CELH Stock Forecast: Bubbling Success & Healthy Growth

This CELH stock forecast article was written by Anastasia Makuyev, a Quantitative Analyst Intern at I Know First and a Mathematics Student at Hunter College.

CELH Stock Forecast: Summary

- Celsius Holdings Inc. (CELH) stands out with a health-focused business model and a strategic partnership with PepsiCo, driving market reach and competitive advantage.

- CELH showcases strong financial growth, highlighted by a significant net income increase and operational efficiency in Q3 2023, underpinning its growth potential.

- Analysts project a positive future for CELH, supported by its financial strength, strategic growth initiatives, and the expanding functional beverage market.

CELH Stock Forecast: Overview

In the rapidly evolving landscape of the global non-alcoholic beverage market, Celsius Holdings Inc. (CELH) emerges as a frontrunner, captivating the attention of health-conscious consumers and savvy investors alike. CELH stands out with its commitment to natural ingredients and innovative product offerings. They specialize in energy drinks that not only invigorate but also offer metabolism-enhancing benefits. CELH is not just navigating the waves of market trends. In fact, it is riding them towards a horizon of unprecedented growth. Strategic ingenuity and robust growth prospects has marked CELH’s trajectory. CELH is anchored by a strategic partnership with industry giant PepsiCo, and buoyed by a remarkable financial performance, (particularly in Q3 2023).

Business Model

Celsius Holdings Inc. (CELH) operates with a distinct business model. This model sets it apart in the global non-alcoholic beverage market. Particularly notable is its position within the energy drink subsegment. CELH emphasizes natural ingredients and a unique metabolism-enhancing formula. This approach caters to a growing demographic of fitness enthusiasts and individuals leading active lifestyles. The focus on health and wellness is a strategic response. It addresses increasing consumer demands for healthier beverage options.

This trend shows no signs of abating. The company’s product range, including Celsius Originals and Celsius On-the-Go powder packets, underscores its commitment to innovation and quality. A pivotal element of CELH’s business strategy is its 20-year distribution partnership with PepsiCo. This collaboration significantly amplifies its market reach and accessibility. This partnership not only enhances CELH’s distribution capabilities but also reinforces its competitive advantage by ensuring its products are readily available to a wide audience, thereby strengthening its position in the market (Celsius Holdings Inc.).

Financial Performance Highlights

The financial trajectory of Celsius Holdings Inc. presently reveals a company on the rise, showcasing impressive growth and operational efficiency. For the third quarter of 2023, CELH reported a net income attributed to common shareholders of $70.5 million. This is markedly a remarkable turnaround from a net loss of $186.5 million in the same period the previous year. The company’s strategic shift to the PepsiCo distribution system likely caused this dramatic improvement in profitability. It highlights the impact of effective partnerships on financial performance. Furthermore, the company’s non-GAAP adjusted EBITDA witnessed a substantial increase of 318% to approximately $104 million. This surge was driven by a combination of revenue growth, margin improvement, and operational leverage. These financial metrics underscore CELH’s strong operational efficiency and market acceptance. They mark it as a standout performer in the beverage industry (Yahoo Finance, GuruFocus).

Growth Strategies and Market Expansion

Celsius Holdings Inc. is relentlessly pursuing growth through a multi-faceted strategy that includes strategic partnerships, product innovation, and market expansion. The partnership with PepsiCo is particularly noteworthy. It offers CELH an extensive distribution network that enhances its presence across various channels, including retail, convenience, and foodservice. This collaboration has already facilitated CELH’s increased availability in major outlets such as Jersey Mike’s and Dunkin’ Donuts.

This evidence showcases the partnership’s immediate impact on brand accessibility and consumer reach. Additionally, CELH is actively eyeing international expansion, with Canada identified as the next target in its global growth plan. This ambition for international reach is undeniably aligned with the company’s innovative spirit. It continues to explore new markets and opportunities for its health-centric product line. These strategic endeavors not only aim to expand CELH’s market presence but also to solidify its standing in the health and wellness sector. This signals robust growth prospects for the company (Celsius Holdings Inc., Yahoo Finance).

Valuation and Investment Thesis

Celsius Holdings Inc. (CELH) presents a compelling investment thesis, buoyed by its strategic market positioning and solid financial performance. As of February 2024, the company’s Price-to-Earnings (P/E) ratio stands at approximately 118.17. This reflects the high growth expectations investors have for CELH. The valuation metric suggests that investors are willing to pay a premium for CELH shares, anticipating that the company’s earnings will continue to grow at an accelerated pace.

Similarly, the Price-to-Book (P/B) ratio of 13.2 indicates that the market values the company significantly above its book value. This is a sign of strong investor confidence in CELH’s future growth prospects. These valuation ratios, while on the higher end, are indicative of the optimism surrounding CELH’s innovative product line, strategic partnership with PepsiCo, and aggressive expansion plans both domestically and internationally. The increasing consumer shift towards healthier beverage options further supports CELH’s growth trajectory, making it an attractive investment opportunity in the health and wellness beverage sector (GuruFocus).

Industry Opportunities and Strategic Responses

The functional beverage market, within which CELH operates, is witnessing significant growth. Consumer demand for products offering health benefits beyond basic nutrition is a significant driving force behind this. Thereafter, by 2024, the energy drink segment is expected to be reached approximately $110 billion, growing at an annual rate of 8-9%. CELH’s strategic partnership with PepsiCo has positioned the company to capitalize on this growth. CELH hopes to achieve this by enhancing its distribution capabilities and market reach.

This collaboration enables CELH to tap into new markets and consumer segments, further solidifying its presence in the global beverage industry. Subsequently to these industry opportunities, CELH has embarked on strategic initiatives. These are aimed at expanding its product lineup and entering new geographic markets. The launch of innovative products like Celsius Essentials and the brand’s expansion into Canada exemplify CELH’s commitment to growth and adaptability. The vast opportunities within the functional beverage market are well-equipped to be seized by CELH through continuous innovation and strategic responses to market trends. This will drive further growth and market share expansion (Yahoo Finance).

Financial Strength and Analyst Insights

Celsius Holdings Inc. (CELH) distinguishes itself not only through its strategic market initiatives but also through its robust financial health and positive reception from industry analysts. Compared to its peers in the functional beverage industry, CELH boasts a solid balance sheet. This is underscored by triple-digit revenue growth for three consecutive years. This financial resilience is a testament to CELH’s effective market strategies, increasing brand strength, and successful exploitation of strategic partnerships, notably with PepsiCo. The partnership has been instrumental in accelerating CELH’s global expansion efforts, enhancing its financial strength, and improving its competitive position in the market.

Analysts have taken note of CELH’s financial performance and strategic positioning. Many express a positive outlook on the company’s growth potential. Indeed, the consensus among industry experts is that CELH stands as a compelling investment. Correspondingly, in Yahoo! Finance’s analyst ratings, where the majority of analysts have been taking a Buy Side. This is given its innovative approach to the beverage market, expanding product portfolio, and strategic market expansions. Although specific target stock prices supported by DCF were not detailed in the sources reviewed, the underlying sentiment indicates CELH’s attractive upside potential. CELH’s performance metrics further support this optimism, such as its increasing market share, expanding distribution points, and growing brand recognition, which are indicative of a company on an upward trajectory.

Moreover, the functional beverage industry’s growth, coupled with CELH’s proactive strategies to address industry challenges, places the company in a favorable position relative to its peers. CELH’s focus on international expansion, product innovation, and leveraging strategic partnerships reflects a forward-thinking approach that analysts believe will drive long-term growth and profitability. The company’s ability to navigate the competitive landscape of the beverage industry, combined with its financial strength and strategic measures, evidently underscores its potential as a future cash cow, making CELH a standout investment opportunity in the eyes of many analysts (Seeking Alpha, Yahoo Finance).

CELH Stock Forecast: Conclusion:

In conclusion, I take a buy-side on the CELH stock and set a price target of $83.00 USD. Celsius Holdings Inc.’s strategic initiatives, coupled with its strong financial performance and positive analyst insights, paint a promising picture of its future prospects. The company’s agility in responding to industry opportunities and challenges, together with its solid financial foundation and favorable analyst projections, positions CELH as a compelling investment with significant growth potential.

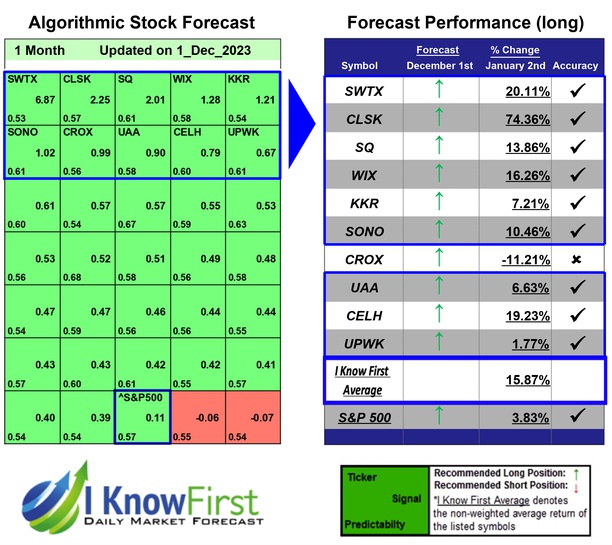

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the CELH stock forecast. The light green for the short-term forecasts indicates a signal which is mildly bullish. The darker green refers to a strong bullish signal for the one-year forecast.

Past Success with the CELH Stock Forecast

I Know First has taken a bullish stance on the CELH stock forecast in the past. On January 3rd, 2024 the I Know First algorithm issued a forecast for CELH stock price and recommended CELH as one of the Top 10 Stocks to buy. The AI-driven CELH stock prediction was successful on a 1-year time horizon resulting in a profit of more than 19.23%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.