Quantitative Trading: Hedge Fund Model -Daily Re-Adjustment Swing Trading (Stocks + Interest rates + Currencies)

Quantitative Trading: Swing Trading Model

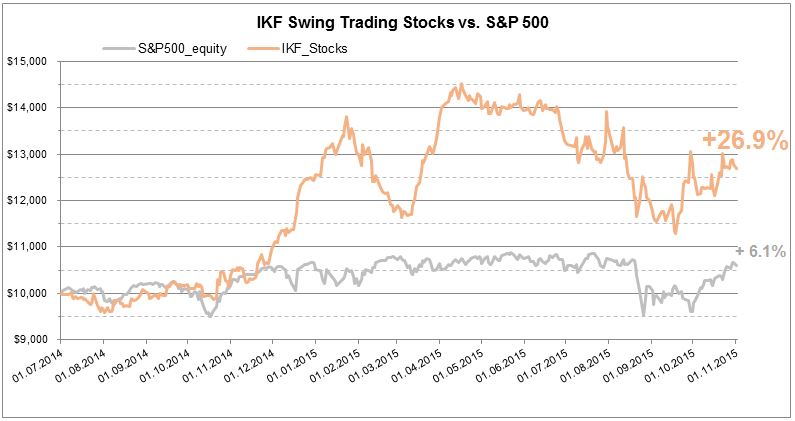

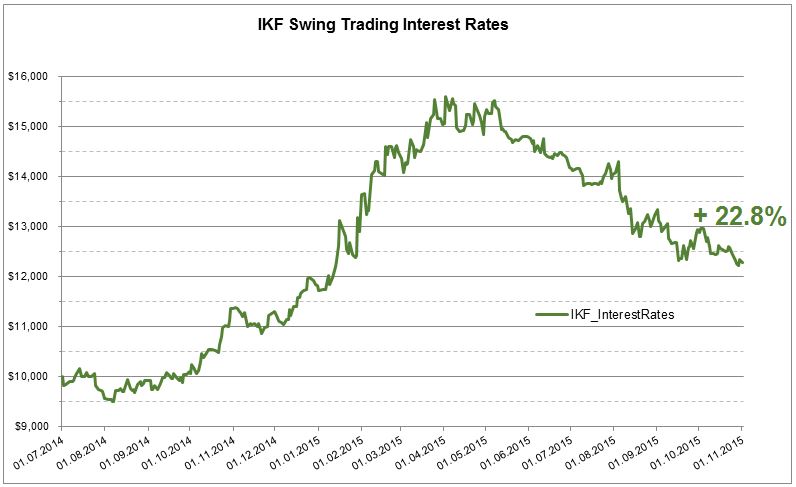

Following the development of Dr. Lipa Roitman’s understanding of relying on the 5 day simple moving average as a secondary trigger for entry and exit, the I Know First R&D team has developed a complementary model to support his thesis. The results were positive, and incorporating the 5 day SMA trigger allows us to design day trading strategies which further enhance returns and reduce risks. The following portfolio invests in the best stocks, interest rate ETFs, and currency pairs as identified by the algorithm and the specified selection process. The trades selection takes place daily before the market opens. Good opportunities are continuously replaced by even better ones to ensure the portfolio is at its optimum with respect to the algorithmic predictions. Both long and short positions are taken, regardless of market direction and trend. The equity is allocated to 60% in stocks, 30% in interest rates, and 10% in G10 currencies x10 leveraged. The overall return in the one year period from July 1st, 2014 to October 31st, 2015 is +102.5% while the S&P 500 increased by just +6.1% during the same period.

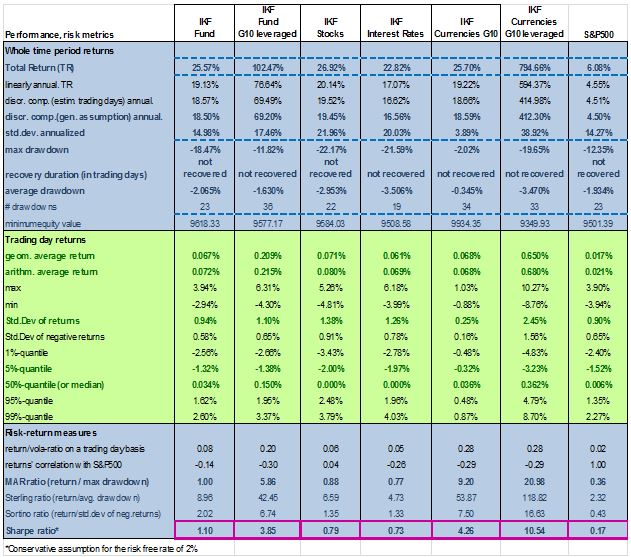

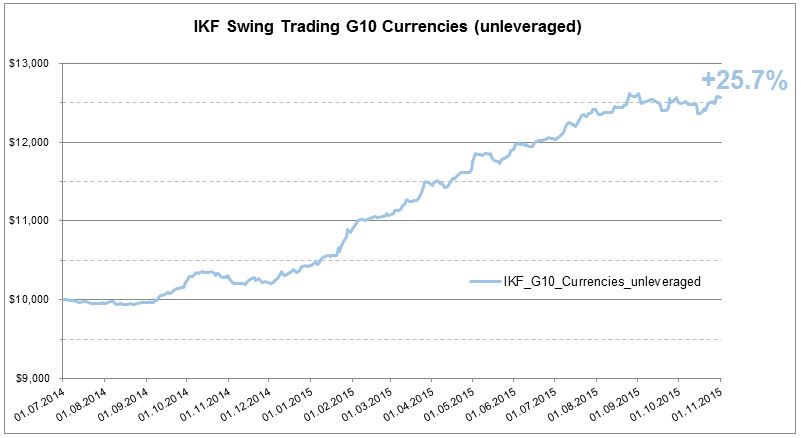

Below is a summary given for the total, daily and annualized performance including the respective key risk metrics – for each of the allocation pools separately as well as for their total combination into the fund. For the Currencies it is differentiated between leveraged (x10) and unleveraged.

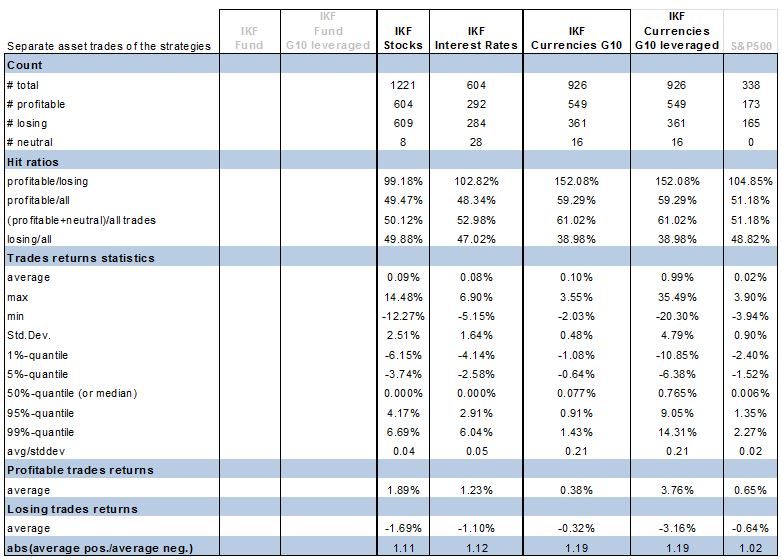

The respective trade statistics are presented in the table below:

The following charts depict the individual development of the stocks, interest rates, and currencies (un-leveraged) over time.

I Know First Research

Download The PDF Version HERE