AI-based Systematic Trading Strategies (S&P 500 Stocks) – Suitable For Mutual Funds And Other Investment Vehicles

As a continuation of our back-test report series, previously focused on daily trading, recent developments on the utilization of I Know First’s AI-based forecasting signals for less frequent systematic trading are presented in this article. These are highly performing and scalable strategies, average holding period of 4.5 to 30 days, that are suitable for mutual fund products and other investment vehicles. Certain constraints were applied to the short positions (total <=15%) and each individual position (<=10%) to take typical requirements of mutual funds and alike into account.

Short-term oriented strategy

Model: short-term

Avg. holding period: 4.5 days

Type: Long/Short (Short<=15%), max 10% per position

I Know First’s short-term signals are applied with a “consistency” trigger in the 5-day forecast. The portfolio is dynamically adjusted to the daily updated forecasts (max holding period of 5 days), with focus on shorter time predictions as time elapses.

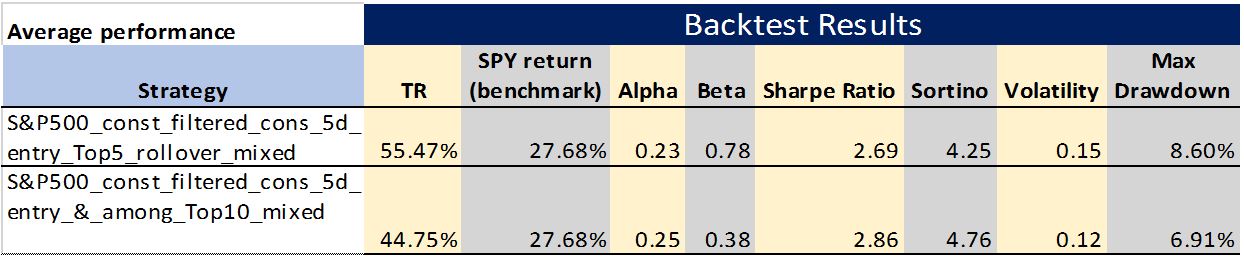

Below two variations are presented, with differentiation in the signal strength for the final trade qualification. Since the constructed portfolios are adjusted with respect to daily updated forecasts and the average holding period per position is around 4.5 trading days, the exact performance numbers depend on the starting dates. Therefore, average performance results are presented in the table below, with starting dates lying in the period between 12/01/2016 – 25/01/2016.

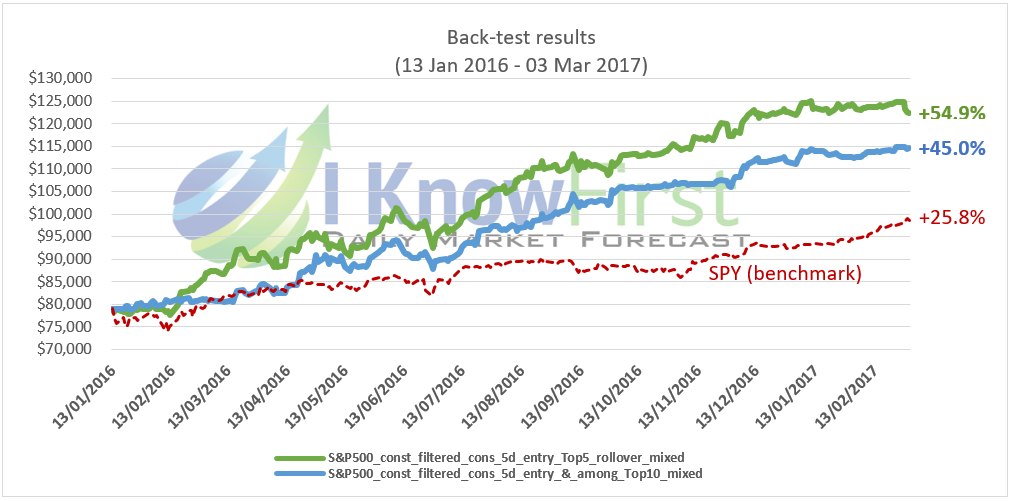

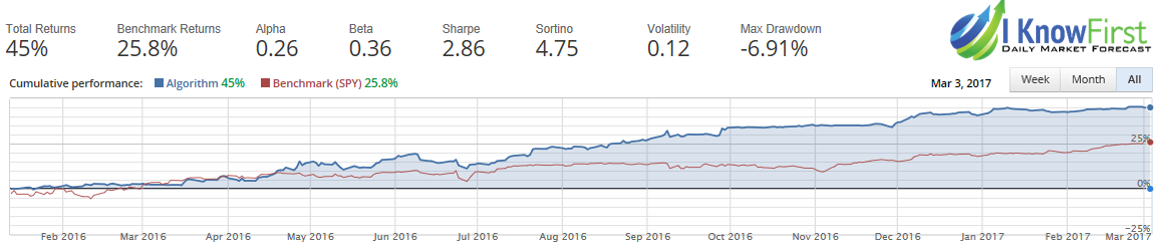

Both of the strategies are significantly outperforming the benchmark (SPY) on the risk-adjusted basis, with Sharpe Ratios above 2.5, and generate high alphas of 0.23 and 0.25, respectively. In the charts below the equity lines can be seen for the starting date 13/01/2016, assuming $ 80,000 of initial capital.

S&P500_const_filtered_cons_5d_entry_Top5_rollover_mixed

S&P500_const_filtered_cons_5d_entry_&_among_Top10_mixed

Mid-term oriented strategy

Model: regular (mid & long-term focus), 3 months forecast as the main trigger

Avg. holding period: ~ 30 days

Type: Long and Long/Short (Short<=15%), max 10% per position

I Know First’s mid-term signals are applied. Selection process is focused on the strong three month forecasts for assets with high predictability levels. Initial portfolio size is 10 stocks and it is adjusted based on the daily updated forecasts, where shorter term signals are used as time elapses. Every closed position is followed by opening a new one, depending on the rankings on the respective trading date.

Below several variations are presented, with differentiation in weighting of predictability and signal scores in the final selection process. Since the constructed portfolios are updated with respect to daily updated forecasts and the average holding period of each position is approximately 30 trading days, the exact performance numbers depend on the starting dates. Therefore, average performance results are presented in the table below, with starting dates lying in the period between 18/08/2015 – 02/11/2015 and each considered back-test period ending in November 2016.

All of the systematic trading strategies presented above returned an annualized alpha ranging between 8% and 18%, with only two of the strategies having beta above 1. Comparing the strategies’ Sharpe Ratios with that of the SPY shows a clear risk-adjusted outperformance against the benchmark. With an average holding period of over 30 trading days, this model delivers highly scalable strategies with insignificant transaction costs, that are suited for mutual funds and/or other fund products.

In the chart below some of the equity lines can be seen for the starting date 03/09/2015.

By taking profits and incorporating stop losses, the performance can be further enhanced. For the Predictability driven stock picking strategy the performance can be doubled in case of 100% Long/Short implementation.

For inquiries related to structuring investment products based on I Know First’s AI-powered forecasting technology and the respective systematic trading rules, please contact:

I Know First Research

People who read this article also liked: