Stock Market Prediction: Low-Risk Strategy by Controlling the Short Majority Direction

Stock Market Prediction: I Know First provides investment solutions for both individual and institutional investors, utilizing an advanced AI self-learning algorithm to gain a competitive advantage. We offer a personalized approach to our institutional clients, assisting them in their investment process based on their specific needs and preferences. For more details about I Know First solutions for institutional investors, please visit our website.

Stock Market Prediction: Low-Risk Strategy with Controlling of the Majority Direction

The following trading strategy was developed using I Know First’s AI Algorithm daily forecasts from January 21st, 2020, to June 26th, 2023, with a focus on S&P 500 stocks selected based on the signal and predictable filters. This strategy is available to our institutional clients: hedge funds, banks, and investment houses, as a tier 2 service on top of tier 1 (the daily forecast).

The strategy involves constructing a tier-weighted portfolio with monthly rebalancing, achieved through the implementation of predictable and signal filters. Additionally, we utilize a signal outlier filter to ensure that stocks with signals outside of the selected range, i.e., those exhibiting extreme values, are not included.

Moreover, the strategy controls the majority direction. The term “majority direction” refers to our predictions for stocks, upon which we base our position. This decision is guided by a number of long and short stock forecasts. Therefore, if the count of long stock forecasts surpasses the count of short stock forecasts, the majority direction is to go long and we construct a long portfolio. Conversely, if the count of short stock forecasts is higher, we assume a short portfolio.

In the case of this strategy, we open our portfolio based on the majority direction. If the majority direction is long, we keep our portfolio until the next monthly rebalancing. If the majority direction is short, we check every week to ensure that the direction does not change. If a short majority direction changes to a long majority direction, then we close our portfolio and wait until the next rebalancing period.

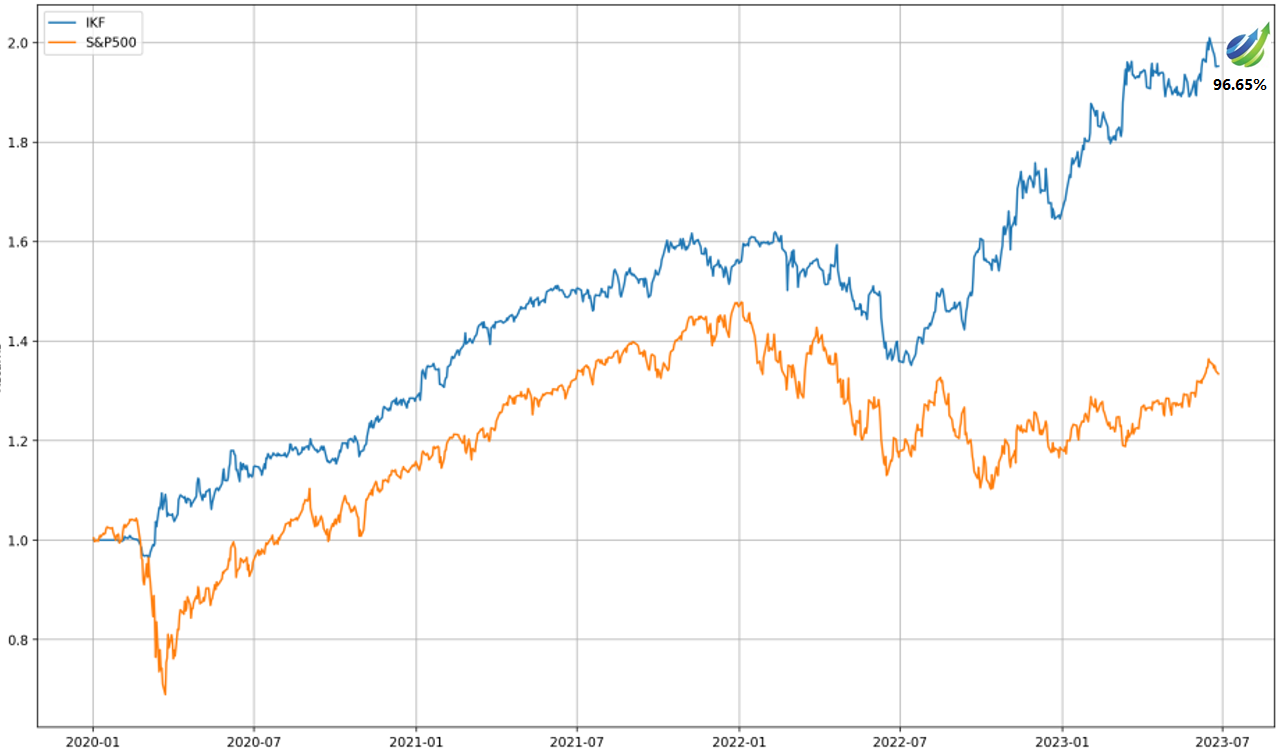

The strategy provides a positive return of 96.65% which exceeded the S&P 500 return by 63.24%. Below we can notice the strategy behavior for each year.

The primary feature of this strategy is risk minimization based on drawdown. Below, we can observe the strategy alongside the drawdowns of the S&P 500 for the analysis periods.

The IKF strategy experienced significantly fewer drawdowns than the S&P 500 across all periods, making it an excellent choice for low-risk investors.

Conclusion

I Know First offers investment solutions for institutional investors, leveraging our advanced self-learning algorithm to gain a competitive advantage. We provide a personalized approach for our institutional clients, enhancing their investment process according to their specific needs and preferences. In this context, we have evaluated the performance of the low-risk strategy by controlling the majority short direction based on AI from January 21st, 2020, to June 26th, 2023.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.