Stock Market Predictions: Sector Rotation Strategy

Stock Market Predictions: I Know First provides investment solutions for both individual and institutional investors, utilizing an advanced AI self-learning algorithm to gain a competitive advantage. We offer a personalized approach to our institutional clients, assisting them in their investment process based on their specific needs and preferences. For more details about I Know First solutions for institutional investors, please visit our website.

Stock Market Predictions: Long/Short the Best Sector

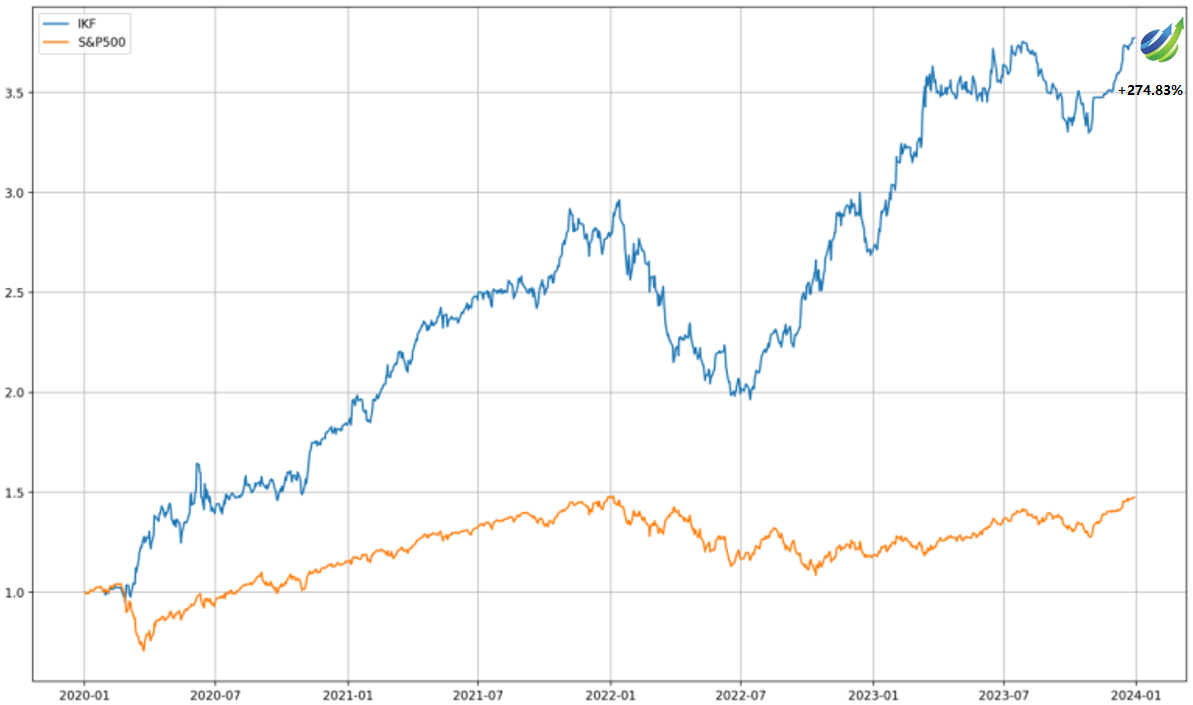

The following trading strategy was developed using I Know First’s AI Algorithm daily forecasts from January 1st, 2020, to December 31st, 2023, with a focus on S&P 500 stocks selected based on the predictable filters. This strategy is available to our institutional clients: hedge funds, banks, and investment houses, as a tier 2 service on top of tier 1 (the daily forecast). The strategy involves selecting the correct SPDR sector. We filter stocks by predictability, check which sector has more stocks from the stock picks, and go long or short on that sector on a 4-week rebalancing basis.

The strategy provides a positive return of 274.83% which exceeded the S&P 500 return by 227.82%. Below we can notice the strategy behavior for each year.

The strategy provides a positive return of 83.72%, which exceeded the S&P 500 return by 67.96% in 2020. In most cases, the strategy selected the long position in the financial sector (XLF) 6 times in 2020. Additionally, there were long positions in the technology (XLK) and industrial (XLI) sectors, along with a short position in the real estate (XLRE) sector, resulting in 11 long and 1 short positions during 2020.

The strategy provides a positive return of 48.65%, exceeding the S&P 500 return by 22.05% in 2021. In most cases, the strategy selected the long position in the financial sector (XLF) 6 times. Additionally, there were long positions in the technology (XLK), industrial (XLI), and consumer discretionary (XLY) sectors, resulting in a total of 13 long positions in 2021.

The strategy provides a positive return of -3.46%, which exceeded the S&P 500 return by 16.18% in 2022. In most cases, the strategy selected the long position in the industrial sector (XLI) 6 times. Additionally, there were positions in the financial (XLF), healthcare (XLV), and consumer discretionary (XLY) sectors, resulting in 10 long positions and 3 short positions in 2022.

The strategy provides a positive return of 37.74%, exceeding the S&P 500 return by 13.95% in 2023. In most cases, the strategy selected the long position in the technology sector (XLI) 6 times. Additionally, there were positions in the financial (XLK) and industrial (XLF) sectors, resulting in 4 long positions and 2 short positions in 2023. It’s important to note that the market witnessed financial turbulence in March due to the bankruptcy of several banks, including Silicon Valley Bank (SVB). The IKF algorithm adeptly identified XLF as the most promising sector and capitalized on short positions within it. Below we can notice the strategy behavior for each year.

Overall, we can notice that the IKF strategy beats the S&P500 in a systematic way for 2020-2023.

Conclusion

I Know First offers investment solutions for institutional investors, leveraging our advanced self-learning algorithm to gain a competitive advantage. We deliver a personalized approach to our institutional clients, enhancing their investment processes to align with their distinct needs and preferences. Within this framework, we have assessed the performance of the Sector Rotation strategy. This evaluation encompasses the period from January 1st, 2020, to December 31st, 2023.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.