Quantitative Trading: Hedge Fund Model -Daily Re-Adjustment Swing Trading (Stocks + Interest rates + Currencies)

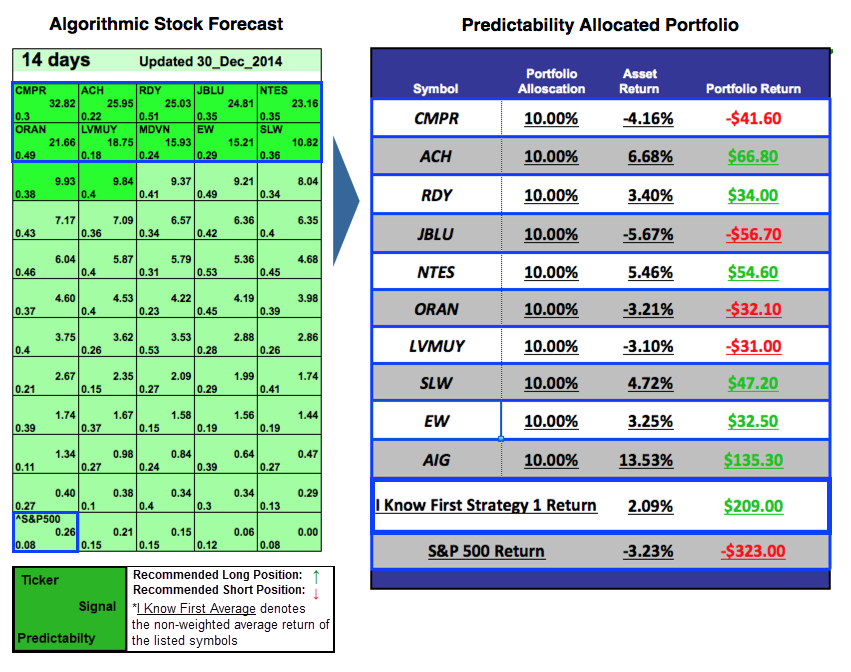

Following the development of Dr. Lipa Roitman’s understanding of relying on the 5 day simple moving average as a secondary trigger for entry and exit, the I Know First R&D team has developed a complementary model to support his thesis. The results were positive, and incorporating the 5 day SMA trigger allows us to design day trading strategies which further enhance returns and reduce risks. The following portfolio invests in the best stocks, interest rate ETFs, and currency pairs as identified by the algorithm and the specified selection process.