MOD Stock Forecast: Keeping Cool

![]() This MOD Stock Forecast article was written by Milana Papadopoulou – Financial Analyst at I Know First.

This MOD Stock Forecast article was written by Milana Papadopoulou – Financial Analyst at I Know First.

Highlights

- MOD stock is in an uptrend and will likely continue increasing.

- The 80/20 approach has brought operational improvements.

- The firm is in a favourable position to gain from sustainability trends.

MOD Stock Forecast: Business Description

Modine Manufacturing Company (MOD) is a premier thermal management solutions provider in Racine, Wisconsin. Founded in 1916 by the legendary Arthur B. Modine, the company has a rich history of serving the automotive industry with cutting-edge solutions. Mr. Modine was a true innovator, holding over 120 heat transfer technology patents, which the company has since acquired. Today, Modine Manufacturing is a publicly traded company that leads the market with its innovative and sustainable thermal management products and solutions, serving a diverse range of customers in commercial, industrial, and building heating, ventilating, air conditioning, and refrigeration markets. Furthermore, it is a top-tier provider of engineered heat transfer systems and high-quality heat transfer components for both on- and off-highway original equipment manufacturer (OEM) vehicular applications. To give you a quick overview, the company’s main product groups are listed below:

A New Vision for a Legacy Company.

In 2021, Modine Manufacturing announced the implementation of a “new vision” with a new way of managing the firm and a higher focus on R&D and innovation through strategic M&As. They have also adopted an 80/20 approach, which determined that 80% of output comes from 20% of input. They then conducted deeper data analysis of their operations than previous ones to pinpoint that elusive 20%. It seems the approach has paid off, with the firm turning over a profit in 2022, and the margins and revenues have been steadily growing each quarter ever since. Each segment’s management has been keenly focused on deep analysis of data about operational efficiency, which allowed them to expand their margins beyond those of competitors while maintaining good levels of R&D investment in projects that yield the most results.

The strategic shift also saw them place more emphasis on climate-conscious technologies. In the performance sector, they work on engineering ways of thermal management with significantly less energy expenditure and reduced emissions. This put them in markets adjacent to the EV industry. The research achieved is also used throughout the rest of the firm’s portfolio subsidiaries, providing greater vertical integration.

Business Segments

- Climate Solutions Segment

The Climate Solutions segment provides energy-efficient, climate-controlled solutions and components for variousapplications. The Climate Solutions segment sells heat transfer products, heating, ventilating, air conditioning and refrigeration (“HVAC & refrigeration”) products, and data center cooling solutions.

- Performance technologies segment

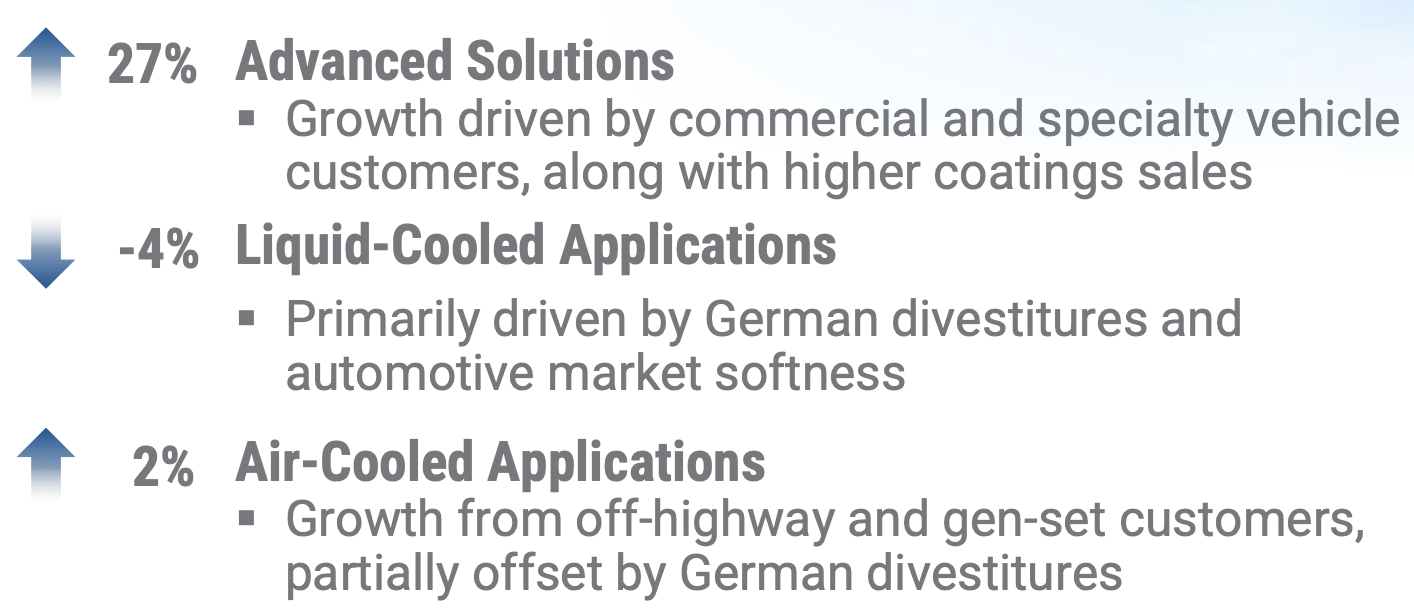

The Performance Technologies segment provides products and solutions that enhance the performance of customer applications and develop solutions that increase fuel economy and lower emissions in light of increasingly stringent government regulations. The Performance Technologies segment designs and manufactures air- and liquid-cooled technology for vehicular, stationary power, and industrial applications. In addition, the Performance Technologies segment provides advanced thermal solutions to zero-emission and hybrid commercial vehicle and automotive customers, coating products, and application services.

Adapting to Change.

Based on the data in their January 2024 report and the general market trends, MOD’s revenue buildup will be reshuffled in the following years. Revenues from heat transfer products are due to decrease as demand declines in the market. However, this setback will be remedied by spectacular growth prospects in the data centre cooling sector and climate systems for EVs.

Although they have had modest growth in sales, MOD forecast a significant increase in EBITDA margin. This has been the trend in recent years due to the implementation of the 80/20 approach and the change in the revenue mix.

Datacenter Cooling Solutions

One market that MOD places particular emphasis on for growth opportunities is the data centre thermal management solutions market. They have had significant increases in sales from this sector recently and are predicting even higher demand. This aligns with global trends as analysts expect a 15% CAGR until at least 2030. With demands for high-performance computing and broader use of IoT, data centres have been at the core of change. However, even the most advanced systems suffer from heat dispersion that needs to be contained. Despite the best efforts, even the most advanced cooling solutions must be more energy efficient to meet future demand and become more affordable. Besides, the data centre cooling market has fewer participants, hence less competition. This is when companies like MOD could reap the benefits. With years of consistent research poured into inventing new solutions and adjusting old ones, Modine can reap the benefits.

Climate Systems for Electric Vehicles

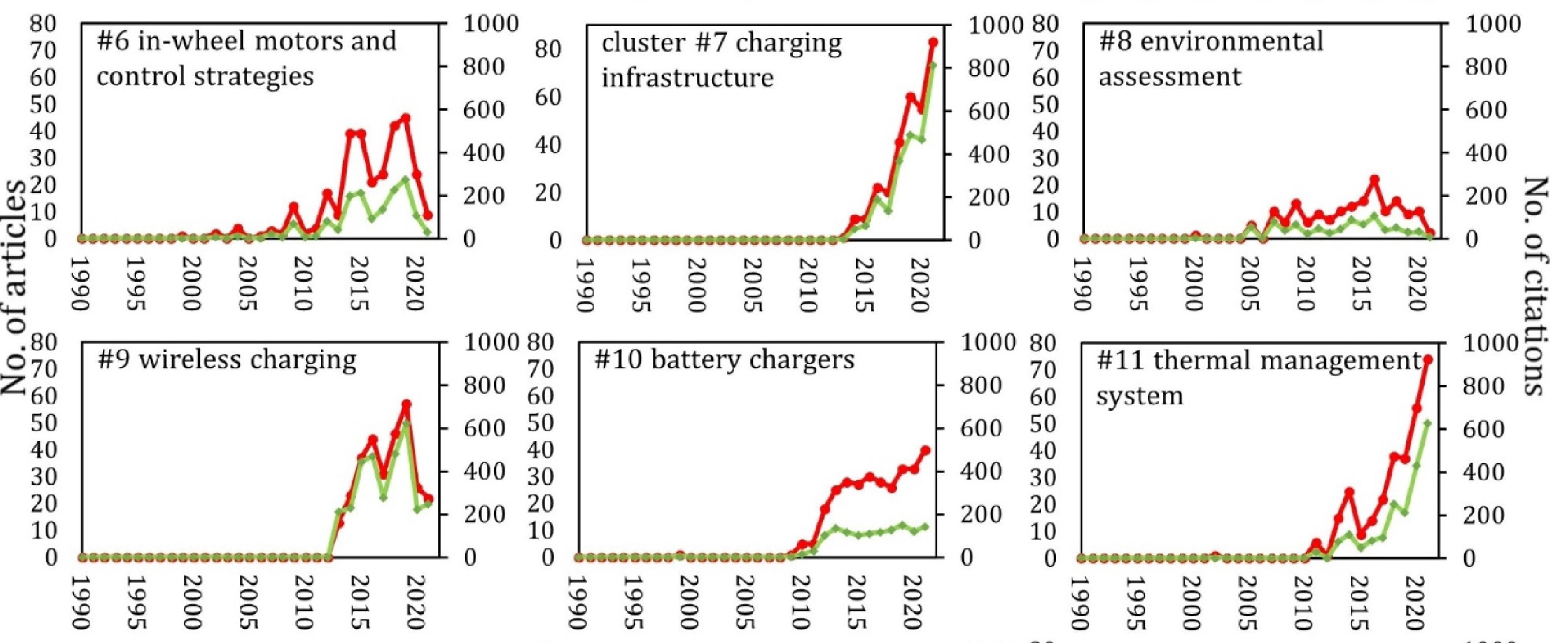

Another sector with stellar prospects is the Thermal Management Systems in Electric Vehicles. With the broader adoption of EVs and a general move towards higher sustainability, energy management is one of the key pressing issues. Having worked for years on improving the car’s aerodynamic capabilities and capacity of batteries and weight management, research is rapidly shifting towards other aspects of running a car, attempting to achieve higher efficiency. According to a recent study, “Thermal management” frequently appeared as a topic in scientific publications, as seen in the graph below.

This includes climate control within the car and maintaining optimal battery temperature levels. Having shifted its research focus towards climate-conscious solutions in 2021, MOD’s management could foresee this development trajectory. This allowed the company to make timely investments, which gave them the upper hand against significantly more prominent companies in a market that participants do not mainly saturate. A report published by Delvens forecasts that the EVTM systems market will observe a near 25% CAGR by 2030. This notion supports the projections made by MOD themselves about the likely growth rate of the segment.

Peer Comparison

Modine Manufacturing also seems to be undervalued relative to its peers. In the past, it lagged behind peers (such as Lennox Industries, Vertiv, and Gentherm Inc.) in profitability, but adopting the 80/20 approach enabled them to change things around since 2022. The firm’s stock is currently trading at lower multiples relative to its earnings, revenue, and EBITDA against peers. MOD has also been consistently pouring investment into R&D for high-growth sectors, which means that it is positioned to benefit from the growth in EV and data centre markets to a greater extent than others.

Outlook on Technical Indicators.

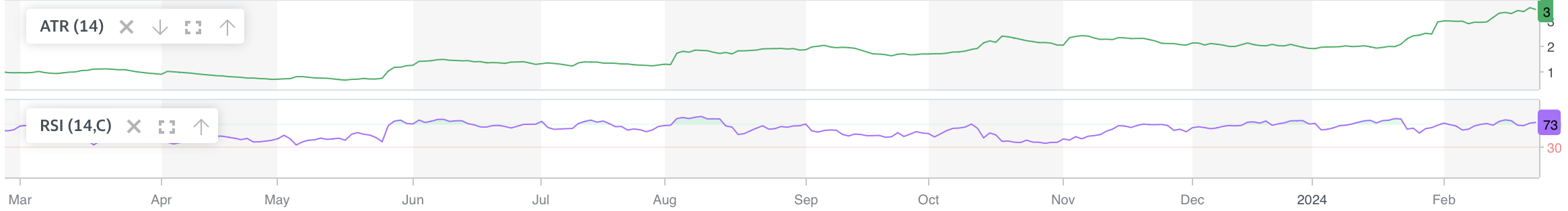

Based on the trends in stock price against the double exponential moving averages (50, 100 and 200 days), the stock is still in an uptrend. The DEMA is chosen for analysis due to recent growth provoked by positive earning results. Notably, the Average True Range value has increased in the last year. This means that the stock has been experiencing higher volatility, so it might make it a less attractive choice for a risk-averse investor. The Relative Strength Indicator is currently slightly above 70, which signals that the security might be overbought and the uptrend might reverse. Based on the increase in volatility, it might be a negative notion, dragging the stock price down slightly.

However, the stock has been in an upward trend since the beginning of 2024, and the slope of the resistance line has been increasing. Therefore, it is unlikely to reverse significantly. Hence, it is still bullish.

MOD Stock Forecast: Conclusion

Modine Manufacturing is a company with diverse growth opportunities. Through the management’s efforts, it is placed in a competitively favourable position to benefit significantly from sustainability initiatives and the data-driven AI boom. They have consistently beaten earnings projections and are improving operationally each quarter. With high volatility in the market, the firm needs to remain conservative with its finances and adopt a degree of strategic thinking to stay profitable and maximise returns. Despite that, the stock is a “Buy” and could grow significantly shortly. It is an excellent addition to a well-diversified portfolio and could yield substantial returns.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the MOD stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with MOD Stock Forecast

I Know First has been bullish on the MOD stock forecast in the past. On February 22nd, 2023 the I Know First algorithm issued a forecast for MOD stock price and recommended MOD as one of the best automotive stocks to buy. The AI-driven MOD stock prediction was successful on a 1-year time horizon resulting in more than 222.56%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.