Stock Market Forecast: Investment Strategies to Beat the Market Using the I Know First AI Algorithm

This article “Stock market forecast: investment strategies to beat the market with the I Know First AI algorithm” was written by the I Know First Research Team.

This article “Stock market forecast: investment strategies to beat the market with the I Know First AI algorithm” was written by the I Know First Research Team.

Stock Market Forecast: I Know First provides investment solutions for individual and institutional investors with a competitive advantage utilizing an advanced AI self-learning algorithm. We provide an individual approach for our institutional clients and help them in their investment process based on their needs and preferences. Visit our website for more details about I Know First solutions for institutional investors.

I Know First Trading Strategies

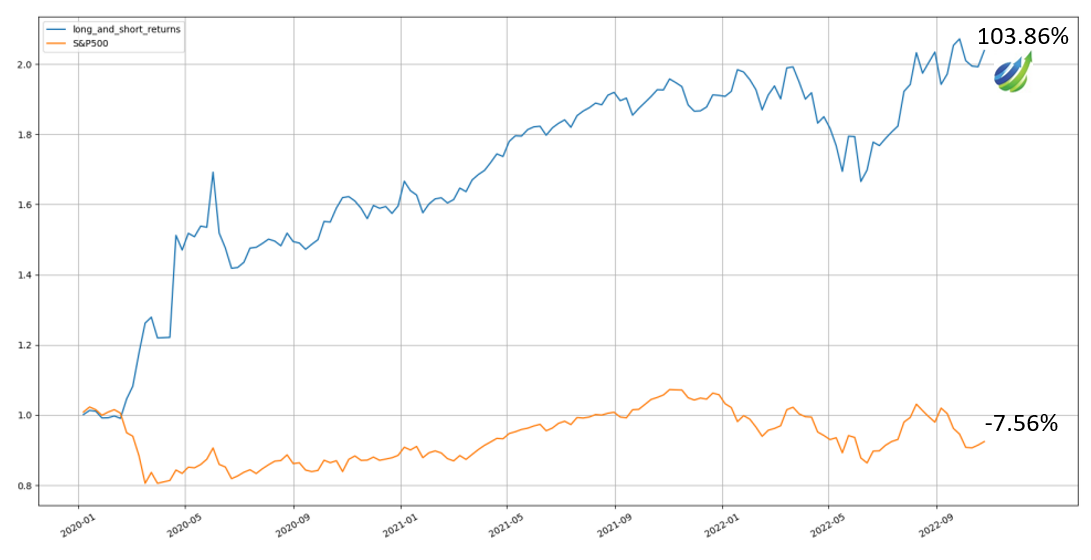

The following trading strategies were built using I Know First AI Algorithm daily forecasts from January 1st, 2020, until October 28th, 2022, focusing on S&P 500 stocks. These strategies’ results are examples of trading solutions I Know First could provide to institutional clients.

The benchmark used for the analysis of different strategies is the S&P 500 index performance during the trading periods. For example, if the trading period of the week is from Wednesday to Friday, the benchmark would be the S&P 500 index performance throughout the same period.

Strategy 1: Low Risk

- Total Return: 40.04%

- Benchmark return: -7.56%

- Average weekly return: 0.25%

- Average weekly Std: 1.62%

- Annualized Sharpe ratio: 1.67

- Average positions open: 450

Strategy 1 focuses on lowering risk, without having very high returns. The strategy beat the benchmark for more than 45% return and obtained a shape ratio of 1.67.

Strategy 2: Moderate Risk

- Total Return: 74.35%

- Benchmark return: -7.56%

- Average weekly return: 0.41%

- Average weekly Std: 2.30%

- Annualized Sharpe ratio: 1.97

- Average positions open: 354

Strategy 2 provides a smaller portfolio, which has higher returns but also the level of risk increases. The total return of strategy 2 was 74.35% beating the benchmark which gave -7.56% return over the same period. The shape ratio increased compared to strategy 1, getting to 1.97.

Strategy 3: High Risk

- Total Return: 103.86%

- Benchmark return: -7.56%

- Average weekly return: 0.54%

- Average weekly Std: 3.22%

- Annualized Sharpe ratio: 1.85

- Average positions open: 350

Strategy 3 increases the level of risk, obtaining high returns with a shape ratio of 1.85. The strategy beat the benchmark for more than 100% return.

Stock Market Forecast: Strategies Comparison Table

I Know First Algorithm – Seeking the Key & Generating Stock Market Forecast

The I Know First predictive algorithm is a successful attempt to discover the rules of the market that enable us to make accurate stock market forecasts. Taking advantage of artificial intelligence and machine learning and using insights of chaos theory and self-similarity (the fractals), the algorithmic system is able to predict the behavior of over 13,500 markets. The key principle of the algorithm lies in the fact that a stock’s price is a function of many factors interacting non-linearly. Therefore, it is advantageous to use elements of artificial neural networks and genetic algorithms. How does it work? At first, an analysis of inputs is performed, ranking them according to their significance in predicting the target stock price. Then multiple models are created and tested utilizing 15 years of historical data. Only the best-performing models are kept while the rest are rejected. Models are refined every day, as new data becomes available. As the algorithm is purely empirical and self-learning, there is no human bias in the models and the market forecast system adapts to the new reality every day while still following general historical rules.

Stock Market Forecast: Conclusion

I Know First provides investment solutions for institutional investors with a competitive advantage utilizing our advanced self-learning algorithm. I Know First provides an individual approach for institutional clients to improve their investment process based on their needs and preferences. We have reviewed the performance of several trading strategies where the AI algorithm beat the S&P500 in a dramatic way for the period from January 1st, 2020, to October 28th, 2022.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.