Unveiling the Power of Quant as a Service in Investment Strategies

This “Quant as a service: quantitative investment with I Know First” article was written by Sergey Okun – Senior Financial Analyst at I Know First, Ph.D. in Economics.

In the dynamic realm of finance and investment, technology continues to play an increasingly crucial role. A notable innovation in recent years is Quantitative Analysis traditionally confined to quantitative hedge funds and institutional investors. However, the advent of “Quant as a Service” (QaaS) is democratizing Quant, revolutionizing how individuals and smaller firms approach markets.

Quantitative Analysis employs mathematical and statistical models to analyze financial markets and inform investment decisions. Traditionally, this required specialized expertise and resources. Yet, with QaaS, these barriers diminish significantly, offering accessible, subscription-based access to sophisticated algorithms and data analytics. QaaS entails outsourcing quantitative analysis tasks to third-party providers who leverage advanced technology like machine learning and artificial intelligence. Cloud-based platforms and APIs make these services accessible, allowing investors to compete effectively with larger institutions.

Key benefits of QaaS include scalability, flexibility, and efficiency. Investors can tailor services to their specific objectives and risk tolerance, harnessing real-time data analysis for faster decision-making. QaaS also promotes data-driven insights, enhancing portfolio management with objective analysis. While quant trading offers substantial benefits, it’s complex and traditionally dominated by large institutions. QaaS addresses these challenges by providing ready-to-use solutions through a subscription model, with options for automated, semi-automated, or manual trading.

Lower barriers to entry, higher efficiency and flexibility, and enhanced transparency and security distinguish QaaS from traditional quant trading. It represents a paradigm shift in investment, offering investors of all sizes the opportunity to unlock new possibilities and gain a competitive edge in today’s digital age.

Investment Solutions for Clients

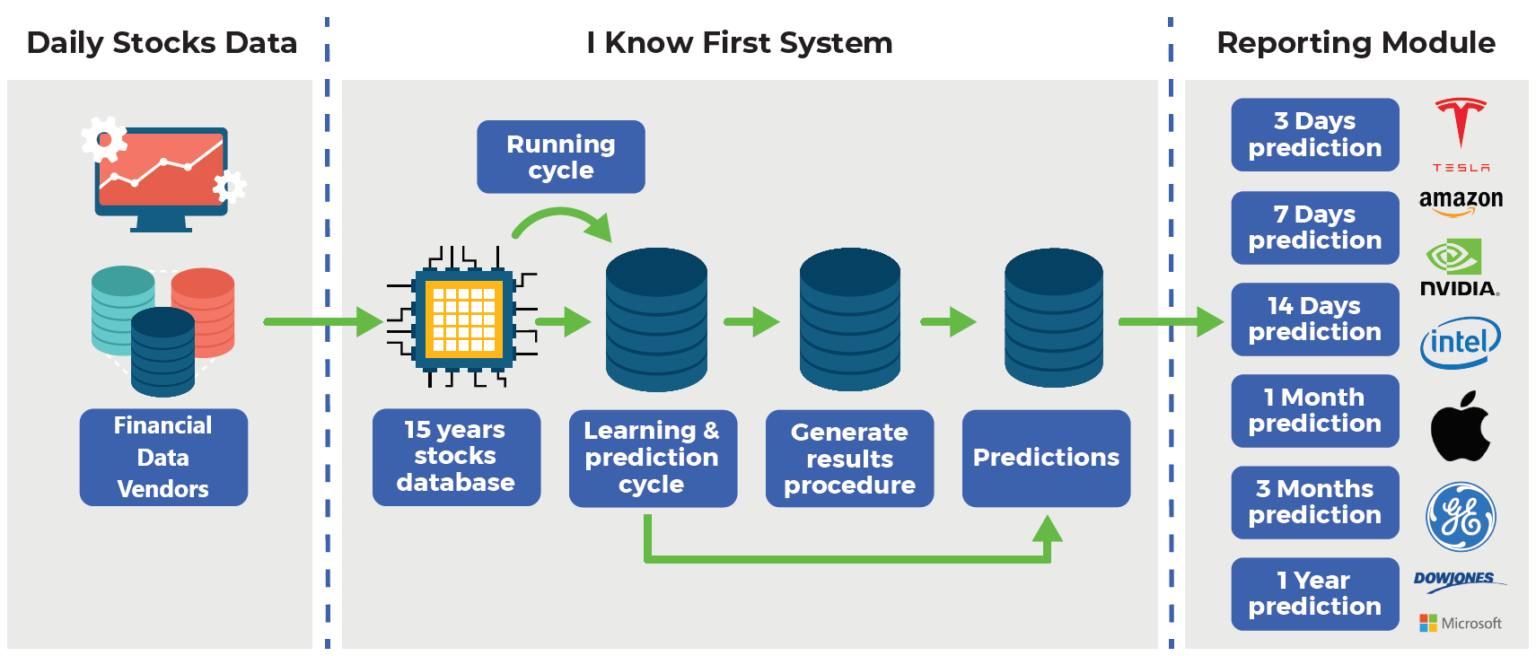

I Know First’s algorithm is based on decades of research into the nature of chaotic systems, self-similarity, fractals, and machine learning algorithms. The algorithm uses artificial neural networks to process large amounts of data from various sources, such as historical prices, volumes, and indicators. The algorithm then generates forecasts for over 13 500 assets and growing, covering stocks, ETFs, commodities, futures, currencies, cryptocurrencies, interest rates, and world indices. The algorithm also provides a predictability indicator, which allows users to identify and focus on the most predictable assets. I Know First’s algorithm is self-learning, adaptable, and evolving, meaning that it constantly updates and improves its forecasts based on new data and feedback. The algorithm also takes a holistic approach, modeling the market as one whole complex system using data from all markets to make its predictions.

We offer two tiers of solutions:

- Tier 1 – the daily AI-powered predictions

- Tier 2 – AI-powered systematic strategies

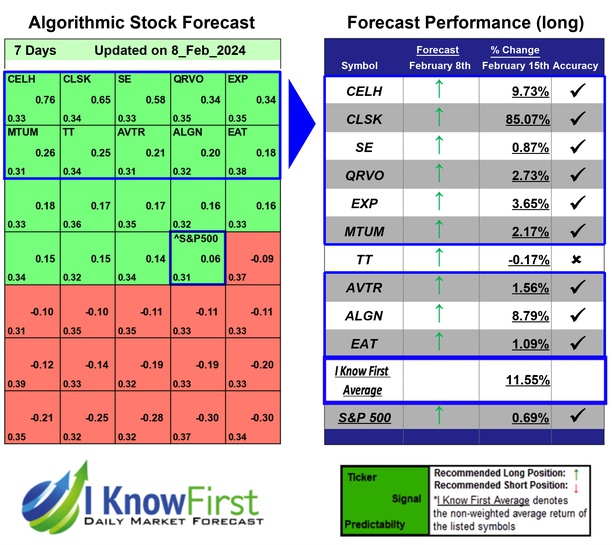

In the context of tier 1, we provide daily forecasts for long and short trading across six time horizons, as outlined in our forecast packages (you can access them here). Before the stock market opened on February 8th, 2024, we had sent recommendations to our clients where we had identified the most promising stocks from the S&P 500 stocks package to buy on a 7-day horizon.

For this 7 Days stock forecast the algorithm has successfully predicted 9 out of 10 movements. CLSK was our best stock pick with a return of 85.07%. Other notable stocks were CELH and ALGN with a return of 9.73% and 8.79%. With these notable trade returns, the package itself registered an average return of 11.55% compared to the S&P 500’s return of 0.69% for the same period.

Also, the algorithm provides recommendations for short positions that are particularly relevant in the period of the bear market. Before the stock market opened on January 31st, 2024, we had sent recommendations to our clients where we had identified the most promising stocks from the Home Builder stocks package to sell or go short on a 3-day horizon.

For this 14 Days stock forecast the algorithm has successfully predicted 9 out of 10 movements. BDN saw a monumental price change of 21.2% in just 14 Days. LXP and KIM also had excellent performances with returns of 5.47% and 4.88% respectively. The package had an overall average return of 4.36%, providing investors with a premium of 2.82% over the S&P 500’s return of 1.54% during the same period.

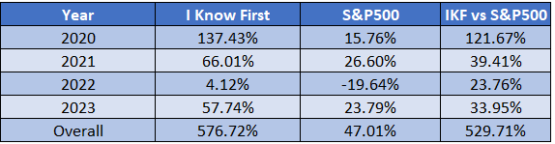

In Tier 2, we offer advanced investment strategies tailored to the specific needs and preferences of institutional clients. Below, we can notice the performance of our “Best Industries Strategy” for the period from January 1st, 2020, to December 31st, 2023 (read more about the strategy here).

The strategy provides a positive return of 576.72% which exceeded the S&P 500 return by 529.71%. Below we can notice the strategy behavior for each year.

You can see more of our strategies here.

I Know First offers its algorithmic solutions to both private and institutional investors, who can access them through web or mobile platforms. Users can select from various packages and plans based on their needs and objectives. Additionally, users have the option to customize their quant trading solutions by choosing the assets, markets, time frames, and strategies they prefer. Furthermore, users can decide between fully automated, semi-automated, or manual quant trading modes, depending on their desired level of involvement and control.

Quant as a service is considered the future of financial markets, democratizing quant trading and empowering users to harness its power. I Know First stands as one of the pioneers and leaders in this field, offering innovative and effective quant trading solutions based on its advanced self-learning algorithm. As the ultimate quant as a service provider, I Know First caters to anyone seeking an edge in the financial markets.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.