Machine Learning in Finance: I Know First’s Deep Learning Trading Strategies

Press Release: Tel Aviv, Israel, March 20th, 2018

– FINOVATE 2018, Conference Date: MARCH 6-9, 2018, London, UK

Special Address: “How Artificial Intelligence Will Transform Investing,”

Yaron Golgher, CEO and Co-Founder of I Know First was selected to speak Finovate Europe Conference Event as a featured keynote speaker in London. Yaron discussed how artificial intelligence will transform investing. Finovate this year hosted 1400+ attendees, 70+ companies demoing, 120+ expert speakers, and countless opportunities. Finovate annually demonstrates cutting-edge banking, financial

Read The Full Premium Article

Read The Full Premium Article

I Know First Algorithmic Trading Strategies: Complete Overview

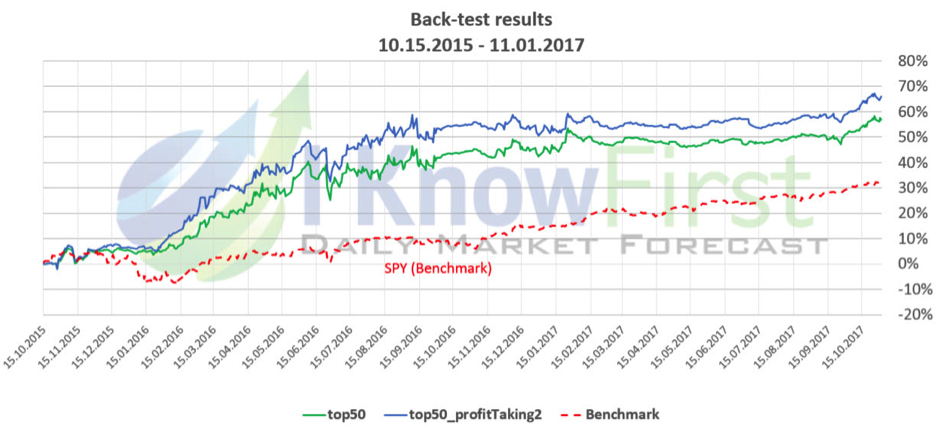

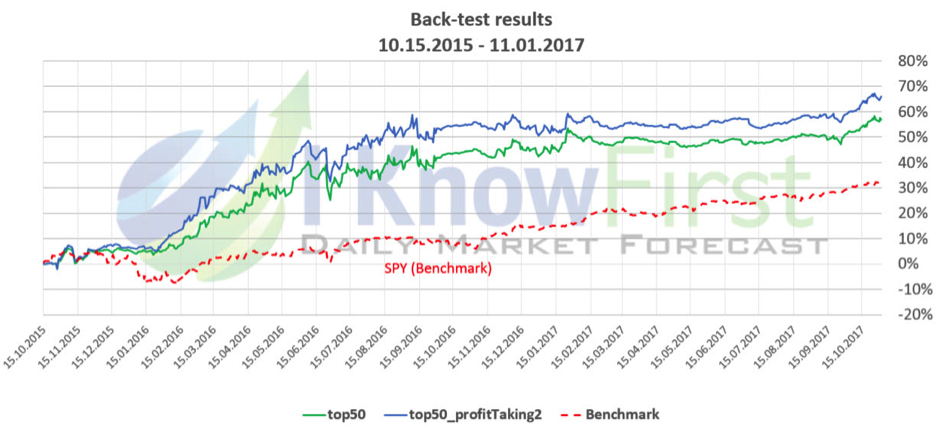

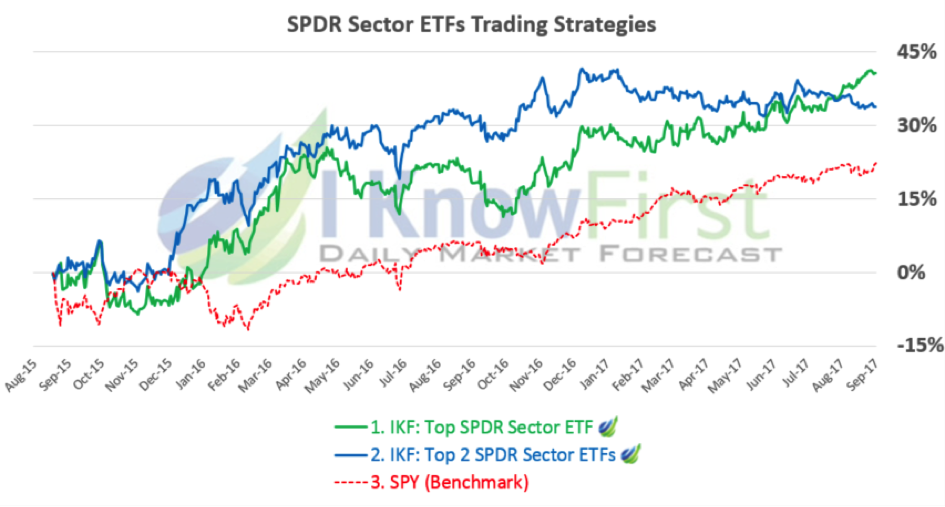

There are multiple algorithmic trading strategies investors can apply when using I Know First’s self-learning algorithm as seen here. After fully understanding how to interpret the heat map, you can construct your own personal portfolio to further optimize returns.

Disclaimer:

I Know First-Daily Market Forecast, does not provide personal investment or financial advice to individuals, or act as personal financial, legal, or institutional investment advisors, or individually advocate the purchase or sale of any security or investment or the use of any particular financial strategy. All investing, stock forecasts and investment strategies include the risk of loss for some or even all of your capital. Before pursuing any financial strategies discussed on this website, you should always consult with a licensed financial advisor.