S&P 500 Forecast Based On AI: SPY Trading Strategies based on I Know First’s algorithmic signals

In the following article we analyze the performance of SPY trading strategies developed using several ways of computing an S&P 500 forecast using I Know First’s daily market predictions. We show different ways such strategies can be built using the algorithmic forecasts and that they result in ETF portfolios with excellent performance and risk statistics.

I Know First Overview

I Know First is an Israeli fintech company that brings artificial intelligence to the financial world by providing daily investment forecasts based on an advanced self-learning algorithm. This algorithm generates investment predictions for a universe of over 8200 assets which result in a daily ranking of investment opportunities. These can easily be integrated into investment selection processes and, combined with the appropriate strategy, be translated into portfolios with outstanding statistics for all types of investors.

Here we focus on ways of constructing long only SPY trading strategies (the SPY is an ETF that tracks the performance of the S&P 500 index) by 1) using the predictions generated by our algorithm specifically for this ETF and 2) aggregating the signals for the ETF’s individual components weighted by their respective weight into a forecast for the whole ETF.

SPY Trading Strategies using a Direct and an Aggregated S&P 500 Forecast

In this article we show the performance of three SPY trading strategies which select whether to be long or exit the SPY on a daily basis:

- Direct

- This strategy uses the signal directly generated by our forecasting algorithm for the SPY to decide each day whether to be long or neutral the SPY

- Weighted aggregation

- Here we take the daily stock signals for the individual components of the SPY ETF as stated on the ETF provider’s website and use them to compute a forecast for the entire ETF. To do this we sum the weights of the components for which our predictions are long and those for which they are short and divide by the total sum of the weights, which gives the weighted percentage of stocks within the ETF in each direction. Finally, we use a fixed threshold level to compute the final ETF forecast. This process results in a daily investment decision for the SPY.

- Combination of Direct and Aggregation

- We combine the two previous approaches into one portfolio which results in an improved strategy in terms of risk adjusted return.

Strategy Performance

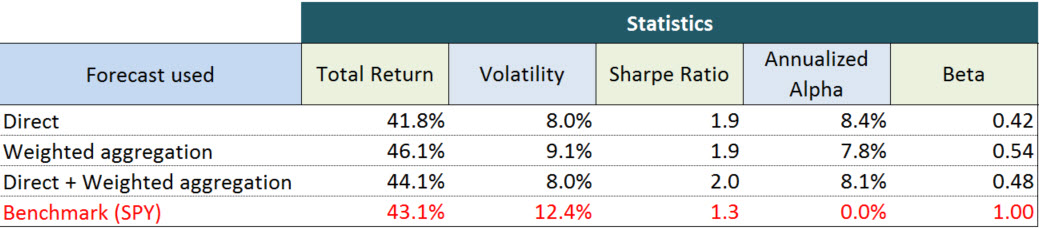

The following table gives the performance of the I Know First SPY trading strategies using the 1 month forecast for the period 08/18/2015 – 01/31/2018 without including transaction or spread costs versus the performance of the benchmark, the long only SPY.

All of I Know First’s SPY trading strategies significantly outperform the benchmark in terms of risk adjusted return (Sharpe Ratios up to 2.0 versus the benchmark’s 1.3) and register very strong alpha and beta statistics (annualized alpha up to 8.4% and betas around 0.5).

The chart for the strategies versus the benchmark (in red) is shown below.

Conclusion

In this article, we presented results of using I Know First’s algorithmic predictions to develop long only SPY trading strategies. Portfolios based on the direct forecasts for the SPY and based on forecasts computed by aggregating stock level signals of the ETF’s components were tested and both showed very good results, registering Total Returns close to and above the SPY, Sharpe Ratios significantly greater than the benchmark and thus significantly better risk-adjusted returns, and excellent alpha and beta statistics. We thus managed to achieve total returns equal and greater than the benchmark’s with 2/3 of the risk.