High Short Interest Stocks: AI Predictive Algorithm Accuracy Up to 69%

Executive Summary

In this High short interest rate stocks evaluation report, we will examine the performance of the forecasts generated by the I Know First AI Algorithm for long and short positions which were sent daily to our customers. Our analysis covers the time period from January 1st, 2020 until April 1st, 2021.

High Short Interest Stocks Evaluation Highlights:

- The most impressive outperformance over S&P 500 index comes from the Top 10 signal group on a 3-days time horizon with more than 982% higher return.

- All the signal groups generated by I Know First outperformed S&P 500 index in all time horizons except the 14-days time horizon.

- Stock predictions’ hit ratio reaches 65% amid the COVID-19 pandemic.

The above results were obtained based on forecasts’ evaluation over the specific time period using a consecutive filtering approach – by predictability, then by signal, to give an overview of the forecasting capabilities of the algorithm for the specific stock universe.

About the I Know First Algorithm

The I Know First self-learning algorithm analyzes, models, and predicts the stock market. The algorithm is based on Artificial Intelligence (AI) and Machine Learning (ML) and incorporates elements of Artificial Neural Networks and Genetic Algorithms.

The system outputs the predicted trend as a number, positive or negative, along with a wave chart that predicts how the waves will overlap the trend. This helps the trader to decide which direction to trade, at what point to enter the trade, and when to exit. Since the model is 100% empirical, the results are based only on factual data, thereby avoiding any biases or emotions that may accompany human-derived assumptions.

The human factor is only involved in building the mathematical framework and providing the initial set of inputs and outputs to the system. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions.

Our algorithm provides two independent indicators for each asset – Signal and Predictability.

The Signal is the predicted strength and direction of the movement of the asset. Measured from -inf to +inf.

The predictability indicates our confidence in that result. It is a Pearson correlation coefficient between past algorithmic performance and actual market movement. Measured from -1 to 1.

You can find a detailed description of our heatmap here.

The Stock Market Forecast Performance Evaluation Method

We perform evaluations on the individual forecast level. It means that we calculate what would be the return of each forecast we have issued for each horizon in the testing period. Then, we take the average of those results by strategy and forecast horizon.

For example, to evaluate the performance of our 1-month forecasts, we calculate the return of each trade by using this formula:

This simulates a client purchasing the asset based on our prediction and selling it exactly 1 month in the future.

We iterate this calculation for all trading days in the analyzed period and average the results.

Note that this evaluation does not take a set portfolio and follow it. This is a different evaluation method at the individual forecast level.

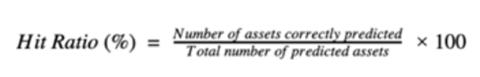

The Hit Ratio Method

The hit ratio helps us to identify the accuracy of our algorithm’s predictions.

Using our Daily Forecast asset filtering, we predict the direction of the movement of different assets. Our predictions are then compared against actual movements of these assets within the same time horizon.

The hit ratio is then calculated as follows:

The Benchmarking Method – S&P 500 Index

In order to evaluate our algorithm’s performance in comparison to the US market, we used the S&P 500 index as a benchmark.

The S&P 500 measures the stock performance of the largest 500 companies by market cap listed on different stock exchanges in the United States. It is one of the most followed equity indices and is frequently used as the best indicator for the overall performance of US public companies, and the US market as a whole. S&P 500 is a capitalization-weighted index, the weight of each company in the index is determined based on its market cap divided by the aggregate market cap of all the S&P 500 companies.

For each time horizon, we compare the S&P 500 performance with the performance of our forecasts.

High Short Interest Stocks Performance Evaluation – Overview

When stocks have a high short interest rate that indicates that investors believe their share prices will decline soon. Stocks with high short interest are often very volatile and well known for making explosive upside moves (known as a short squeeze). Such stocks have prices that can potentially move up very quickly as traders with open short positions move to cover.

In recent months several stocks rose to fame due to the Reddit users’ frenzy, such as GameStop (NASDAQ: GME) and AMC Entertainment (NYSE: AMC). The media buzz around them caused their price to surge up to 1260% in 3 months. Among the other stocks that provided high returns recently are RUBY – 135.67% in 1 month over the S&P 500’s return of 8.11%, and DDD – 127.51% in 3 months over the S&P 500’s performance of 8.85%.

In this report, we conduct testing for High short interest rate stocks that I Know First covers by its algorithmic forecast. The period for evaluation and testing is from January 1st, 2020 to April 1st, 2021. During this period, we were providing our clients with daily forecasts in time horizons spanning from 3 days to 3 months which we evaluate in this report.

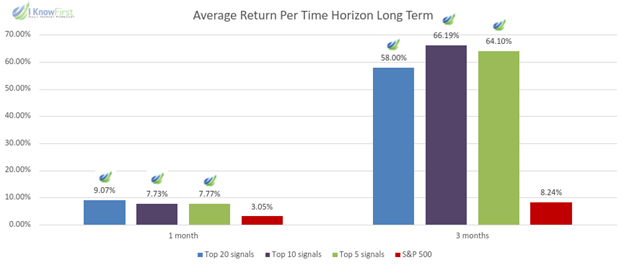

As can be seen in the table above, our algorithm provided positive returns for all time horizons. The S&P 500 benchmark was outperformed in most signal groups for most of the time horizon by up to 9.8 times (3-days’ time period). We can also notice that for the 3-months time horizon, our algorithm outperformed the benchmark in every signal group by at least 320% and up to 703%.

According to the table above, predictions for the long time horizons for all signal groups are greater than 51%. This shows that the algorithm’s accuracy is consistent and reliable amid the COVID-19 worldwide pandemic. For example, for the 3-months time horizon, the Top 20 signal group had a hit ratio of 69% and the Top 5 signal group had a hit ratio of 64%. The average return in most of the other time horizons for the top 5 signal group was outperforming by 62-982% than the S&P 500 index. This is significant because, in addition to having high returns on a long horizon, I Know First’s algorithm has demonstrated consistency for positive gains in all time frames.

Conclusion

This high short Interest rate evaluation report presented the performance of I Know First’s algorithm for options from January 1st, 2020 to April 1st, 2021. It shows the average returns and hit ratios for all time horizons, with the algorithm outperforming the benchmark index in most of the time periods. The I Know First algorithm has obtained better performance on the 3-months time horizon. It is also important to note that every signal group across every time horizon gave a hit ratio are above 46% and up to 69%, showing a consistent and reliable accuracy.