taking over Hedge Fund Markets

AI Hedge Fund: Bridgewater Using AI to Increase Profits and Productivity

Portfolio Strategies & Asset Allocation – 86.43% Expected Annual Return Using Algorithmic Allocation

I Know First Live Evaluation Report For The Singaporean Stock Universe: Top 5 Stock Signals Return 2.30% in a 3-Month Investment Horizon

I

Read The Full Premium Article

Read The Full Premium Article Read The Full Premium Article

Read The Full Premium Article