Machine Learning for Trading: Collaborations with Institutional Investors on Mid-term Oriented Strategies

In this article, we summarize some methods of utilizing I Know First’s state of the art machine learning for trading in particular in the area of fund management. We present the performance of mid-term oriented algorithmic trading strategies based on I Know First’s AI-based forecasting signals and give an update on one of Know First’s collaborations with an institutional investor to bring AI-powered funds to the marketplace.

The analyses continue to show that portfolios of S&P 500 stocks based on I Know First’s signals result in high performing and scalable strategies with average holding periods up to 30 days, suitable for mutual fund products and other investment vehicles. Portfolio constraints (total short positions <=15% & each individual position<=10%) and costs of commissions and bid-ask spreads are applied to take typical requirements of mutual funds and alike into account.

Mid-term Oriented Strategies

- Model: regular (mid & long-term focus), 3 months forecast as the main trigger

- Holding period: ~ 30 days

- Type: Long and Long/Short (Short<=15%), max 10% of the portfolio per position

- Period: August 2015 – September 2017

In these strategies I Know First’s mid-term signals are used as basis for the investment selection process and present an innovative application of machine learning for trading. Selection is focused on the S&P 500 stocks with the strongest three-month forecasts and high predictability levels. Initial portfolio size is 10 stocks for all strategies and positions are adjusted based on the daily updated forecasts, where shorter term signals are used as time elapses resulting in a maximum holding period of 63 trading days. As our algorithmic forecasts signal that price targets have been reached positions are closed and replaced by new ones based on the rankings on the respective trading date.

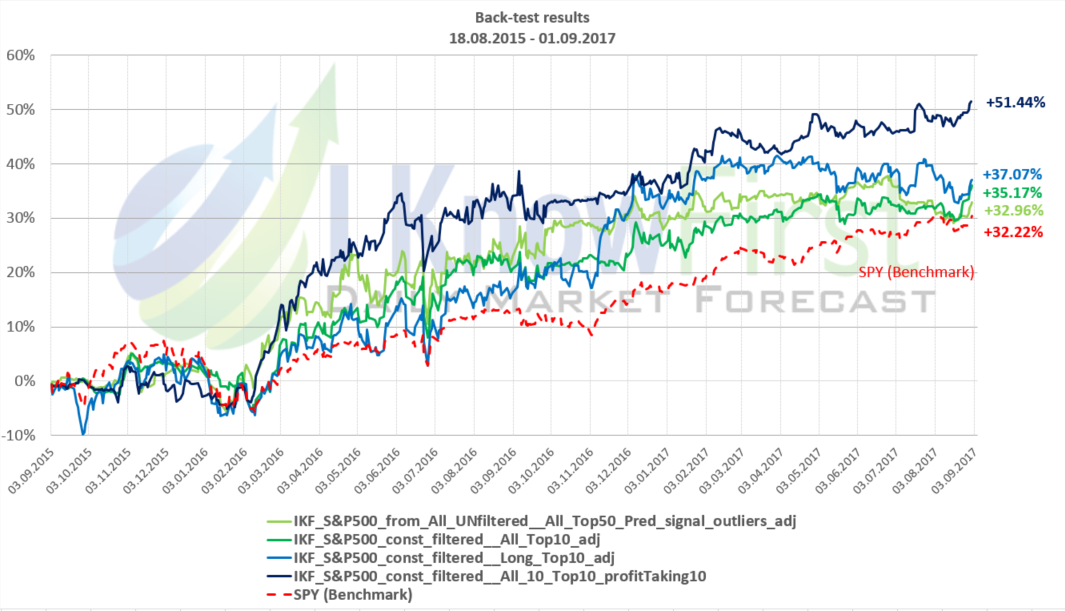

In the table below (click on the table to enlarge) performance numbers of several I Know First strategies using different combinations of predictability and signal scores in the selection process (rows 1-4) versus the benchmark (SPY ETF, row 5) are presented for the period 08/2015-09/2017. As the constructed portfolios exhibit “path-dependence” and the performance numbers depend on the starting date average performance results for several starting dates are shown.

In the analyzed time period 3 out of 4 of the systematic trading strategies applying machine learning in finance beat the benchmark in terms of Total Return resulting in an annualized Alpha ranging between 1% and 14%, with only 1 of the strategies registering a Beta above 1.00. In particular strategy number 4 with a Total Return of 52%, Alpha of 14%, Beta of 0.68, and Sharpe Ratio of 1.50 delivers an outstanding performance. With an average holding period of over 30 trading days, this model delivers scalable strategies minimally affected by transaction and spread costs, that are suited for mutual funds and/or other financial products.

In the chart below the equity lines can be seen for the starting date 09/03/2015.

The equity lines show consistent and steady growth, beating the benchmark even in this period of great market expansion.

Promoting Machine Learning for Trading: Collaboration with Institutional Investor

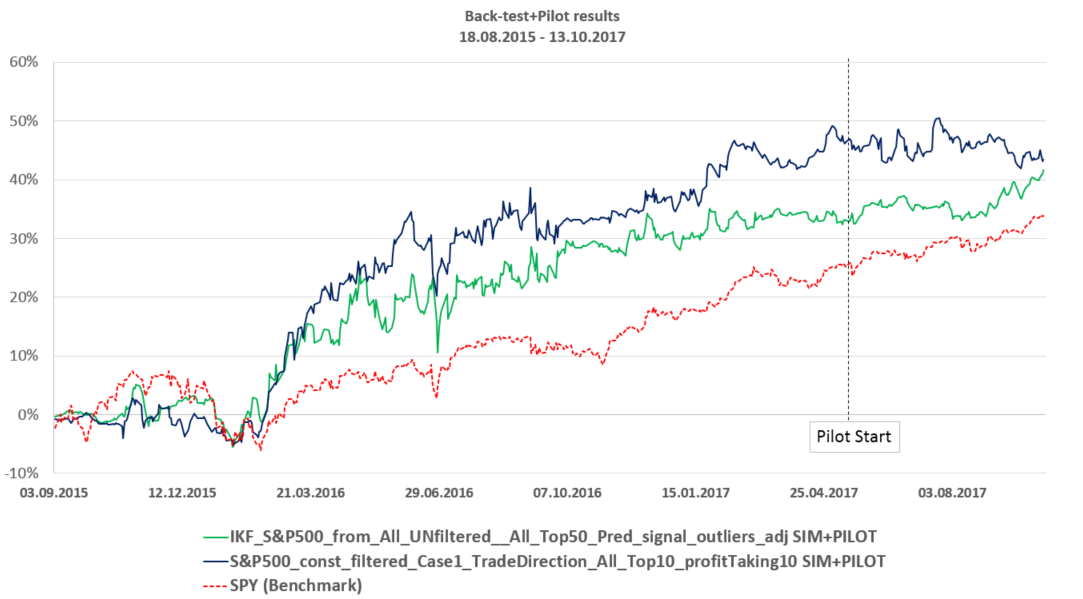

At I Know First we are currently running two of the strategies shown above in collaboration with an important institutional investor. This collaboration as of October 13, 2017 has resulted in the following equity lines.

The two selected strategies have significantly outperformed the benchmark in the analyzed time period, promising well for their future utilization in a fund which will allow retail clients to directly invest in an I Know First algorithm powered investment product. This fund will contribute to the growing applications of machine learning for trading and the permeation of successful Artificial Intelligence systems like I Know First’s algorithm for investment selection and monitoring.

Conclusion

In the previous article we have given an update on I Know First’s mid-term oriented strategies which including transaction costs continue to outperform the benchmark with:

- Total Returns over 50% in the two year time period versus the benchmark’s 27%

- Sharpe Ratios reaching 1.50

- Alphas as high as 14%

- Betas as low as 0.68

I Know First is promoting the growing field of AI and machine learning for trading by currently working with well-known institutional money managers for the implementation of these types of strategies as investment funds. This partnership has given very positive results and promises to soon bring I Know First AI-powered investment products to the marketplace.

Read More

If you are interested in algorithmic trading strategies for ETFs and Stocks or the application of machine learning for trading read more here: