Stock Market Prediction: High-Performance Strategy

This article “Stock market prediction: High-Performance Strategy” was written by the I Know First Research Team.

This article “Stock market prediction: High-Performance Strategy” was written by the I Know First Research Team.

Stock Market Prediction: I Know First provides investment solutions for both individual and institutional investors, utilizing an advanced AI self-learning algorithm to gain a competitive advantage. We offer a personalized approach to our institutional clients, assisting them in their investment process based on their specific needs and preferences. For more details about I Know First solutions for institutional investors, please visit our website.

Stock Market Prediction: The Signal Weighted Strategy with the Signal Outlier Filter

The following trading strategy was developed using I Know First’s AI Algorithm daily forecasts from January 21st, 2020, to June 26th, 2023, with a focus on S&P 500 stocks selected based on the signal and predictable filters. This strategy is available to our institutional clients: hedge funds, banks, and investment houses, as a tier 2 service on top of tier 1 (the daily forecast).

The strategy involves constructing a signal-weighted portfolio with monthly rebalancing by implementing the predictable filter and signal outlier filter. In this context, we select the most predictable stocks for our portfolio. After, we assign stock weights based on the signal filter. Also, we implement the signal outlier filter for ensuring that stocks with signals outside of the chosen range, i.e., those with extreme values, are not considered.

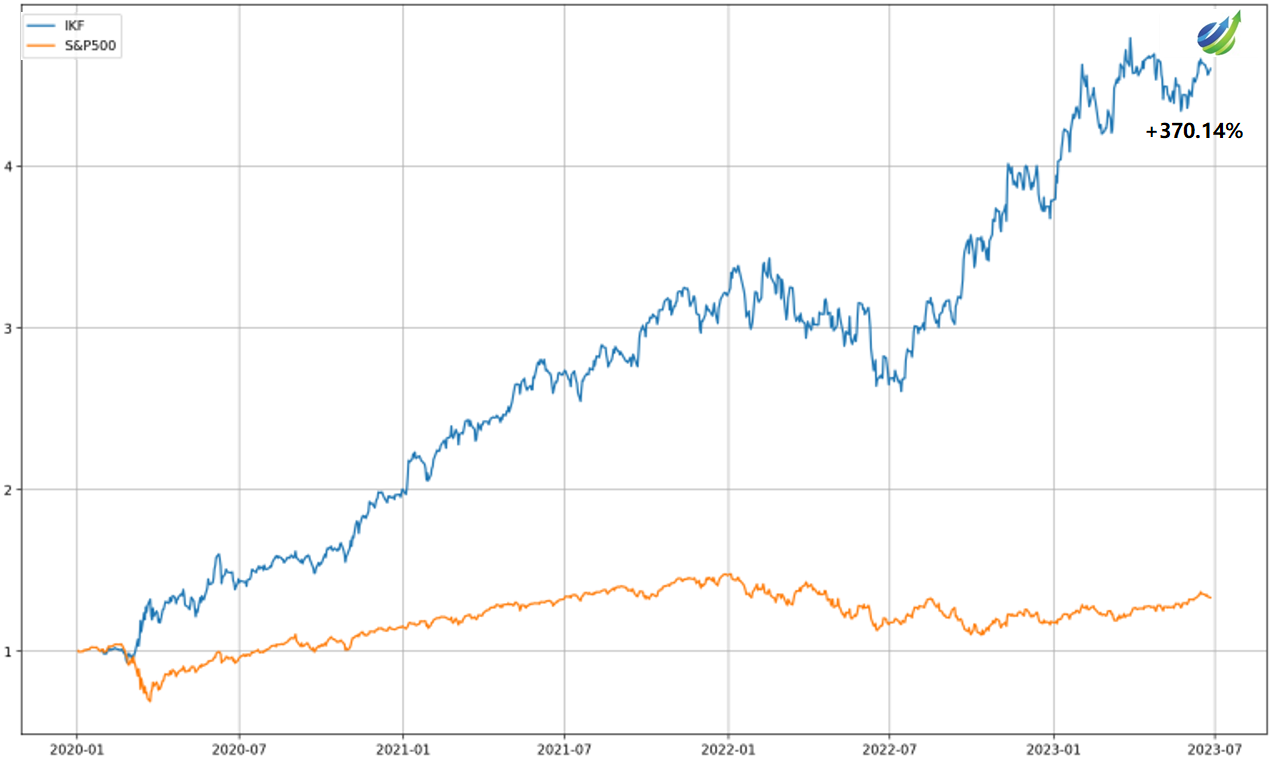

The strategy provides a positive return of 370.14% which exceeded the S&P 500 return by 338.34%. Below we can notice the strategy behavior for each year.

The IKF strategy achieved a return of 100.19% in 2020, surpassing the S&P 500 return by 84.63%. The most significant disparity between the strategy’s return and that of the S&P 500 occurred from February 26th, 2020, to March 23rd, 2020. As illustrated in Figure 3, XLE (energy sector) demonstrated the best performance in terms of absolute return for both SPY and the IKF strategy. However, the IKF strategy managed to outperform SPY by executing 50 short positions. Furthermore, Figure 4 presents the top 10 performing stocks within the IKF portfolio during this specific period.

The strategy provides a return of 62.52% in 2021, which exceeded the S&P 500 return by 35.97%.

The most significant difference in return between the IKF strategy and the S&P 500 occurred from January 29th, 2021, to March 15th, 2021. Figure 6 reveals that XLE (energy sector) and XLF (financial sector) exhibited the best performance in terms of absolute return for SPY. Simultaneously, XLF (financial sector) and XLI (industrial sector) emerged as the best performing sectors in absolute return for the IKF strategy. Through the engagement of 72 long positions, the IKF strategy outperformed SPY. Additionally, Figure 7 presents the top 10 performing stocks within the IKF portfolio for this specific period.

The strategy provides a return of 16.67% in 2022, while the S&P 500 shows a negative return of -19.71%.

The most significant difference between the IKF strategy’s return and that of the S&P 500 occurred from September 9th, 2022, to October 6th, 2022. As evident in Figure 9, XLRE (real estate sector) and XLU (utility sector) showcased the best performance in terms of absolute return for SPY. Simultaneously, for the IKF strategy, XLRE (real estate sector) and XLC (communication services sector) stood out as the best performing sectors in absolute return. The IKF strategy managed to surpass SPY by engaging in 76 short positions. Furthermore, Figure 10 presents the top 10 performing stocks within the IKF portfolio during this particular period.

The strategy provides a return of 21.19% in 2023, which exceeded the S&P 500 return by 8.94%.

The most significant difference between the strategy’s return and the S&P 500 occurred from March 6th, 2023, to March 15th, 2023. As depicted in Figure 12, the XLF (financial sector) exhibited the best performance in terms of absolute return for both SPY and the IKF strategy. However, the IKF strategy outperformed SPY by executing 42 long and 49 short positions. It’s important to note that this period witnessed financial turbulence due to the bankruptcy of several banks, including Silicon Valley Bank (SVB). The IKF algorithm adeptly identified the most promising sector and capitalized on short positions within it. Figure 13 illustrates the top 10 performing stocks in the IKF portfolio during this timeframe.

Conclusion

I Know First offers investment solutions for institutional investors, leveraging our advanced self-learning algorithm to gain a competitive advantage. We deliver a personalized approach to our institutional clients, enhancing their investment processes to align with their distinct needs and preferences. Within this framework, we have assessed the performance of the High-Performance strategy. This evaluation encompasses the period from January 21st, 2020, to June 26th.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.