Algorithmic Trading Strategies for European Stocks

In the following, we present an analysis of Algorithmic Trading Strategies for the I Know First “European Stocks Package” which rely upon the algorithm’s daily quantitative predictions and can easily be implemented by I Know First’s retail clients. We show that these strategies result in high performing trading portfolios with:

- Sharpe ratios reaching 1.7

- Returns of up to 109% in a 1.5-year time period

- Portfolios constantly adjusted to the ever-changing market environment identified by the AI system

- Portfolio statistics that vastly outperform the benchmark

Algorithmic Trading Strategies for European Stocks

We present an analysis of a series of trading strategies easily implementable by I Know First retail clients using the standard European Stocks Package, that generated returns of up to 109% over the time period going from August 2015 to March 2017.

The strategies follow the algorithm’s 1-month signals and invest daily in the strongest 2, 3, 4, and 5 stocks (long and short) from the “European Stocks” package, resulting in a portfolio continuously in line with the AI system’s recommendations and thus the evolving market conditions.

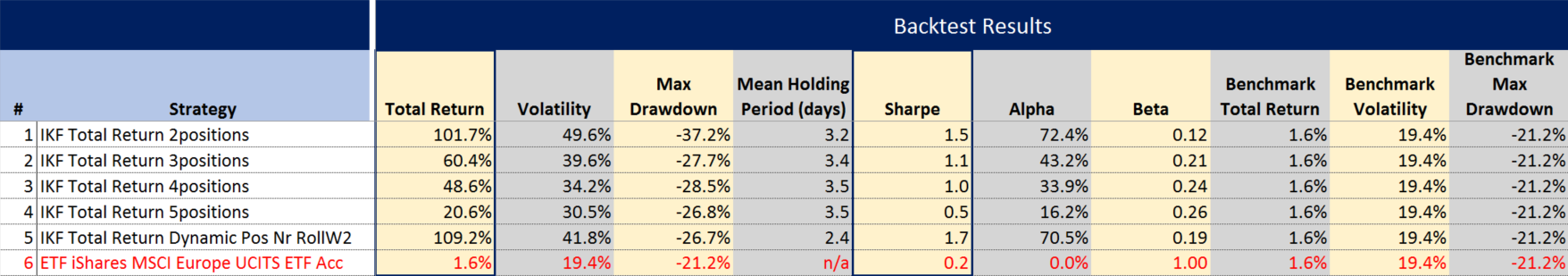

The results of these strategies including the effect of bid-ask spreads and commissions (0.08% per trade) are summarized in the following table (click on the table to enlarge). Rows 1 through 5 present the statistics of the I Know First Portfolios while row 6 shows those of the benchmark, the ETF iShares MSCI Europe UCITS ETF Acc (largest 445 European stocks, market cap weighted ETF).

As can be seen above the I Know First Portfolios largely outperform the benchmark with returns reaching 109% in the 1.5-year time period and Sharpe ratios reaching 1.7 versus the benchmark’s total return of 1.6% and Sharpe ratio of 0.2 in the same timeframe.

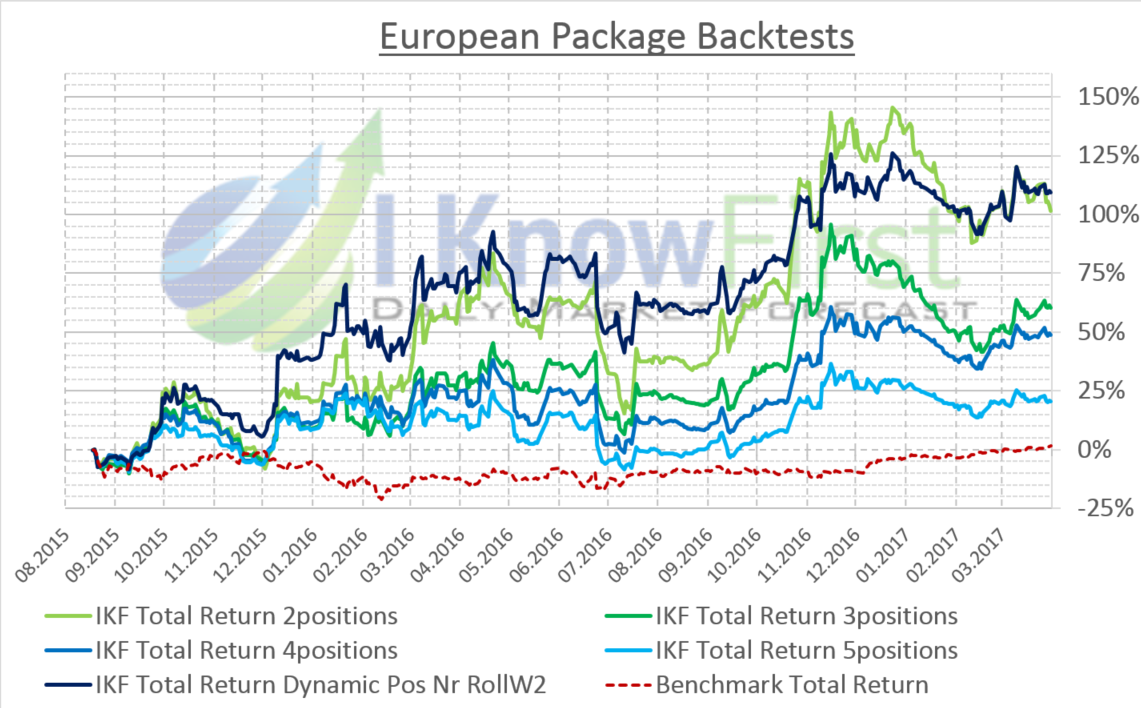

The graph below shows the evolution in time of the 5 strategies versus the benchmark (in red).

Strategy Description

In the first day of the simulation we extract the highest 2, 3, 4, or 5 (depending on the strategy adopted) signals from the forecasts sent to clients for the 1-month time horizon and open long or short positions (depending on whether the signal is positive or negative) for the respective tickers in the investment portfolio. In this analysis, all positions are allocated the same weight (equally weighted). The last strategy in the table (row 5) starts out by investing in the top 2 signals but adjusts the position number to the portfolio returns: this results in a more dynamic and self-regulating portfolio without the need to specify and fix the portfolio size a priori.

Every following day the portfolio is rebalanced according to the most recent algorithmic predictions which are sent to clients on a daily basis. Positions for which signals in absolute value are not among the strongest anymore or for which signals changed direction are closed and new positions are opened again in order of the signals’ absolute value until that the portfolio is again full.

This system translates into a portfolio continuously in line with the algorithm’s recommendations and hence with the market’s evolving dynamics.

Automatized Portfolio Management

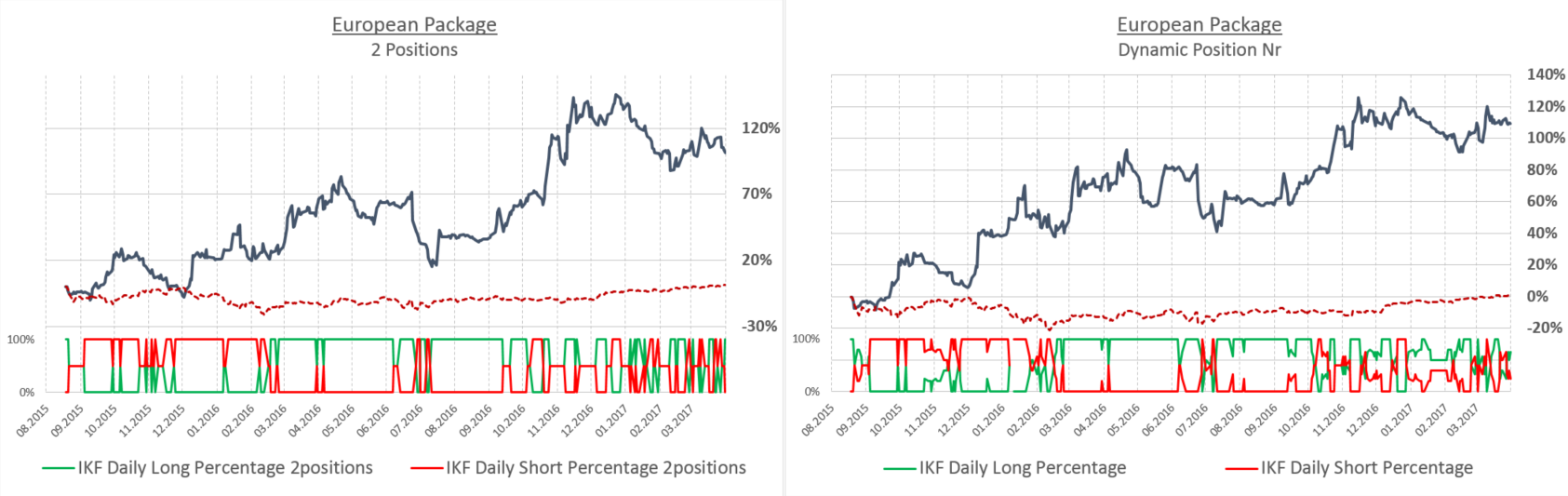

The following chart plots the returns of the two best performing strategies (IKF Total Return 2 Positions and IKF Total Return Dynamic Pos Nr RollW2) against the benchmark in red, in parallel with the percentage of the portfolio that is invested long and short (green and red lines in the bottom section of the graph).

One can see that the portfolios dynamically adjust to the current market conditions, reallocating proportions of their capital to long or short positions depending on the direction of the algorithm’s signals. Thus the algorithmic forecasts guide the client, effectively regulating his or her exposure to market downturns.

Conclusion

We show that including the effects of commissions and spreads the I Know First AI based predictions for European Stocks can very effectively be used to create algorithmic trading strategies available to retail investors with excellent returns and risk adjusted returns.

The strategies record total returns reaching 109% and Sharpe ratios of 1.7 in the 1.5-year time period analyzed versus a market return of 1.6% and Sharpe ratio of 0.2. Finally, these strategies leverage our predictive algorithm’s daily market analysis to adjust their exposure to market moves in an automized fashion, resulting in a dynamically adjusted and controlled portfolios.