I Know First ETF Predictions Coverage Update for 2021

I Know First generates daily predictions for over 10,000 assets and 559 Equity ETF predictions and continues to expand the coverage.

The Importance of Investing in ETFs

The ETF industry had a great year in 2020 as it has benefitted from the rising popularity of low-cost, diversified index fund management. The global inflows for the year surpassed $750 billion, a new record, and global assets under management grew by over 30%. According to ETF.com, a minimum of a 110% return was required to be among the top 10 best-performing ETFs of 2020, while a 94% gain was the threshold to enter the top 20.

The popularity of ETFs is expected to continue in 2021. Active ETFs gathered year-to-date net inflows of US$33.80 billion. Among the recommended ETFs for 2021 by CFRA Research, we can find several ETFs that are covered by the I Know First: Invesco NASDAQ 100 ETF (QQQM), Invesco S&P 500 Equal Weight Health Care ETF (RYH), and Industrial Select Sector SPDR ETF (XLI).

The Equity ETF Coverage by I Know First

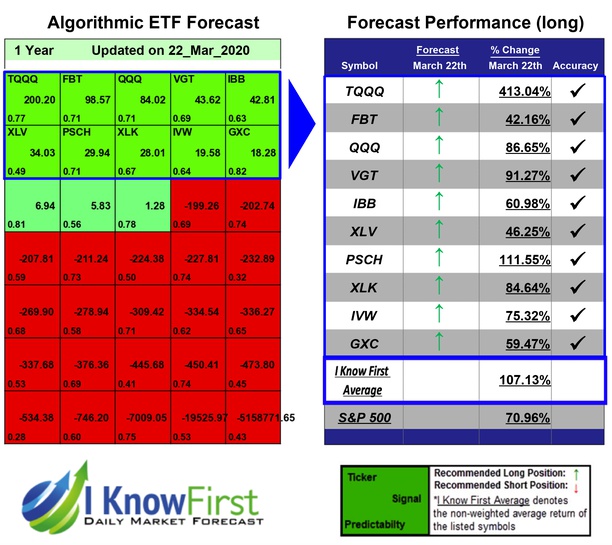

I Know First has successfully predicted ETF movements in the past. The algorithm’s performance evaluation report from September 24th, 2020 shows that our AI-powered predictive algorithm’s accuracy reaches 73%. Another example is the algorithm’s March 22th, 2020, the 1-year forecast had successfully predicted 10 out of 10 movements and resulted in returns up to 413.04%.

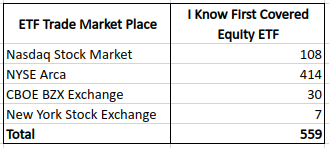

Nowadays, I Know First continues to expand the ETF coverage, especially in the USA. The following table shows the US-traded equity ETFs covered by I Know First in the latest version of the algorithm:

We currently cover a total of 559 equity ETFs and I Know First is continuously adding new ETFs to the system in order to fulfill clients’ needs and improve the algorithm’s predictive power.

About I Know First

I Know First, Ltd. is a financial technology company that provides daily investment forecasts based on an advanced, self-learning algorithm. Thus, the company’s algorithm predicts over 10,500 securities (and growing). Thus, it has the capability to discover patterns in large sets of historical stock market data.

The underlying technology of the algorithm based itself on Artificial Intelligence. It also based itself on machine learning and incorporating elements of artificial neural networks and genetic algorithms. Moreover, the algorithm generates daily market predictions for stocks, commodities, ETF’s, interest rates, currencies, and world indices for not only short but also for medium and long-term time horizons.

If you want to have access to more information about this topic, visit I Know First.