Stock Predictions: Daily Stock Selection Based On a Self-Learning Algorithm January-November 29th, 2016

Stock Predictions: Short-term Trading

Daily Stock Selection Based On a Self-Learning Algorithm

Time Period: January 7th, 2016 – November 29th, 2016 for stock predictions

The short-term signals of I Know First’s proprietary algorithm can be successfully utilized besides their application for better timing of the mid and long term investments. Variety of rules based on those can be developed for trades execution and rebalancing on a daily basis.

A high predictability level and signal strength are key factors for the most intuitive approach of selecting the highest ranked stocks. For the surface plot below 1 day signals and predictabilities of the short-term model are used. The average of the daily close-to-close returns of the stock positions, as suggested by the signal direction, are depicted depending on the absolute predictability level as well as the signal strength quantiles of the respective days. The returns are higher for higher predictability and signal levels*.

*Note, that for the graph above the return averages are calculated for stocks where both the predictability level is above a given threshold as well as the stock’s signal strength is above the specified signal strength quantile on the respective day – see corresponding axes. Hence the intersection of both criteria doesn’t guarantee a certain minimum amount of trades per day.

Except the most intuitive ranking process, driven only by the raw signal strength and predictability level, there can be several ways of integrating a trend or mean reversion logic into the selection process to account for trader’s approach and/or market conditions.

The following back test results of five strategies in this context are given for the S&P 500 stocks universe since the begin of 2016. At most 20 highest ranked stocks per day (if available) are traded in each case, the equity lines represent the value of corresponding equally weighted and daily rebalanced baskets of stocks, set up to outperform the broader universe. For three of them, additionally to the predictability and signal level, the price and signal dynamics are taken into account for the respective selection processes. No technical analysis elements (indicators, oscillators) are part of the analysis below.

The signals are generated daily before the market opens and subsequently used to rank the stocks. For simplification purposes the simulation uses close-to-close price changes only and hence no limit orders or stop losses are considered for further performance enhancement. Both long and short positions can be taken, no leverage is applied.

The overall return in the period January 7th 2016 – November 29th 2016 ranges between 77% and 20.3% while the S&P 500 increased by 10.8%.

The following table summarizes the overall results and the annualized figures (assuming 252 business days in a year) for each of the strategies.

The table below breaks down the analysis into the respective trade statistics over the considered period:

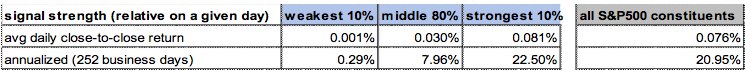

Overall, without the default predictability filter applied and without considering any specific strategy, below are the averages of the daily trade returns depending on the one-day signal strength:

Focusing on the trades with a higher level of predictability further improves the returns for stronger signals, beating the realized average S&P500 stocks return.

(Here, strongest 10% guarantee >=20 trades a day.)

In all of the strategies mentioned above only signals with higher predictability levels were used.

The short-term model is (currently) available to institutional clients only. Based on cooperation/partnership agreements for fund management purposes, integration of I Know First’s signals into the respective investment processes as well as development of quantitative strategies can be included into I Know First’s scope of services.