Stock Forecast Based on AI: Profit-Taking Strategy

Stock Forecast Based on AI: I Know First provides investment solutions for both individual and institutional investors, utilizing an advanced AI self-learning algorithm to gain a competitive advantage. We offer a personalized approach to our institutional clients, assisting them in their investment process based on their specific needs and preferences. For more details about I Know First solutions for institutional investors, please visit our website.

Stock Forecast Based on AI: Profit-Taking Strategy

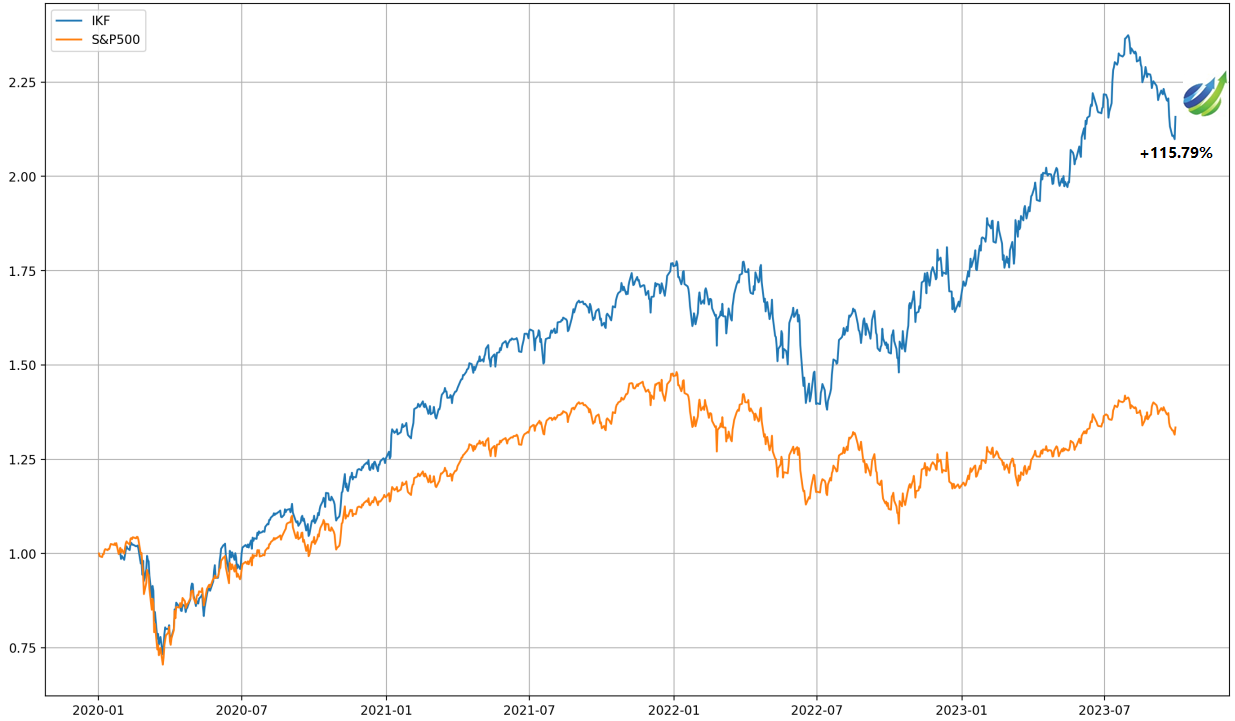

The following trading strategy was developed using I Know First’s AI Algorithm daily forecasts from January 29ht, 2020, to September 30th, 2023, with a focus on S&P 500 stocks selected based on the signal filter. The result of this strategy serves as an example of the trading solutions that I Know First could offer to institutional clients.

The main idea of the strategy is to systematically outperform the S&P 500 index. This is achieved by constructing our tier-weighted portfolio on a monthly basis, implementing both the signal outlier filter and the majority direction. To systematically beat the S&P 500 index, we take profits when our portfolio surpasses the index by 1% and reinvest the funds in SPY until the next monthly rebalance.

The strategy involves constructing a tier-weighted portfolio with monthly rebalancing, achieved through the implementation of predictable and signal filters. Additionally, we utilize the signal outlier filter to ensure that stocks with signals outside of the selected range, i.e., those exhibiting extreme values, are not included.

Moreover, the strategy controls the majority direction. The term “majority direction” refers to our predictions for stocks, upon which we base our position. This decision is guided by a number of long and short stock forecasts. Therefore, if the count of long stock forecasts surpasses the count of short stock forecasts, the majority direction is to go long and we construct a long portfolio. Conversely, if the count of short stock forecasts is higher, we assume a short portfolio. In the case of this strategy, we control only the short majority direction. If the majority direction is long, we keep our portfolio until the next monthly rebalancing. If the majority direction is short, we check every week to ensure that the direction does not change. If a short majority direction changes to a long majority direction, then we close our portfolio and invest in SPY until the next rebalancing period.

The strategy provides a positive return of 115.79% which exceeded the S&P 500 return by 84.33%. Below we can notice the strategy behavior for each year.

According to the table below, we can observe the consistent stability of the strategy in outperforming the S&P 500 by 1%, as the hit ratio for all years exceeds 60%, with an overall hit ratio of 70.83%.

I Know First Algorithm – Seeking the Key & Generating Stock Market Forecast

The I Know First predictive algorithm is a successful attempt to discover the rules of the market that enable us to make accurate stock market forecasts. Taking advantage of artificial intelligence and machine learning and using insights of chaos theory and self-similarity (the fractals), the algorithmic system is able to predict the behavior of over 13,500 markets. The key principle of the algorithm lies in the fact that a stock’s price is a function of many factors interacting non-linearly. Therefore, it is advantageous to use elements of artificial neural networks and genetic algorithms. How does it work? At first, an analysis of inputs is performed, ranking them according to their significance in predicting the target stock price. Then multiple models are created and tested utilizing 15 years of historical data. Only the best-performing models are kept while the rest are rejected. Models are refined every day, as new data becomes available. As the algorithm is purely empirical and self-learning, there is no human bias in the models and the market forecast system adapts to the new reality every day while still following general historical rules.

Conclusion

I Know First offers investment solutions for institutional investors, leveraging our advanced self-learning algorithm to gain a competitive advantage. We provide a personalized approach for our institutional clients, enhancing their investment process according to their specific needs and preferences. In this context, we have evaluated the performance of the profit-taking strategy during the period from January 29ht, 2020, to September 30th, 2023.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.