I Know First Live Forecast Evaluation Report For Indian Stock Market – Sustainable Algorithm’s Out-performance Over Benchmark and Nifty 200 Index

Executive Summary

In this live forecast evaluation report, we will examine the performance of the forecasts generated by the I Know First AI Algorithm for the Indian stock market and sent to our customers on a daily basis. Our analysis covers time period from January 3, 2018 to September 28, 2018.We will start with an introduction to our stock picking and benchmarking methods and then apply it to the stock universe of the Nifty 200 index as well as all of the stocks covered by us in the “Indian Stocks” Package. This evaluation is part of our continuous studies of live I Know First’s AI predictive algorithm performance.

Nifty 200 Index Highlights

- Top 10 signals provided the most predictable stocks with a return of 8.32% in a 3-month investment horizon, beating the benchmark Nifty 200 by 10.49%.

- There is a clear correlation between increasing time horizons and investment return.

- The benchmark was over-performed in all top signal classes.

The above results were obtained based on forecasts’ evaluation over the specific time period using consecutive filtering approach – by predictability, then by signal, to give general overview of the forecasting capabilities of the algorithm for specific stock universe. The following sections of this study will develop the analysis and the data behind the above results and provide you with deeper understanding of the Methodology and the filtering results for different subsets of assets.

About the I Know First Algorithm

The I Know First self-learning algorithm analyzes, models, and predicts the stock market. The algorithm is based on Artificial Intelligence (AI) and Machine Learning (ML), and incorporates elements of Artificial Neural Networks and Genetic Algorithms.

The system outputs the predicted trend as a number, positive or negative, along with a wave chart that predicts how the waves will overlap the trend. This helps the trader to decide which direction to trade, at what point to enter the trade, and when to exit. Since the model is 100% empirical, the results are based only on factual data, thereby avoiding any biases or emotions that may accompany human derived assumptions. The human factor is only involved in building the mathematical framework and providing the initial set of inputs and outputs to the system. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions.

Our algorithm provides two independent indicators for each asset – Signal and Predictability.

The Signal is the predicted strength and direction of movement of the asset. Measured from -inf to +inf.

The predictability indicates our confidence in that result. It is a Pearson correlation coefficient between past algorithmic performance and actual market movement. Measured from -1 to 1.

You can find the detailed description of our heatmap here.

The Stock Picking Method

The method in this evaluation is as follows:

We take the top X most predictable assets, and from them we pick the top Y highest signals.

By doing so we focus on the most predictable assets on the one hand, while capturing the ones with the highest signal on the other.

For example, a top 30 predictability filter with a top 10 signal filter means that on each day we take only the 30 most predictable assets, and then we pick from them the top 10 assets with the highest absolute signals.

We use absolute signals since these strategies are long and short ones. If the signal is positive, then we buy and, if negative, we short.

The Performance Evaluation Method

We perform evaluations on the individual forecast level. It means that we calculate what would be the return of each forecast we have issued for each horizon in the testing period. Then, we take the average of those results by strategy and forecast horizon.

For example, to evaluate the performance of our 1-month forecasts, we calculate the return of each trade by using this formula:

This simulates a client purchasing the asset based on our prediction and selling it exactly 1 month in the future.

We iterate this calculation for all trading days in the analyzed period and average the results.

Note that this evaluation does not take a set portfolio and follow it. This is a different evaluation method at the individual forecast level.

The Benchmarking Method

The theory behind our benchmarking method is the “Null hypothesis“, meaning buying every stock in the particular asset universe regardless of our I Know First indicators.

In comparison, only when our signals are of high signal strength and high predictability, then the particular stocks should be bought (or shorted).

The ratio of our signals trading results to benchmark results indicates the quality of the system and our indicators.

Example: A benchmark for the 3d horizon means buy on each day and sell exactly 3 business days afterwards. We then average the results to get the benchmark. This is in order to get an apples to apples comparison.

Stock universe under consideration – Indian Stock Market

In this report we conduct testing for Indian stock market that I Know First cover by its algorithmic forecast in “Indian stocks” package. The period for evaluation and testing is from January 3, 2018 to September 28, 2018. During this period, we were providing our clients with daily forecasts for Indian stocks and the time horizons which we evaluate in this report are 5 periods spanning from 3 days to 3 months. This evaluation is part of our series of live evaluation studies of I Know First’s AI predictive algorithm performance. The previous study conducted for the period from January 3, 2018 to August 24, 2018 is available here. Also, for the comparison purposes we consider the performance of NIFTY 200 index, which is a commonly used for representation of India’s stock market performance, over the same time period and corresponding time horizons. The methodology of NIFTY 200 index can be found here.

Evaluating the predictability indicator

Following the methodology described in the previous sections, we start our analysis with computing the performance of the algorithm’s long and short signals for time horizons ranging from 3 days to 3 months without considering the signal indicator. Therefore, we applied filtering by the predictability indicator for 5 different levels to investigate its sole marginal effect in terms of return when different filters are applied. Afterwards, we calculated the returns for the same time horizons of the benchmark using the same stocks universe and compared them to the performance of the filtered sets of assets. Our findings are summarized in the table below:

Figure 6.1 Indian Stock Universe Predictability Effect On Return

From the above table and following charts, we can observe that generally the marginal predictability effect gives considerable increases with the narrowing of the asset subsets from the Top 50 assets to the Top 30 assets filtered by predictability. We observed this effect for the all of the considered time horizons and the maximum performance was recorded at 3-months’ horizon at 6.94%. In comparison with the benchmark based on all assets from the considered assets universe, we can see that just by applying the predictability indicator as an investment criterion without consideration of the signal strength, already yields positive return and outperforms the benchmark and NIFTY 200 index by more than 11% and 9%, respectively, in case of Top 30 stock by predictability criterion on 3-months’ horizon.

Average returns per time horizon (3 days to 2 weeks), only predictability filter

Average returns per time horizon (1 month to 3 months), only predictability filter

Evaluating the Signal indicator

In this section we will demonstrate how adding the signal indicator to our stock picking method improves the above performance even further. It is also important to measure the out-performance relative to the benchmark and for that we will apply the formula:

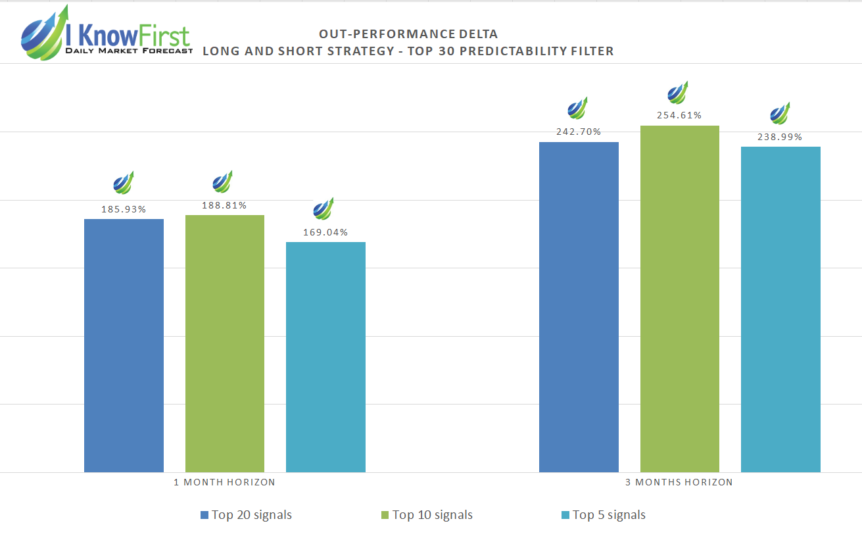

As far as the Top 30 assets filtered by predictability showed the best performance in the previous section, we applied further filtering by signal strength to this subset to investigate potential improvement in return in comparison with sole predictability filtering. The results of the testing showed that there is a significant positive marginal effect on the assets return, especially in the case of the 3-months’ investment horizon. We present our findings in the following table and charts (Figure 6-2).

Figures 6-2 Indian Stock Universe Key Performance Indicators Summary

Average returns per time horizon (3 days to 2 weeks), predictability & signal filters

Average returns per time horizon (1 month and 3 months), predictability & signal filters

Out-performance per time horizon (3 days to 3 months), predictability & signal filters

Average hit ratio per time horizon, predictability & signal filters

From the above set of charts, we can clearly see that if we apply signal strength filtering to the Indian stocks’ universe, all of the presented above subsets show significant improvements in the performance comparing to sole predictability filter being applied reaching more than 1,5% in the case of Top 10 by signal assets’ subset. In general, all the above subsets start to produce greater returns than the benchmarks with increase of time horizon. If we consider shorter horizons spanning from 3 days to 1 week, we record that Top 5 by signal subset demonstrate the best performance comparing to Top 10 and Top 20 subsets reaching average returns of .60% and corresponding out-performance of 196.91%. As soon as we start to move on to longer periods ranging from 2 weeks to 3 months it is easy to see that for the 2-weeks’ period Top 20 subset provided the highest return (.57%) among other subsets, but for 1-month’ and 3-months’ time horizons the best choice was to use Top 10 subset. For these time horizons the returns were at the levels 1.92% and 8.32% and the corresponding out-performance was 188.81% and 254.61% respectively, comparing to the benchmark. Moreover, if we compare these results to the NIFTY 200 performance, we will see that the performance of all considered subsets is far higher, effectively providing corresponding out-performance ranging from .18% to almost 10% with increasing time horizon. Finally, the hit ratio for Top 10 and the other filtered subsets follows the similar pattern – for all of the time horizons it stays at some 50% and we observe its peak values for Top 10 set on 3-month time horizon at 71.11% comparing to the benchmark’s 36.20%.

Conclusion

In this analysis, we demonstrated the out-performance of our forecasts for the stocks from Indian market picked by I Know First’s AI Algorithm for the period from January 3, 2018 to September 28, 2018. Based on the presented observations we record significant out-performance of the Top 30 stocks filtered by predictability for all time horizons for the considered asset universe, even without filtering by signal strength.

Applying our predictability indicator as an investment criterion coupled with filtering by our signal strength, results in even greater out-performance over the benchmarks comprised of stocks from the Indian stocks universe, in general. That said, the Top 5 stocks from the considered stock universe filtered by predictability and signal yield significantly higher returns than any other asset subset on shorter horizons (from 3 days to 1 week) and Top 10 stocks’ subset yields the highest returns on longer horizons (from 1 month to 3 months). The corresponding out-performance over the considered benchmark is also great and reaches its maximum with Top 10 stocks at 3-months’ time horizon (as shown in Figure 6.2 above). Therefore, an investor who wants to critically improve the structure of his investments by adding Indian stocks to his portfolio can do so by simultaneously utilizing the I Know First predictability and signal indicators as criteria for picking stocks.