Performance Report of I Know First’s AI-Predictive System for ETF Universe – Beating SPY

Early upon the launch of I Know First’s forecasting algorithm, we implemented our AI-based ranking and forecasting model for a selection of 100 ETFs in the U.S. market. Since then, I Know First began to issue ETF forecasts for our global subscribed investors.

According to our forecast evaluation results, the predictions generated returns greatly surpassing that of the benchmark we have utilized, namely, the SPDR S&P 500 Trust ETF (NYSE: SPY) which tracks the S&P 500 stock market index.

For each covered ETF, the forecasts are generated daily for 5 main time horizons, expressed in calendar days or months: 3 days, 7 days, 14 days, 1 month and 3 months.

The daily updated forecast consists of two numbers: the signal which indicates the predicted direction and strength of the ETF’s movement in the respective time frame, and the predictability which indicates how predictable the algorithm considers the ETF’s movements to be.

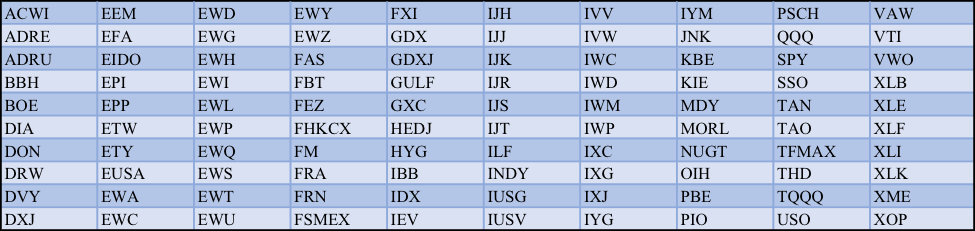

Currently, I Know First’s AI-based forecasting system covers 100 ETFs in total in the U.S. market, which are shown in the table below by their tickers.

Table 1: I Know First’s ETF Coverage

AI Added Value to the Investors

The predictive AI system can be used by investors/traders to make smarter investment decisions by:

- Identifying promising opportunities in the U.S. ETF universe

- Implementing custom screens as overlay to support their research and investment process.

The AI tool is an active investment management product, suitable for institutional as well as private self-directed DIY investors, helping outperform the market and manage portfolios with more confidence.

Performance Evaluation

Time Horizon

Since implementation, the forecasts for the ETF universe have been generated daily. Evaluation is based on all published Long/Short forecasts, for 3d, 7d, 14d, 1m and 3m time horizons during the period of 08/18/2015 – 07/17/2018.

*Since the forecasting time frames are given in calendar days, the table below details the corresponding holding periods in trading days used

Table 2: Map Between Forecast Time Horizon and Holding Period

Benchmark

The average return of SPDR S&P 500 Trust ETF, which tracks the S&P 500 stock market index, according to same time horizons is used as the benchmark for our evaluation.

Evaluation Result

The following table and chart present the respective evaluation of the forecasted performance of the 100 ETFs among the benchmarked SPY ETF in the market. The table clearly shows that for the 100 ETFs the average trade return outperformed the benchmark return for all 5 time horizons, with performance generally improving as ETFs with stronger signals were selected. It emphasizes the importance of signals in successfully outperforming the benchmark.

Table 3: Forecast Evaluation for Most Predictable ETFs

(Evaluation Period: 08/18/2015 – 07/17/2018)

Evaluation Remarks

It is evident that the signal indicator is crucial to identifying consistently market outperforming opportunities and that virtually all the average returns obtained using the signal filtered algorithmic forecasts beat the benchmark.

Therefore, in order to outperform the market and get more impressive results from the algorithm, it is crucial to focus on the assets which the algorithm identifies as most predictable and with the strongest signals (and thus the most up/down side depending on signal’s direction).

Conclusion

I Know First AI-based predictive system considers the markets holistically – it searches for patterns and relationships/interconnections in huge sets of historical daily updated, structured capital markets data and considers the financial world as a large complex system as a whole.

From the patterns learned and matched to the current market conditions, the algorithm is deriving future projections for the securities. It condenses the learned patterns into two indicators representing each asset’s forecast, allowing the investor to use the ranked predictions to identify great investment opportunities and to support his/her investment process and beat the broad market.

The predictability and signal indicators, available for each security and time frame, help to track how successful the algorithm is in learning the behavior of each individual asset and thus to focus on the most promising opportunities.

Besides primarily focusing on the U.S. stock market, the implementation of I Know First deep-learning model for the ETF universe and its outstanding results since its launch highlight the superiority of I Know First’s approach and exemplifies the adaptability and high scalability level of the system to markets across the globe.