I Know First Evaluation Report For Bitcoin Forecast Performance 2020

Executive Summary

In this Bitcoin forecast evaluation report, we will examine the performance of the forecasts generated by the I Know First AI Algorithm for Bitcoin currency pairs with time horizons ranging from 3 days to 3 months, which were delivered daily to our clients. Our analysis covers the time period from 1 January 2020 to 7 December 2020. Below, we present our key takeaways from applying our algorithm to determine the predicted direction in the given time horizon for Bitcoin currency pairs:

Bitcoin Forecast Highlights:

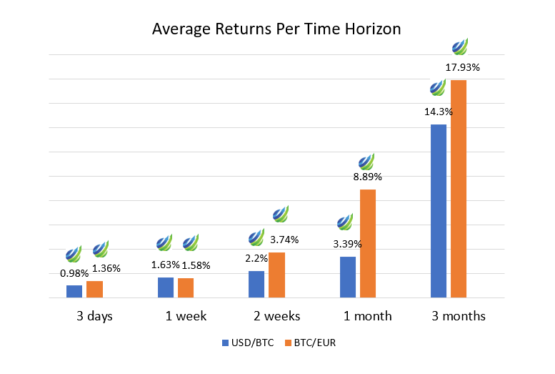

- The best returns were obtained in the 3-months time horizon, providing an average return of 14.30% for USD / BTC and 17.93% for BTC / EUR.

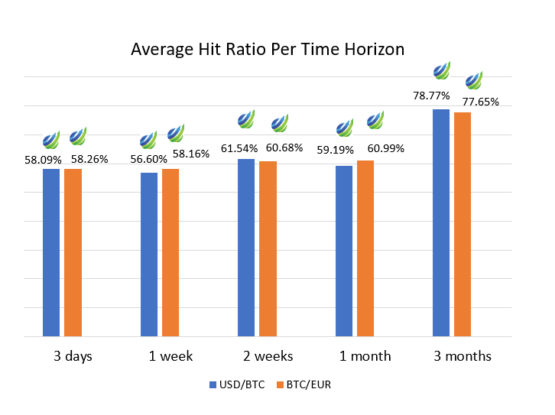

- The best hit ratios were similarly obtained for the 3-months time horizon, with the best hit ratio being 78.77% for USD / BTC and 77.65% for BTC / EUR.

- The forecast accuracy has increased by an average of 9% over intervals of 3 to 14 days, 3% in 3 months horizon, compared to the previous year.

Note that the above results were obtained as a result of an evaluation conducted over a specific time period to give a general presentation of the forecast performance patterns for Bitcoin currency pairs. The following report provides an extensive explanation of our methodology and a detailed analysis of the performance metrics that we obtained during the evaluation. This report continues the I Know First evaluation series illustrating the ability to provide successful long-term and flexible forecasting for Bitcoin currency pairs.

About the I Know First Algorithm

The I Know First self-learning algorithm analyzes, models, and predicts the capital market, including stocks, bonds, currencies, commodities and interest rates. The algorithm is based on Artificial Intelligence (AI) and Machine Learning (ML) and incorporates elements of Artificial Neural Networks and Genetic Algorithms.

The system outputs the predicted trend as a number, positive or negative, along with a wave chart that predicts how the waves will overlap with the predicted trend. Consequently, the trader can decide which direction to trade, when to enter the trade, and when to exit the trade. The model is 100% empirical, based only on factual data, thereby avoiding any biases or emotions that may accompany human assumptions. I Know First’s model only involves the human factor is building the mathematical framework and providing the initial set of inputs and outputs to the system. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions.

Our algorithm provides two independent indicators for each asset – signal and predictability.

The signal is the predicted strength and direction of movement of the asset. This is measured from -inf to +inf.

The predictability indicates our confidence in the signal. The predictability is a Pearson correlation coefficient relating past algorithmic performance and actual market movement, measured from -1 to 1.

You can find a detailed description of our heatmap here.

The Performance Evaluation Method

We perform evaluations on the individual forecast level. This means that we calculate the return of each forecast we have issued for each horizon in the testing period. We then take the average of those results based on our positions on different currencies and forecast horizon.

For example, to evaluate the performance of our 1-month forecasts, we calculate the return of each trade by using this formula:

This simulates a client buying Bitcoin currency pairs on the day we issue our prediction and selling it exactly 1 month in the future from that day.

We iterate this calculation for all trading days in the analysed period and average the results.

The Hit Ratio Calculation

The hit ratio helps us to identify the accuracy of our algorithm’s predictions.

We predict the direction of movement of Bitcoin currency pairs using our algorithm. Our predictions are then compared against their actual price movements within the same time horizon.

The hit ratio is then calculated as follows:

For instance, a 100% hit ratio would imply that the algorithm correctly predicted the price movements of all assets within the Bitcoin package.

Universe Under Consideration: Bitcoin Forecast

In this report, we conduct testing for Bitcoin currency pairs, which is covered by I Know First in the “Bitcoin” package. The Bitcoin Package is designed for investors and analysts who need predictions for the best cryptocurrencies to buy, in particular, for Bitcoin. It includes predictions with bullish and bearish signals and indicates the predicted direction in the given time horizon for the cryptocurrencies.

Bitcoin Forecast Amid Coronavirus Market

Bitcoin has hit a new all-time high breaking through during last 2 weeks. Bitcoin has jumped of $19441.96 to $26711.95 to two-week highs on 28 December, 2020. Growth in 2 weeks by 1.4 times.

COVID-19 has been good for Bitcoin. First, the pandemic accelerated our advance into a more digital world: People who had never before risked an online transaction were forced to try, for the simple reason that banks were closed. Second, and as a result, the pandemic significantly increased our exposure to financial fraud. According to www.accountingtoday.com, more of the 2,096 anti-fraud experts who responded to the survey have noticed an increase in fraud since the previous quarter. 68 % said they were seeing an increase in fraud in 2020. To manipulate a cryptocurrency network is extremely difficult. Erasing or overwriting a block of already spent Bitcoin, known as “double spending”, is rendered impossible by the decentralized, chronological and computing, power-intensive characteristics of the Bitcoin blockchain.

Another reason for Bitcoin’s rise is the growing inflation of the U.S. dollar. The recent stimulus of around $2.4 trillion to the economy spending is poised to greatly increase the level of inflation and decrease the dollar’s purchasing power. The long-term bullish case for bitcoin continues to strengthen with observers predicting a deeper dollar decline in 2021 and a rising global stockpile of negative-yielding bonds.

Other 2020 Bitcoin landmarks have been tied to household brands that have attracted small, individual investors. Paypal announced that it would allow its customers to buy and sell bitcoin on its site in October. This news pushed Bitcoin’s price higher immediately. PayPal has nearly 350 million users who will now have the ability to easily buy, store, and use Bitcoin. PayPal also has well over 20 million active merchants who can now accept the currency.

Publicly traded companies have begun converting cash from their Treasury securities into bitcoins. For example, MicroStrategy has converted $ 425 million from its treasury into bitcoins. Visa joined forces with BlockFi to launch a credit card that rewards customers with bitcoin Increasingly, people see Bitcoin as a store of value and refuge.

Performance Evaluation: Evaluating the Rate of Returns

We conduct our research for the period from 1 January 2020 to 7 December 2020. Following the methodology from the previous sections, we start our analysis by computing the performance of the algorithm’s signals for time horizons ranging from 3 days to 3 months.

From the above table, we can observe that the return on investment from Bitcoin currency pairs both for USD/BTC and BTC/EUR is generally increasing over the time horizon. Right from the onset, for the short-term time horizon, a positive return has already been recorded, as seen by the 0.98% return for USD/BTC and 1.36% return for BTC/EUR for the 3-day time horizon. The maximum performance was recorded at the 3 months horizon – 14.30% and 17.93%.

Performance Evaluation: Evaluating the Hit Ratio

The aggregated hit ratio is obtained by considering the accuracy of the algorithm for each time horizon within the given time period. For instance, for the 3 days time horizon, all possible consecutive 3-day periods are considered from 1 January 2020 to 7 December 2020. The actual price movement of assets within the Bitcoin package is compared with our algorithm’s forecast. A 100% hit ratio would imply that the algorithm had correctly predicted all the Bitcoin currency pairs’ price movements in this period. We then average all figures over the number of possible consecutive time-periods to obtain the hit ratio effect figures.

As you can see from the table above, we can see that the algorithm has proven to be extremely effective in determining the price movement of Bitcoin currency pairs. The best indicator for a time horizon of 3 months, when the algorithm correctly predicted 78.77% of the price movement for USD / BTC and 77.65% for BTC / EUR. We see similar excellent results for other time horizons, with forecast accuracy of at least 56% for all time horizons. The lowest forecast falls for a time period of 7 days: 56.90% for USD / BTC and 58.16% for BTC / EUR. Also, the forecast accuracy falls within 1 month for USD / BTC and is 59.19%.

The figure below shows that the 2019 Bitcoin forecasting has a lower forecast accuracy for all time intervals. The time horizon on a 3-day interval has a negative average return, while the 2020 forecast shows a positive average return at the same time horizon. The 2019 forecast accuracy is less than the 2020 forecast. The forecast accuracy has increased by 3% in 3 months horizon, an average of 9% over intervals of 3 to 14 days, compared to the previous year. It shows the improvement of our algorithm’s performance in comparison to the past results.

Conclusion

In this analysis, we demonstrated the out-performance of our forecasts for Bitcoin currency pairs-related, which was detected by I Know First’s AI Algorithm during the period from 1 January 2020 to 7 December 2020. COVID-19 had a positive impact on Bitcoin. The forecast accuracy has increased by 3% in 3 months horizon, an average of 9% over intervals of 3 to 14 days, compared to the previous year. Based on the presented observations, we record a significant performance of I Know First forecasts for Bitcoin currency pairs for longer time horizons, as well as greater certainty of our forecasts over longer time horizons in terms of hit ratio. Thus, an investor who wants to add a Bitcoin currency position to improve the structure of his investments within his portfolio can do so by utilizing I Know First’s forecasts to foresee price movements of Bitcoin currency pairs over different time horizons.