Swing Trading Report

Swing Trading Report

STOCKS

This trades report is linked to I Know First Algorithm remarkably successful swing trading strategy which resulted in an impressive overall return of 102% during the dates July 1st 2014 to October 31th 2015.

This article will drill down into the details of the specific stocks which were included in the IKF stock portfolio and significantly outperformed the S&P500 return, yielding a remarkable 27.8%.

We see how the first real boom was during the period between 16/11/2014 and 13/1/2015.

Let’s take a closer look at this time period and analyse the specific details.

The IKF Swing Trading strategy managed to beat the S&P 500 by 36.18% which translates to $3,617.93 in dollar return given 10,000$ initial capital was invested.

| 1) | Earnings in % | Earnings in $ |

| IKF Swing Trading Stocks mixed | 37.32% | $3,732.30 |

| S&P500 | 1.14% | $114.37 |

| Difference: | 36.18% | $3,617.93 |

Below we can see the top 3 stocks which contributed the most to the total earnings, and their corresponding industry.

Sasol Limited (SSL) – The South African company’s rocketing success was due to the announcement of a US$4 billion credit facility for its ethane cracker and derivatives at its existing site in Lake Charles, Louisiana. The news was released midway through December of last year and helped produce fruitful results for the company.

Genesis Energy, L.P. (GEL) – In mid-November 2014 the energy firm confirmed that it has completed the previously announced acquisition of the M/T American Phoenix from Mid Ocean Tanker Company. The purchase price was approximately $157 million.

Tesla Motors (TESLA) – The US electronic carmaker were in talks with Germany’s BMW over a possible collaboration in batteries and lightweight components towards the end of 2015, thus helping to boost the company’s share prices.

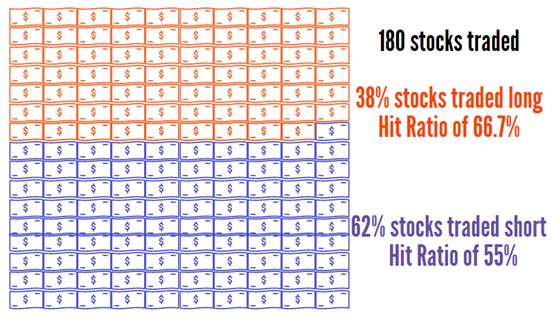

Out of the stocks traded within the period we can see the following:

In depth trade report for the top three contributing stocks

I Know First Trade Report: SSL, 24.27% In 8 Trading Days

On the 26th of November 2014 I Know First algorithm released a bearish signal on its 1 month forecast for SSL. At the same time the previous closing price moved below the 5 day simple moving average, which is a strong indication for selling the stock. Below is the original forecast, and the resulting trade which made 24.27% in just 8 trading days.

*Sell Line: The Sell Line depicts the absolute lower bound (LB) for the signal strength. Here +10 for long positions and -10 for short positions. No positions are taken/held for signals in between (-LB; LB).

Key Numbers and Dates

Short Recommendation

You would short the stock on Nov, 26th 2014 according to the I Know First signal of -114.943 you received that morning and the fact that the stock closed below the 5 day simple moving average on the previous day. You would exit the position on the morning of 9th of December at the market opening price of $35.36 because of a weaker signal.

Where could I have found this forecast?

SSL belongs to our “Top 10 Stock Picks + S&P500” universe. On Nov 26th, 2014 the stock’s position on the 1 Month table was 2, making available to “Top 10” and above subscribers.

I Know First Trade Report: GEL, 16.27% In 5 Trading Days

On the 15 of December 2014 I Know First algorithm released a bullish signal on its 1 month forecast for GEL. The previous closing price moved above the 5 day simple moving average, which, together with the signal, is a strong indication to buy the stock. Below is the original forecast, and the resulting trade which made 16.27% in just 5 trading days.

Key Numbers and Dates

Long Recommendation

You would take a long position in this stock on Dec, 15th 2014 according to the I Know First signal of 103.19 you received that morning and the fact that the stock closed above the 5 day simple moving average on the previous day. You would sell the stock at the market opening price of $44.51 on December 22nd as the signal dropped below the predefined lower bound of 10.

Where could I have found this forecast?

GEL belongs to our “Top 10 Stock Picks + S&P500” universe. On December 15th, 2014 the stock’s signal was ranked first in the 1 Month table making it available to “Top 10” and above subscribers.

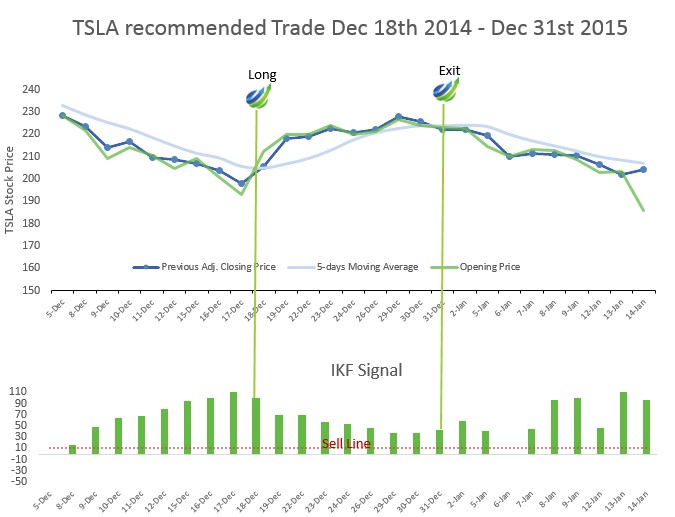

I Know First Trade Report: TSLA, 5.04% In 8 Trading Days

On the 18st of December 2014 I Know First algorithm released a bullish signal on its 1 month forecast for TESLA. At the same time the price moved above the 5 day simple moving average, making together with the signal a strong buy recommendation for the stock. Below is the original forecast, and the resulting trade which made 5.04% in just 8 trading days.

Key Numbers and Dates

Short Recommendation

You would long the stock on Dec, 18St 2014 according to the I Know First signal you received that morning of 99.81 and the fact that the stock closed above the 5 day simple moving average on the 31st of December. You would sell the stock at the market opening price of $223.99 because the moving average rule does not hold anymore.

Where could I have found this forecast?

TSU belongs to our “Top 10 Stock Picks + S&P500” universe. On December 18th, 2014 the stock’s position on the 1 Month table was ranked first in the 1 Month table making it available to “Top 10” and above subscribers.

Conclusion

To conclude this article helps to analyze the time period between mid-November to mid-December. We see how the IKF algorithm helped to achieve an impressive return during this period. Furthermore, the article also illustrates how the top three stocks contributed to this success.